Considering the heightened uncertainty in global markets at the moment, today’s update on US industrial production for December looks ok. Although production slipped 0.1% last month vs. November, “warmer-than-usual temperatures reduced demand for heating” and translated into “a sharp drop in the output of utilities,” the Federal Reserve advises. As a result, industrial production ex-utilities posted a healthy 0.7% increase last month. Note too that manufacturing activity–the main component in industrial activity–expanded 0.3% in December, according to the Fed.

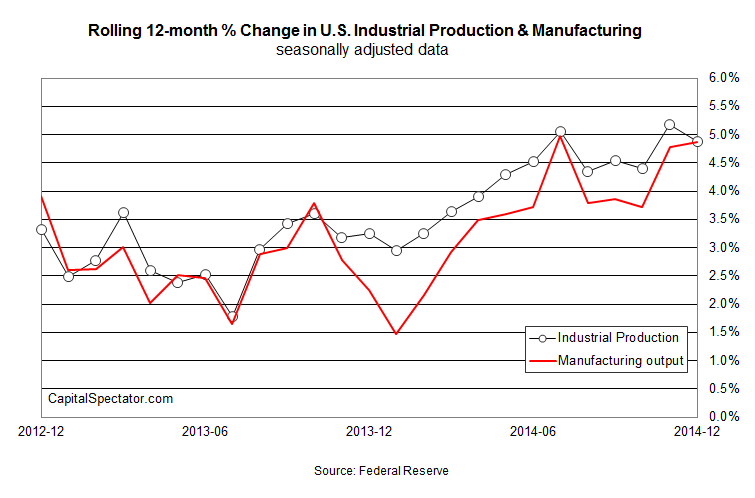

Although it’s clear that industrial activity slowed sharply in the final month of last year, it’s important to recognize that the year-over-year gain is only slightly off its recent peak. Output climbed 4.9% in December vs. the year-earlier level. That’s marginally below the 5.2% annual gain in November, which is the strongest rise in nearly four years. In short, today’s numbers for industrial production still point to an economy that’s poised to grow at a healthy rate in the near term.

If you’re inclined to worry, today’s update on consumer inflation offers better prospects for thinking bearishly. Headline CPI tumbled 0.4% last month, the most in six years, primarily due to sliding fuel costs. On a year-over-year unadjusted basis, CPI’s now rising at just 0.8%, which suggests that the deflationary winds are blowing harder. Core inflation, however, is still higher by 1.6% for the year through December—a moderate gain that tells us that energy’s bear market has yet to make a serious dent in the overall inflationary trend.

The latest drop in inflation “is a number that consumers will love but economists will worry about,” Russell Price, senior economist at Ameriprise Financial, tells Bloomberg. As falling commodity prices “filter through the system, it should take nine months to a year, then we should start to see inflation in the U.S. and around the world start to pick back up.”

If Price’s outlook is wrong, we’ll see the evidence in a lesser pace of core inflation in the months ahead. But there’s no sign of that now. Core CPI in the US still looks stable, rising at 1.6% a year through last month—roughly in line with the pace we’ve seen over the past 12 months, albeit skewed slightly to the downside.

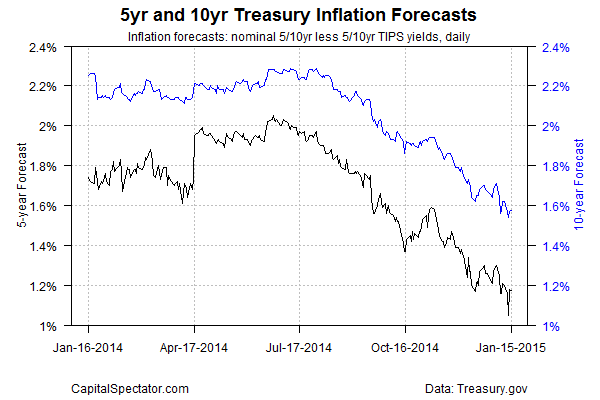

History suggests that core inflation is a more reliable measure of pricing trends and so we should keep a close eye on how this data evolves in the coming months. But while there are no smoking guns in today’s core CPI figures, it’s unclear in the current climate of rising deflationary worries if darker numbers are lurking around the next bend. Markets are certainly worried. The Treasury market’s implied inflation forecast has been dropping persistently in recent months, reflecting the crowd’s rising anxiety. The question is whether this forecast will show up in the hard data in the months ahead?

Yes, we should be wary, but for now it’s premature to assume the worst. Indeed, today’s industrial production data suggests that the outlook for US growth may be tarnished a bit but the case for anticipating moderate growth still looks compelling. That could change, of course, depending on what we see in upcoming reports. But based on what we know now, the odds still look favorable for expecting that the US recovery will survive the latest round of turbulence. But let’s also recognize that the case for arguing that growth is accelerating is on hold… again. But that’s about as far as the damage goes at this stage if we’re discussing the outlook according to the numbers vs. emotion.

It’s crucial to point out that if the US can maintain a moderate growth rate at a time of lower inflation and falling energy costs, the net effect could very well turn into a positive development for the macro trend. All bets are off, of course, if growth decelerates substantially. That’s a risk, of course, but it still looks like a low-probability event based on the numbers in hand.

asdfdfa

Pingback: Industrial Production Declines in December