For a brief few weeks it looked like the jig was up. But the selling wave has all but faded as sentiment has recovered and markets have rebounded from the perspective of a high-level global asset allocation perspective. Reviewing a select set of proxy ETFs suggests that risk-on sentiment has returned for the strategic outlook, based on prices through Friday’s close (June 27).

Daily Archives: June 30, 2025

Macro Briefing: 30 June 2025

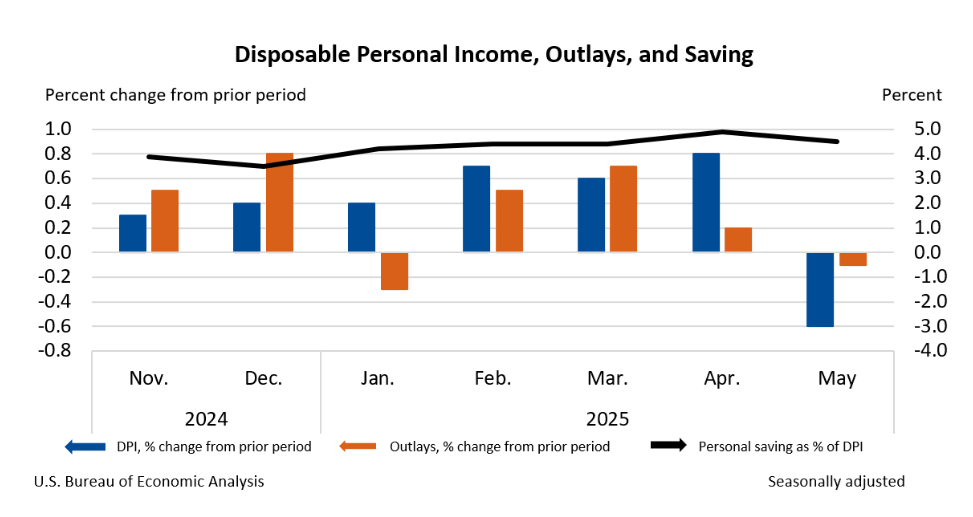

US consumer spending and income fell in May, the Bureau of Economic Analysis reported on Friday. Inflation also ticked up, based on core PCE. This measure of inflation, which is the Fed’s preferred benchmark for monitoring prices, edged up to a 2.7% year-over-year rate. “The report is a wash for the Fed and won’t alter its wait-and-see stance,” said Sal Guatieri, a senior economist at BMO Capital Markets. “The pullback in spending in May partly reflects payback from earlier tariff front-running, while the slightly warmer core price increase doesn’t settle the debate about how much tariffs will impact inflation.”