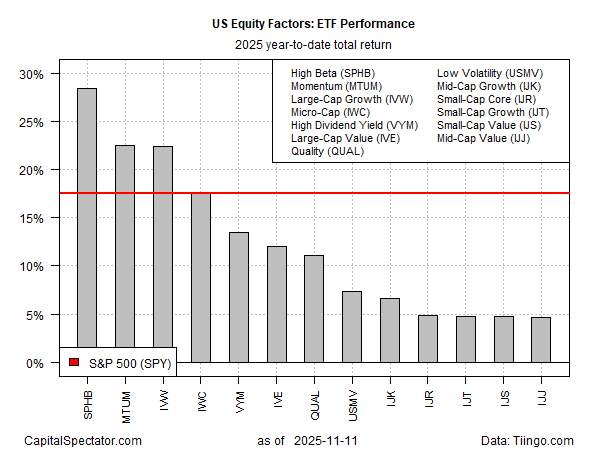

There’s no contest going into the final stretch of the year among US equity factor ETFs. So-called high beta stocks – shares with relatively high levels of return volatility – are leading the field by a wide margin, based on a set of ETFs through Tuesday’s close (Nov. 11).

The Invesco S&P 500 High Beta ETF (SPHB) is up a red-hot 28.4% year to date. Two factor funds are neck and neck for second place this year: momentum (MTUM) and large-cap growth (IVW), each rallying 22.5% so far in 2025. The benchmark for US equities is well behind with a 17.6% total return this year via SPDR S&P 500 ETF (SPY).

The key takeaway from the results: favoring riskier stocks in the large cap space has paid off handsomely this year. The caveat: SPHB’s outperformance over the market and other factors ebbs and flows through time. Reviewing SPHB’s rolling 1-year return vs. the market benchmark (SPY), for example, highlights the hefty return premium for high-beta stocks lately. SPHB is ahead of SPY by nearly 8 percentage points over the past year (252 trading days), reversing its trailing performance that prevailed for much of 2024. No one knows how long SPHB’s relatively hot hand will last, but it’s likely that it will end at some point.

Meanwhile, the relative weakness for small-cap and value stocks rolls on. This too shall pass… eventually. But timing is a mystery, and given the long-running underperformance in these factors it’s reasonable to remain cautious on the outlook until trend data suggests otherwise. At the moment, the tell tale signs of a rebound still look elusive.