* House vote expected today on infrastructure bills

* Global food prices rise to 10-year high, UN says

* OPEC rejects US request for more oil output; sticks to modest production plan

* Will transition away from carbon-intensive energy derail economic recovery?

* US trade deficit reaches a new record in September, driven by slumping exports

* US productivity fell to a 40-year low in Q3–probably due to temporary factors

* US jobless claims continue to ease, falling to new pandemic low:

The ETF Portfolio Strategist: 4 Nov 2021

Total return expectations for the Global Market Index (GMI) continue to hold at 4%-plus, or roughly half the level of the index’s 10-year performance.

Today’s update of new total return forecasts for GMI through October show the benchmark’s ex ante performance ticked up to a 4.4% total return for the long term, slightly above the 4.3% estimate in last month’s outlook.

Short-Term TIPS And Junk Are 2021’s Top-Performing Bond Factors

The Federal Reserve yesterday confirmed what it’s been hinting at for months: it will start winding down its bond-buying program. It’s still a long leap to launching interest-rate hikes, Fed Chair Powell suggests. But the first baby step has been taken for laying the groundwork for a post-pandemic policy regime.

Macro Briefing: 4 November 2021

* Federal Reserve says it will start tapering bond purchases this month

* Fed Chair Powell offers no hints interest-rate hike in near term

* Does the Fed risk a policy mistake by letting inflation run hot?

* Inflation debate lurks behind stock market’s bull run

* US private employment rose more than expected in October via ADP data

* Eurozone growth slows to six-month low via PMI survey data

* Factory orders in US unexpectedly increased in September

* US services industry activity surges to record high via survey data in Oct

* US 10-year Treasury yield rebounds to 1.60% as Fed dials back bond buying:

Major Asset Classes | October 2021 | Risk Profile

It had to end eventually. The recent run higher in the Sharpe ratio for the Global Market Index (GMI) finally reversed in October. The decline marks the first time in eight months that this popular risk metric eased for GMI, an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash).

Macro Briefing: 3 November 2021

* Republicans score win in Virginia governor’s race

* GOP may win NJ governor’s race in the still-too-close-to-call election

* Fed expected to announce that it will begin tapering bond-buying program

* Zillow shuts down house-flipping division after forecasting model fails

* China’s service sector posted solid growth momentum in October via PMI data

* Global Manufacturing PMI steady in October, reflecting moderate expansion

* US regular gasoline edges up to 7-year high — $2.45 a gallon:

Risk Premia Forecasts: Major Asset Classes | 2 November 2021

The long-run risk premium forecast for the Global Market Index (GMI) rebounded in October, edging up to 6.1%, based on revised numbers through last month. The new estimate is calculated in terms of the projected return over the “risk-free” rate, according to a risk-based model (detailed below).

Macro Briefing: 2 November 2021

* More than 100 countries pledge to end deforestation by 2030

* US to announce tougher regs on methane emissions for oil, gas production

* Drug companies aren’t liable for opioid crisis in California, says state court

* Supply-chain risk for US economy remains close to two-decade high

* Shortages that are slowing auto output are a risk for the world economy

* Don’t expect stocks and bonds to provide protection from inflation, AQR warns

* 82% of S&P 500 firms have beat Wall Street’s profit expectations

* Is surging bond-market volatility a warning for stocks?

* US construction spending fell 0.5% in September

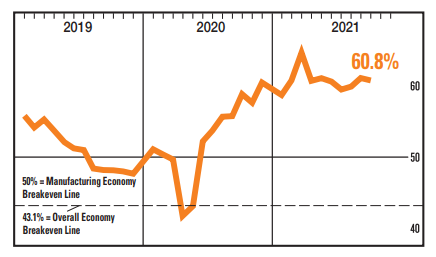

* US Mfg PMI for October: softer growth but new orders “remains sharp”

* US ISM Mfg Index edges lower in October but still indicates strong growth:

Major Asset Classes | October 2021 | Performance Review

US real estate investment trusts (REITs) and stocks posted the strongest returns for the major asset classes in October — by wide margins.

Macro Briefing: 1 November 2021

* Biden’s plan for US to lead in battling climate crisis faces big hurdles

* COP26 climate talks come with major implications for investing

* US Covid-19 cases down 58% from most recent peak

* Covid-19 pandemic accelerated baby-boomer retirements

* Treasury Sec. Yellen downplays flattening yield curve; says recovery is solid

* China’s factory output contracted for a second month in October

* Japan’s new prime minister plans to redistribute wealth via “new capitalism”

* Consumer prices and wages rose in September at fastest pace in decades

* Consumer spending continued to increase in September: