Every recession is different, born of unique conditions that conspire to push an expanding economy into contraction. That’s certainly true for the deep decline in output that’s widely expected from the coronavirus fallout. As recessions go in the modern era, the one that’s arrived is a one-of-a-kind gut punch that few, if any economists expected as a recently as a month ago. The macro devastation will reorder recession-risk modeling and, in time, spawn new econometric tools. In fact, the change has already started with an early entrant to the new world order via the New York Federal Reserve, which this week announced a new index for monitoring the US economy in “real time.”

Monthly Archives: March 2020

Macro Briefing | 31 March 2020

Congress considers additional steps after passing $2.2 trillion stimulus: Reuters

The grand experiment: putting the global economy into an induced coma: WSJ

Coronavirus will leave millions in poverty, the World Bank warns: BBC

US retail sector shedding workers at alarming pace: NY Times

Will coronavirus fallout lead to civil disorder? Reason

China Mfg PMI rebounds in March from depressed Feb print: Reuters

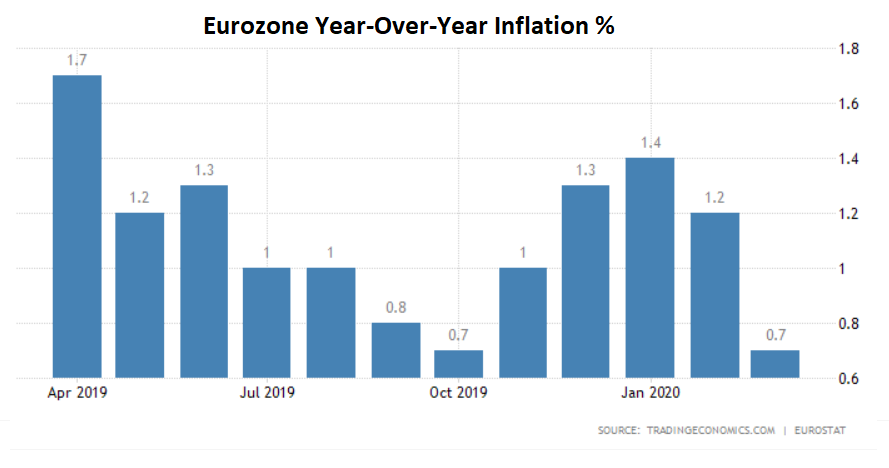

Eurozone inflation falls sharply in March: MW

More Volatility Awaits Global Markets After Last Week’s Gains

The major asset classes posted widespread gains last week, but the reprieve may be brief as the world continues to grapple with coronavirus risk. But for the trading week ended Friday, Mar. 27, broad-based gains prevailed, based on a set of exchange-traded funds.

Continue reading

Macro Briefing | 30 March 2020

Trumps extends social distancing guidelines to April 30: CNN

Strict containment in Washington state appears useful in slowing Covid-19: NYT

Eurozone economic sentiment posts largest monthly decline on record: MW

This week’s March payrolls report will only show partial impact from Covid-19: WSJ

What will keep a stock market rebound going amid coronavirus fallout? CNBC

Oil falls to 17-year low: CNBC

Oil demand appears set to fall by 20 million barrels a day in April: CNBC

VIX Index (US stock market’s ‘fear gauge’) holds at historically high level:

Coronavirus Forecast Update: 29 March 2020

Revised data for CapitalSpectator.com’s coronavirus (Covid-19) forecast, based on an 8-model combination, still points to a rise in the number of global reported cases (via the median point forecast). At some point, when the reported cases reflect a tendency to print below the median forecast, the downside bias will be welcome news since it suggests that the trend is peaking. Unfortunately, there’s no sign of the apex yet using this framework.

Book Bits | 28 March 2020

● Capital Wars: The Rise of Global Liquidity

By Michael J. Howell

Summary via publisher (Palgrave Macmillan)

Economic cycles are driven by financial flows, namely quantities of savings and credits, and not by high street inflation or interest rates. Their sweeping destructive powers are expressed through Global Liquidity, a $130 trillion pool of footloose cash. Global Liquidity describes the gross flows of credit and international capital feeding through the world’s banking systems and wholesale money markets. The huge jump in the volume of international financial markets since the mid-1980s has been boosted by deregulation, innovation and easy money, with financial globalisation now surpassing the peaks of integration reached before the First World War. Global Liquidity drives these markets: it is often determinant, frequently disruptive and always fast-moving. Barely one fifth of Wall Street’s huge gains over recent decades have come from earnings: rising liquidity and investors’ appetite for riskier financial assets have propelled stock prices higher.

Continue reading

Research Review | 27 March 2020 | Coronavirus

Government Equity Investments in Coronavirus Rescues: Why, How, When?

William L. Megginson (U. of Oklahoma) and Veljko Fotak (SUNY at Buffalo)

March 25, 2020

The coronavirus pandemic has led to a “great shutdown” whose ultimate impact on the US economy is hard to predict. What is already clear is that government intervention at an unprecedented scale is forthcoming. A rescue/stimulus package worth $2 trillion, or 10% of US GDP, is being approved at the time of writing. We argue that part of the intervention should take the form of preferred equity injections in both large and small firms. We discuss pros and cons of such an approach, the potential challenges, and our suggested solutions. While historical precedents help guide the policy response aimed at publicly traded firms, we call for a novel approach aimed at small businesses. With over 30 million small businesses in the country, novel public-private partnerships will be required for governments to incentivize private-sector actors to assist in identifying and valuing the right targets.

Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy

Nuno Fernandes (University of Navarra)

March 22, 2020

This report discusses the economic impact of the Coronavirus/COVID-19 crisis across industries, and countries. It also provides estimates of the potential global economic costs of COVID-19, and the GDP growth of different countries, under different scenarios. The report shows the economic effects of outbreak are currently being underestimated, due to over-reliance on historical comparisons with SARS, or the 2008/2009 financial crisis. The results show GDP growth will take a hit ranging from 3-5% depending on the country, in a mild scenario. Every extra month of shutdown accounts for approx. 2-2.5% of global GDP growth. Service-oriented economies will be particularly negatively affected, and have more jobs at risk. Countries like Greece, Portugal, and Spain that are more reliant on tourism (more than 15% of GDP) will be more affected by this crisis.

Real-Time Weakness of the Global Economy: A First Assessment of the Coronavirus Crisis

Danilo Leiva‐Leon (Banco de España), et al.

March, 2020

We propose an empirical framework to measure the degree of weakness of the global economy in real-time. It relies on nonlinear factor models designed to infer recessionary episodes of heterogeneous deepness, and fitted to the largest advanced economies (U.S., Euro Area, Japan, U.K., Canada and Australia) and emerging markets (China, India, Russia, Brazil, Mexico and South Africa). Based on such inferences, we construct a Global Weakness Index that has three main features. First, it can be updated as soon as new regional data is released, as we show by measuring the economic effects of coronavirus. Second, it provides a consistent narrative of the main regional contributors of world economy’s weakness. Third, it allows to perform robust risk assessments based on the probability that the level of global weakness would exceed a certain threshold of interest in every period of time.

A Coronavirus Outbreak and Sector Stock Returns: The Tale from The First Ten Weeks of Year 2020

Khoa Nguyen (Southern Connecticut State University)

March 23, 2020

This paper examines the early impact of the coronavirus disease (COVID-19) outbreak on stock returns of eleven sectors using the firm-level stock price data from ten countries.

The Coronavirus and the Great Influenza Epidemic – Lessons from the ‘Spanish Flu’ for the Coronavirus’s Potential Effects on Mortality and Economic Activity

Robert J. Barro (Harvard University), et al.

March 2020

Mortality and economic contraction during the 1918-1920 Great Influenza Epidemic provide plausible upper bounds for outcomes under the coronavirus (COVID-19). Data for 43 countries imply flu-related deaths in 1918-1920 of 39 million, 2.0 percent of world population, implying 150 million deaths when applied to current population. Regressions with annual information on flu deaths 1918-1920 and war deaths during WWI imply flu-generated economic declines for GDP and consumption in the typical country of 6 and 8 percent, respectively. There is also some evidence that higher flu death rates decreased realized real returns on stocks and, especially, on short-term government bills.

Will Coronavirus Pandemic Diminish by Summer?

Qasim Bukhari and Yusuf Jameel (Massachusetts Institute of Technology)

March 17, 2020

The novel coronavirus (2019-nCoV) has spread rapidly to multiple countries and has been declared a pandemic by the World Health Organization. While influenza virus has been shown to be affected by weather, it is unknown if COVID19 is similarly affected. In this work, we analyze the patterns in local weather of the regions affected by 2019-nCoV virus until March 22, 2020.

Efficiency and Effectiveness of Measures to Combat the Coronavirus in Selected Countries

Constantin Zaman (CES Paris 1) and Bogdan Meunier (Novalis Research Centre)

March 26, 2020

The current contagion that has rapidly spread all over the world mobilised impressive financial and sanitary resources in most of the affected countries. However, in the majority of cases these measures seem insufficient or inefficient, as the number of cases has exploded, while the increase in the number of deaths becomes alarming. In this paper we analyse the response of authorities to the pandemic challenges in those countries that are confronted with a large number of cases. Those twelve countries record together 86,65% of total confirmed cases reported in the world. The analysis considers the statistical data available on March 25, 2020.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Macro Briefing | 27 March 2020

US now leads world in reported coronavirus cases: WSJ

Massive coronavirus relief bill awaits approval in House today: Reuters

Who will get stimulus checks in the $2 trillion bill awaiting approval? USA Today

US national debt is set to soar: NY Times

US dollar on track for worst week since 2009: Bloomberg

Endless quantitative easing is crushing traditional bond strategies: BBG

Short-covering and rebalancing may explain this week’s rebound in stocks: MW

US jobless claims posted massive increase last week: CNBC

Will Trillions Of Dollars In Stimulus Raise Inflation?

Before the coronavirus shock, inflation in the US appeared tame by the standard measures. But the macroeconomic earth has shifted in recent weeks to combat the fallout from Covid-19. The Federal Reserve has announced unlimited asset purchases and is running ultra-dovish monetary policy. Meanwhile, the federal government is about to roll out a new $2 trillion stimulus package. It all adds up to what is perhaps the most ambitious effort in history to grease the economy’s wheels (or at least prevent collapse). Is this herculean effort also laying the groundwork for higher or even soaring inflation?

Macro Briefing | 26 March 2020

$2 trillion US economic stimulus package expected to become law today: Politico

What’s in the massive stimulus bill? TH

Pressure builds on Trump for gov’t intervention for ventilator output: BBG

US jobless claims filings expected to surge in today’s report: Reuters

What are the risks to Trump’s preference for reopening US by Easter? CNN

Should you expect to become immune to coronavirus at some point? NY Times

Economic assumptions upended amid coronavirus crisis: BBG

Consumer sentiment in Germany suffers dramatic decline: AF

US durable goods orders rose in Feb, but coronavirus damage lies ahead: MW

World trade’s 1-year trend fell deeper into the red in January: CPB