Trump will roll out $1.5 trillion infrastructure plan on Monday: Politico

US budget director: rates may “spike” due to jump in budget deficit: Bloomberg

Vice President Pence raises possibility of US-North Korea talks: Reuters

White House staff roiled by domestic abuse allegations: The Hill

Is the UK considering a second Brexit vote? NY Times

US wholesale trade inventories rise more than expected in Dec: RTT

Capital Group Chairman and CEO: return of volatility is healthy: Capital Group

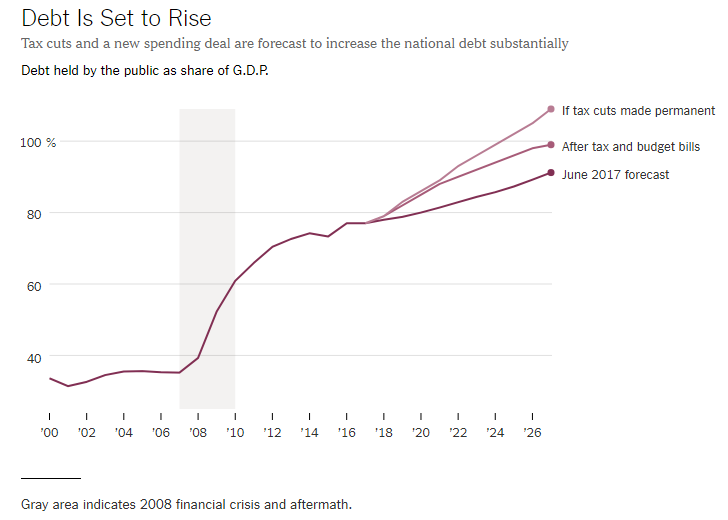

The era of big US deficits is back: NY Times

Category Archives: Uncategorized

Book Bits | 10 February 2018

By Annie Duke

Summary via publisher (Portfolio)

Annie Duke, a former World Series of Poker champion turned business consultant, draws on examples from business, sports, politics, and (of course) poker to share tools anyone can use to embrace uncertainty and make better decisions. For most people, it’s difficult to say “I’m not sure” in a world that values and, even, rewards the appearance of certainty. But professional poker players are comfortable with the fact that great decisions don’t always lead to great outcomes and bad decisions don’t always lead to bad outcomes.

Continue reading

Is It A Bear Market Yet?

The latest plunge in the US stock market left the S&P 500’s drawdown at a bit more than 10%. That’s the amount of red ink that brings usually out the “correction” label. The latest slide has also inspired fresh chatter about the possibility that a bear market is near, which is widely defined as a drop of 20%-plus.

Continue reading

Macro Briefing: 9 February 2018

Senate OKs bill to avert government shutdown, sends it to House: The Hill

Higher US budget-deficit risk is weighing on the stock market too: AP

Asia stocks tumble on Friday after Wall Street’s plunge on Thursday: Reuters

Oil prices continue to slide as supply fears mount: Reuters

New photos show extent of China’s military buildup in S. China Sea: NY Times

Bank of England hints at earlier, faster rate hikes: BBC

US jobless claims fall, nearing 45-year low: Reuters

VIX futures curve in backwardation, signaling outlook for more vol: Bloomberg

VIX vs. Stock Market Volatility: Similar But Different

The recent plunge in the US stock market ended the extended run of tranquility in equity returns. The media’s metric of choice to cite this change is the CBOE Volatility Index, or VIX, which surged earlier this week to the highest level in nearly three years, based on daily data. The upward explosion was even sharper on an intraday basis.

Continue reading

Macro Briefing: 8 February 2018

Senate leaders agree to 2-year spending deal: NY Times

Pro-government forces in Syria attack US troops: WaPo

Dallas Fed President: US growth could slip over next 2 years: Reuters

Dept of Homeland Security: Russians penetrated US voter systems: CNBC

Canada Prime Minister raises doubts about revising NAFTA with US: Reuters

US consumer credit increased to a record $3.84 trillion (s.a.) in Dec: MarketWatch

Late-day rise in Treasury yields coincides with late-day slide in stocks: Bloomberg

10-yr T-Note yield rebounds to 2.84%, matching Monday’s 4-yr high: Treasury.gov

Federal Reserve Is Still Expected To Raise Rates Next Month

The stock market turbulence in recent days has rattled investors, but the Federal Reserve remains on track to lift interest rates at the March policy meeting, according to this morning’s implied forecast via Fed fund futures.

Continue reading

Macro Briefing: 7 February 2018

House OKs bill to avoid US gov’t shutdown, but Senate approval is unclear: Politico

US trade deficit for 2017 at highest level since 2008: The Hill

Trump favors shutdown if Dems don’t agree to immigration demands: The HIll

Germany’s main parties end deadlock and form coalition: Reuters

US job openings fall to seven-month low in Dec: Bloomberg

Growth outlook for UK ticks up: MNI

Market crash claims its first victims for VIX-linked products: Bloomberg

Analyst Ed Yardeni remains bullish on outlook for equities: Yardeni.com

GDPNow model projects strong 4.0% gain for US GDP in Q1: Atlanta Fed

What Does History Tell Us About The Stock Market’s Dive?

The 4.1% plunge in the S&P 500 yesterday looks ominous, all the more so since it follows last week’s hefty 3.8% decline. But focusing on what just happened distorts our capacity to maintain a healthy sense of historical perspective. As an antidote, let’s step back and consider the latest market action through a longer-term lens.

Continue reading

Macro Briefing: 6 February 2018

World stock markets continue to dive on Tuesday: Reuters

Monday’s 1175-point Dow slide is a record for absolute declines: WSJ

Global policy makers react to stock market plunge: Bloomberg

Re-evaluating the wisdom of tax cuts after the market slide: NY Times

US ISM Non-Mfg Index surges in Jan, near 10-year high: CNBC

PMI: US services sector growth eases to nine-month low in Jan: IHS Markit

Survey data shows global economic growth at 40-mo high in Jan: IHS Markit