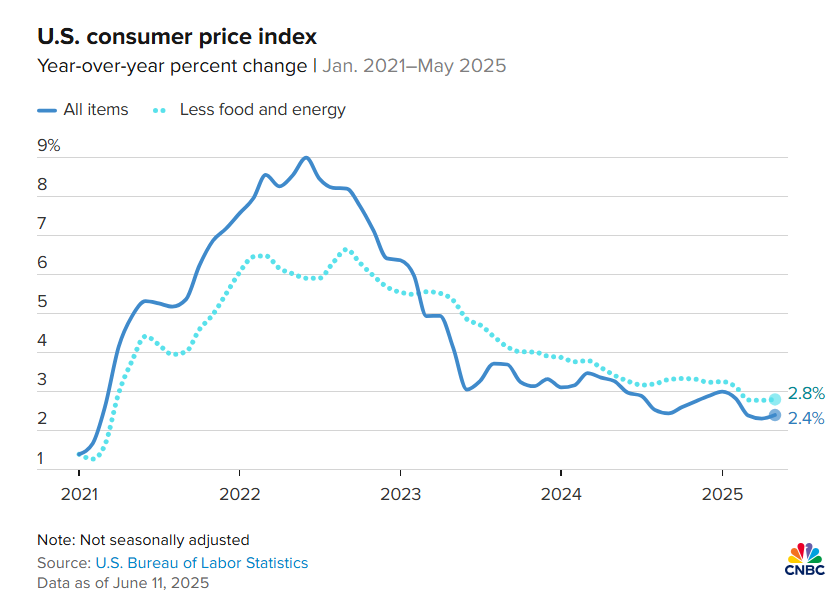

US consumer inflation remains muted in May as headline CPI’s year-over-year change ticked down to 2.4%. Core CPI, a more robust measure of the trend, held steady, which could be a sign that pricing pressure will remain “sticky” at a time when tariffs are only just starting to factor into prices. “It was a very good report,” said Mark Zandi, chief economist at Moody’s. “Basically, it says inflation has finally gotten back to the Federal Reserve’s annual inflation target.” He added: “I think it’s the calm before the inflation storm. This [report] still reflects the disinflation that began a few years ago and continued on through the month of May.”

President Trump on Wednesday said that he would send letters to trading partners in the next week or two to set unilateral tariff rates. “At a certain point, we’re just going to send letters out. And I think you understand that, saying this is the deal, you can take it or leave it.”

The US government budget deficit deepened in May. The deficit totaled more than $316 billion for the month, lifting the year-to-date total to $1.36 trillion. Surging financing costs remained a key factor: interest on the $36.2 trillion debt pile topped $92 billion.

OpenAI chief Sam Altman said that the era of artificial superintelligence has begun. “We are past the event horizon; the takeoff has started. Humanity is close to building digital superintelligence, and at least so far it’s much less weird than it seems like it should be.”

Crypto bill is close to approval in the Senate. The legislation would create the first-ever U.S. regulatory framework for digital tokens known as stablecoins that are pegged to the value of the dollar.

Gold has overtaken the euro as the world’s second-most important reserve asset for central banks, advised the European Central Bank. “Central banks continued to accumulate gold at a record pace,” the ECB wrote. Central bank gold reserves, which peaked at 38,000 tonnes in the mid-1960s, rebounded ito 36,000 tons in 2024. “Central banks worldwide now hold almost as much gold as they did in 1965,” the ECB reported.