President Trump announced a US-UK trade deal yesterday, which may be an early sign of a thaw in the global trade war. Talks between China and the US scheduled for this weekend could bring more good news. But with tariffs still in place, sentiment in the US equity market remains cautious, based on a review of equity sectors via a set of ETFs through yesterday’s close (May 8).

Macro Briefing: 9 May 2025

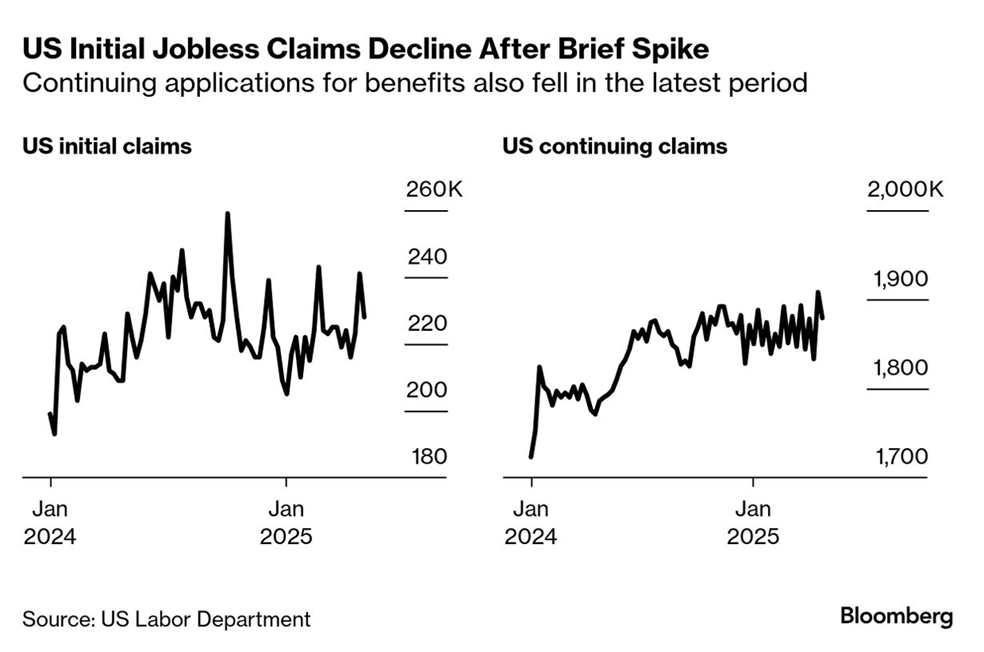

US jobless claims fell last week, printing at a relatively low level that downplays recesssion risk. “The previous week’s jump in claims was reversed in the week ended May 3, and there is little in the incoming data to challenge the Federal Reserve’s assessment that labor market conditions remain solid,” said Michael Pearce, deputy chief US economist at Oxford Economics.

Bitcoin Leads Global Markets Since “Liberation Day”

The most popular cryptocurrency, bitcoin, is posting the strongest performance among the world’s primary markets since President Trump on Apr. 2 announced “Liberation Day” and rolled out sharply higher US tariffs on imports. Gold is a strong runner-up since the announcement. US Treasuries are up only fractionally while US stocks are slightly under water since a pivotal shift for global trade roiled markets more than a month ago, based on a set of ETFs through yesterday’s close (May 7).

Macro Briefing: 8 May 2025

The policy-sensitive US 2-year yield holds steady at 3.78% as Federal Reserve leaves its target rate unchanged. The 2-year yield continues to trade at 55 basis points below the median 4.33% Fed funds rate, a sign that the market continues to price in expectations for a rate cut. Fed Chairman Powell, citing elevated uncertainty about inflation and economic activity related to tariffs, said the central bank does not “need to be in a hurry” to change policy as it waits for a clearer picture of how macro conditions are evolving.

Rebound For Initial US Q2 GDP Nowcast Could Be Misleading

Preliminary estimates for the US economic activity in the second quarter point to a recovery following a mild decline for GDP in the first quarter. The obvious caveat: Q2 data is still sparse and so there’s a high degree of uncertainty about how the quarter will evolve as the effects of tariffs move through the economy in the weeks ahead.

Macro Briefing: 7 May 2025

The US slide in exports this year has expanded to to most American ports, according to trade tracker Vizion. The consultancy analyzed US export container bookings for the 5-week period before President Donald Trump’s tariffs began and the 5 weeks after the tariffs took effect. “We haven’t seen anything like this since the disruptions of summer 2020,” said Kyle Henderson, CEO of Vizion. “That means goods expected to arrive in the next six to eight weeks simply won’t. With tariffs driving costs higher, small businesses are pausing orders. Products that once moved reliably are now twice as expensive, forcing importers into tough decisions.”

Risk Appetite Remains Weak As Trade Tensions Remain High

The year started on a positive note as markets extended 2024’s rally. But as details of the dramatic shift in US tariff policy emerged, sentiment took a hit as 2025 unfolded. The defensive stance persists, based on a set of ETF pairs that map the crowd’s appetite for risk via prices through Monday (May 5).

Macro Briefing: 6 May 2025

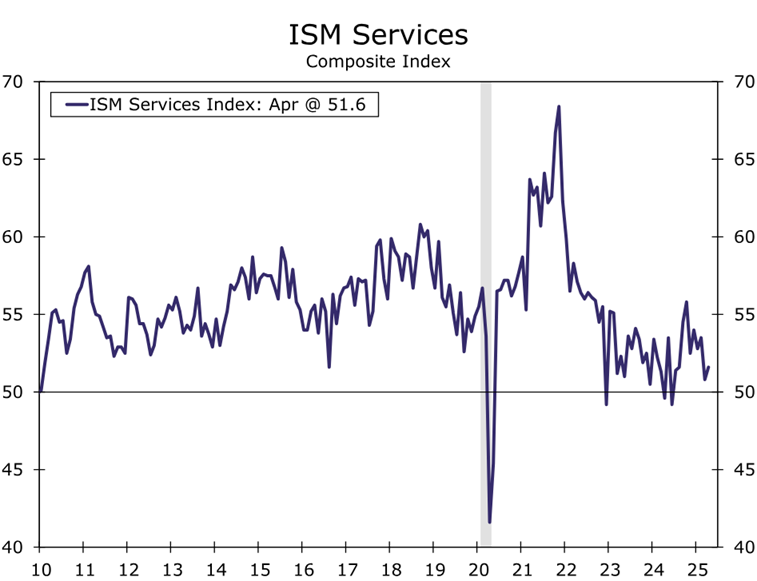

The US services sector posted a stronger growth rate in April, according to the survey-based ISM Services PMI. The indicator edged up to 51.6, reflecting a modest pace of growth by printing above the neutral 50 mark. But in a worrisome sign for the inflation outlook, the prices paid component of the survey rose to a 27-month high.

Fed Set To Keep Rates Steady, Despite Pressure From Trump

President Trump said he wouldn’t fire Federal Reserve Chairman Powell, but the pressure for rate cuts continues. The market, however, is still betting that the central bank will stand firm and leave its target rate steady at Wednesday’s policy announcement.

Macro Briefing: 5 May 2025

The US unemployment rate was steady in April at 4.2% and nonfarm payrolls rose increased a seasonally adjusted 177,000 last month. “We can push recession concerns to another month. Job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy in play before the tariff shock,” said Seema Shah, chief global strategist at Principal Asset Management. “The economy will weaken in the coming months but, with this underlying momentum, the U.S. has a decent chance of averting recession if it can step back from the tariff brink in time.”