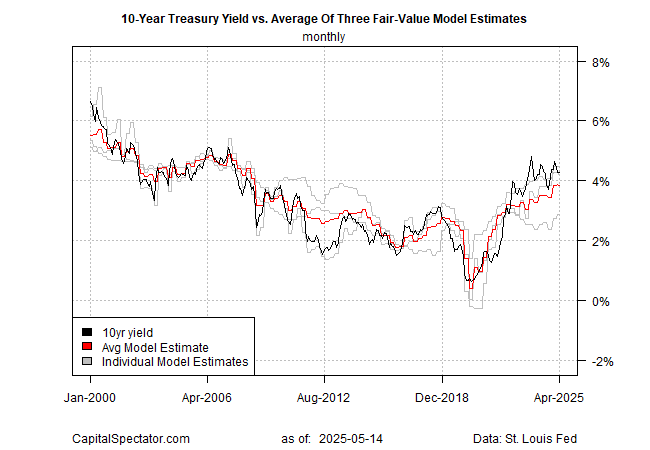

The US 10-year yield was steady in April in terms of the market premium relative to a “fair value” estimate. The 10-year yield’s monthly average last month remained mostly unchanged at roughly 40 basis points-plus over the average fair value via three models run by CapitalSpectator.com.

The current average monthly fair-value estimate is 3.84%, which remains below the actual 10-year yield. In yesterday’s trading, the benchmark rate was 4.49% (May 14), the highest in a month, according to Treasury.gov.

The roughly 40 basis-points market premium has fallen sharply in recent history. As recently as Oct. 2023, the premium was 140 basis points, an unusually but not unprecedented level. As expected, the premium has returned to a “normal” level after the Federal Reserve stopped raising interest rates and adopted a less hawkish policy stance.

A key question for the bond market in the weeks and months ahead: Will tariff-related inflation emerge and push the market premium higher? The April data suggests that investors have become comfortable with a relatively modest premium, but it’s unclear how much additional yield, if any, the market will demand in the wake of higher tariffs, which could lift pricing pressure.

Another factor that could bring upward pressure to yields is the perceived decline in US government bonds as a safe havens. Although this is challenging to quantify, and is speculative at this point, some analysts see a shift underway in how the market is pricing Treasuries.

“I believe the appeal of Treasuries as a safe haven has eroded due to two key factors: the potential for a significant increase in supply and the (Trump) administration’s tariff policies,” Jabaz Mathai, head of G10 rates and FX at Citi, tells Reuters. “Right now, tariffs are the dominant driver, but as we move through the rest of the year, fiscal policy will also come into play,” he added.

“If the administration manages to push through tax cuts — and not just extensions of the 2017 cuts, but also other promises like eliminating taxes on Social Security benefits, tips and possibly lowering corporate taxes — that could further unsettle investors” because such changes are expected to further raise the government’s already hefty debt burden.