Trump favors arming teachers to prevent school shootings: Reuters

Air strikes by Syrian regime and Russian allies kill more than 300 since Sun: WaPo

Fed minutes: officials say growth, inflation make case for more rate hikes: The Hill

Fed’s Quarles: US economy in “best shape” since financial crisis: Bloomberg

US existing home sales post biggest year-over-year drop in 3 years in Jan: Reuters

Signs of slower US growth are on the horizon: MainStay Investments

Larry Swedroe: research shows that combining factors can outperform: ETF.com

Small-biz sentiment indicators are no silver bullet for investors: Barry Ritholtz

Southern Poverty Law Center: hate groups in US are proliferating: Reuters

Composite PMI: US output in Jan rises at fastest rate since Nov 2015: IHS Markit

Monthly Archives: February 2018

Trend Behavior: Comparing US vs. Emerging Markets Stocks

Standard finance theory tells us to select weights for stocks and other asset classes based on market value. By that standard, emerging markets deserve a relatively light touch in portfolios. But this strikes some investors are misguided. As Frontera, a research shop, noted last year, “Emerging Markets Account for 80% of Global GDP Growth But Only 10% of World Equity Market Cap.”

Continue reading

Macro Briefing: 21 February 2018

Supreme Court rejects challenge to waiting period for gun purchases: Reuters

Shocking new corruption charges leveled at Israel’s Netanyahu: LA Times

Obama’s chief economist: Trump’s economic projections are “absurd”: Vox

Weak sales growth for Wal-Mart rattled investors on Tuesday: USA Today

How will the US safety net for workers fare in the next recession? NY Times

Venezuela launches crypto currency; reports raising $735 million: Reuters

Study projects world’s oceans rising 3 feet by 2300: Nature Communications

Treasury auction sees 3- and 6-mo bills sell at rates unseen since 2008: Bloomberg

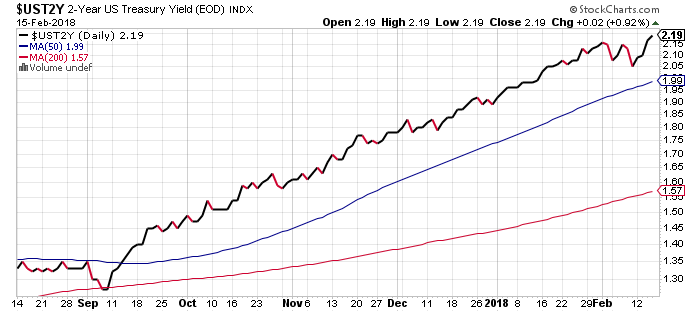

2-year Treasury rate continues rising, setting another 10yr high on Tues: 2.25%

There Are (Still) No Shortcuts For Estimating Recession Risk

The St. Louis Fed last week pondered the question: “Is the U.S. Due for a Recession?” In a blog post the bank advised that after a long expansion “there is a concern that, even though the economy looks good right now, the next recession may be lurking just around the corner.” On the short list for possible smoking guns, the post continued, is the low unemployment rate, which is currently at 4.1%, which is near a two-decade low.

Continue reading

Macro Briefing: 20 February 2018

Iran responds with a warning of its own after Israel PM’s fiery speech: CNN

Will Iran’s “axis of resistance” trigger another war in the Mideast? NY Times

Senate seeks to roll back bank regs put in place after 2008 crash: Politico

Gun-control push finds new traction after Florida shooting: WaPo

Diversification may be challenged this year as a risk-management tool: Bloomberg

The case for global small-cap stocks is strenghtening: Fortune Financial

Ethereum’s co-founder: digital currencies could “drop to near-zero”: MarketWatch

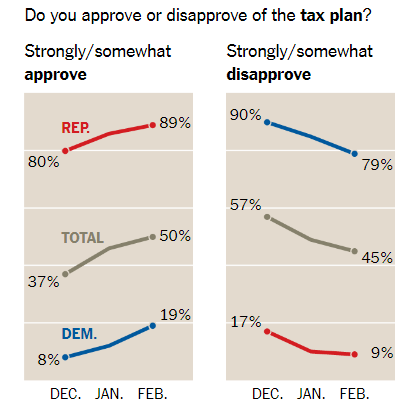

Americans are starting to view the GOP tax plan more favorably: NY Times

Across-The-Board Gains For The Major Asset Classes Last Week

After two weeks of red ink, all the major asset classes bounced back last week, based on a set of exchange-traded products through Friday’s close (Feb. 16).

Continue reading

Macro Briefing: 19 February 2018

Russia issues warning to US on Syrian conflict: Bloomberg

Will tax cuts help GOP retain control of Congress in elections this fall? Reuters

US consumer sentiment jumps to 2nd highest level in 14 years: MarketWatch

Import prices for US up more than forecast in January: WSJ

Are commodities a worthwhile hedge against inflation? MarketWatch

Markets may be overestimating the risk of higher inflation: Nataxis

US economic growth coupled with a rising deficit is troubling: FiveThirtyEight

Book Bits | 17 February 2018

● The Divide: Global Inequality from Conquest to Free Markets

Summary via publisher (W. W. Norton)

By Jason Hickel

Global inequality doesn’t just exist; it has been created. More than four billion people—some 60 percent of humanity—live in debilitating poverty, on less than $5 per day. The standard narrative tells us this crisis is a natural phenomenon, having to do with things like climate and geography and culture. It tells us that all we have to do is give a bit of aid here and there to help poor countries up the development ladder. It insists that if poor countries would only adopt the right institutions and economic policies, they could overcome their disadvantages and join the ranks of the rich world. Anthropologist Jason Hickel argues that this story ignores the broader political forces at play.

Continue reading

A Closer Look At The Links For Stocks, Interest Rates, And Inflation

Does history offer a reason to be cautious on the outlook for stocks if inflation and interest rates are rising? Yes, sort of, according to a New York Times article published on Thursday.

Continue reading

Macro Briefing: 16 February 2018

Global stocks on track for best weekly gain since 2011: Reuters

US industrial production slips in Jan, first slide in 5 months: MarketWatch

US producer prices rise in Jan — another sign of firming inflation: WSJ

Jobless claims in US rise after touching a near-45-year low: Reuters

NY Fed manufacturing index dips modestly in Feb: RTT

Philly Fed index points to firmer growth for manufacturing in Feb: RTT

Builder confidence in US remained high in Feb: HousingWire

History suggests caution for stocks when rates and inflation rise: NY Times

A study of financial advisors’ personal investing habits reveal poor decisions: SSRN

2-year Treasury yield edges up to 2.19%, highest since 2008: