Equity prices in emerging markets posted the strongest gain for the major asset classes for the trading week through Friday, July 10, based on a set of US-listed exchange traded funds.

Monthly Archives: July 2020

Macro Briefing | 13 July 2020

White House undercuts Fauci re: US coronavirus response: NBC

Summer doesn’t appear to be slowing Covid-19’s transmission rate: WSJ

US warns citizens of “heightened risk of arbitrary detention” in China: CNBC

China announces sanctions on US officials in retaliation to Uighur policy: Reuters

Poland’s conservative President Duda narrowly wins re-election: BBC

US bankruptcies persist due to ongoing Covid-19 blowback: Bloomberg

Producer price index for US unexpectedly fell in June: CNBC

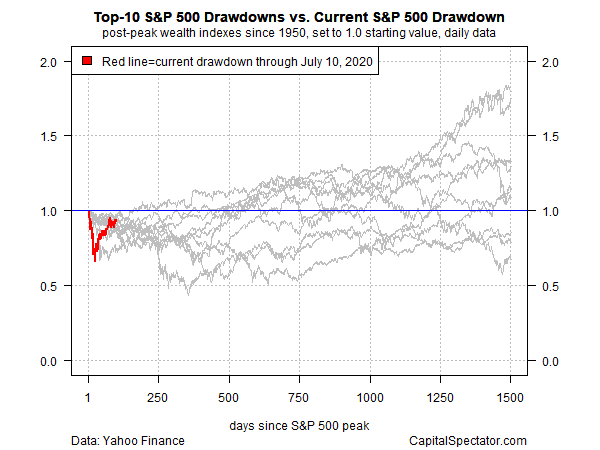

US stock market (S&P 500) begins trading week with drawdown near -6%:

Book Bits | 11 July 2020

● The Rules of Contagion: Why Things Spread–And Why They Stop

Adam Kucharski

Review via Wired

Kucharski, an epidemiologist at the London School of Hygiene and Tropical Medicine, is a mathematician by training. He uses data and models to predict how disease outbreaks will progress. His new book, The Rules of Contagion: Why Things Spread—and Why They Stop, lays out those tools and how they can be applied to other parts of life. Think methods to predict how panic might course through the global financial system, or how bad information is transmitted on Facebook. But most important, Kucharski says, is what he calls “epidemiological thinking.” That’s a mindset for dealing with incomplete information, as infectious-disease researchers must when they encounter a novel, fast-moving pathogen. Sometimes you might make bad assumptions, and your models might make predictions that never come to pass. But in a crisis, coming up with a hypothesis, even if it’s a rough one, is often the only way to get people to act.

Large Cap Growth And Momentum Dominate 2020 Factor Returns

If your US equity strategy is posting a gain this year there’s a good chance that the key driver is a hefty allocation to either the large-cap growth or momentum factors. These are the only two factor strategies posting gains so far in 2020, based on a set of exchange-traded funds. Otherwise, red ink rules, based on numbers through July 9.

Macro Briefing | 10 July 2020

US economic recovery dependent on managing coronavirus, say economists: WSJ

Coronavirus killing record number of Americans in Sunbelt: Bloomberg

A second round of stimulus checks may be coming for US workers: CNBC

Vaccine arms race has health and economic risks, consultancy warns: CNBC

Wealthy investors are increasingly focused on sustainability trends: CNBC

Second South American leader tests positive for coronavirus: NY Times

Supreme Court: roughly half of Oklahoma is Native American land: BBC

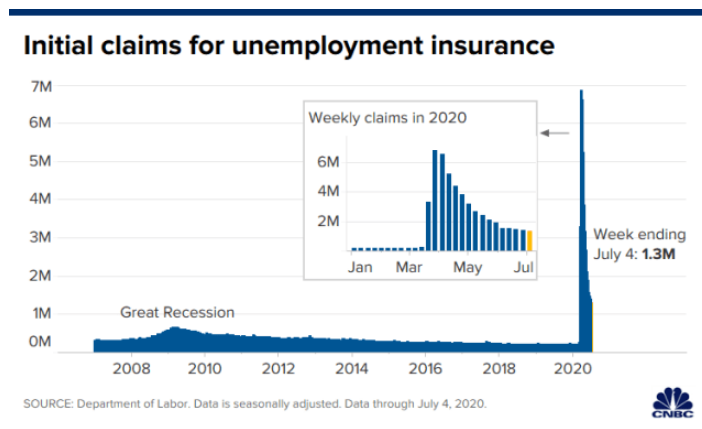

US jobless claims rise by 1-million-plus for 15th straight week: CNBC

Has The Fed Launched A Yield-Curve-Control Policy For Treasuries?

The Federal Reserve has publicly disclosed it’s considering it and many commentators have analyzed the implications. Officially, the central bank is conducting “further analysis” on so-called yield curve control (YCC). But looking at the flat trend in the 10-year Treasury yield in recent months raises the obvious question: Has YCC already started?

Macro Briefing | 9 July 2020

Top Chinese diplomats offer conciliatory comments as tension rise with US: CNBC

Rising US Covid-19 cases trigger tougher face-mask rules: Reuters

Supreme Court expands worker exemptions for health care regulations: WSJ

Supreme Court set to rule on access to Trump’s taxes: Politico

Australia announces suspension of extradition agreement with Hong Kong: NYT

United Airlines will furlough up to 36,000 workers: BBC

China’s factory deflation eased in June amid rebound in commodity prices: MW

Decline in US consumer credit slowed in May as economy began to rebound: MW

Gold continues to rise, nearing record high price: Bloomberg

China’s Equity Market Surges, Leaving Rest Of World Far Behind

China’s stock market is enjoying a banner year in 2020, partly due to a surge in prices in recent days. Using a set of US exchange-listed funds as proxies for the world’s major equity regions also shows that Chinese shares have pulled far ahead of the rest of the field, based on the close of trading for Tuesday, July 7.

Macro Briefing | 8 July 2020

WHO warns of ’emerging evidence’ of airborne transmission of coronavirus: CNN

New US coronavirus cases reach 60,000 for July 7–a record high: WSJ

Dr. Fauci warns against ‘false complacency’ re: low Covid-19 death rate: NW

FBI chief says China’s cyberattacks on US are ‘breathtaking’: CNBC

China is ‘happy’ to join arms control talks with US and Russia: Reuters

Gold reaches $1800 an ounce–highest since 2011: CNN

Has the long-short equity strategy concept hit a wall? Bloomberg

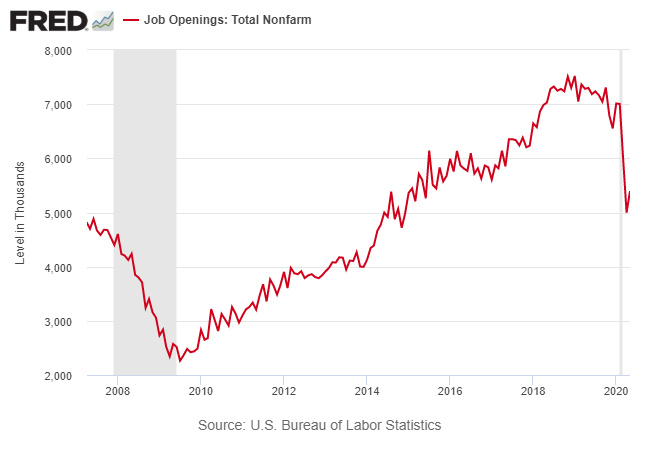

US job opening rose in May, surprising economists: Bloomberg

Will The US Economic Rebound Continue?

The US economy is growing again. The growth to date is largely due to the snap-back effect that followed a sudden, sharp decline in output, but recent data clearly show that the coronavirus recession has bottomed and a recovery is unfolding. The mystery is whether the recovery will persist. The primary reason for the mystery, of course, is the uncertainty linked to Covid-19.