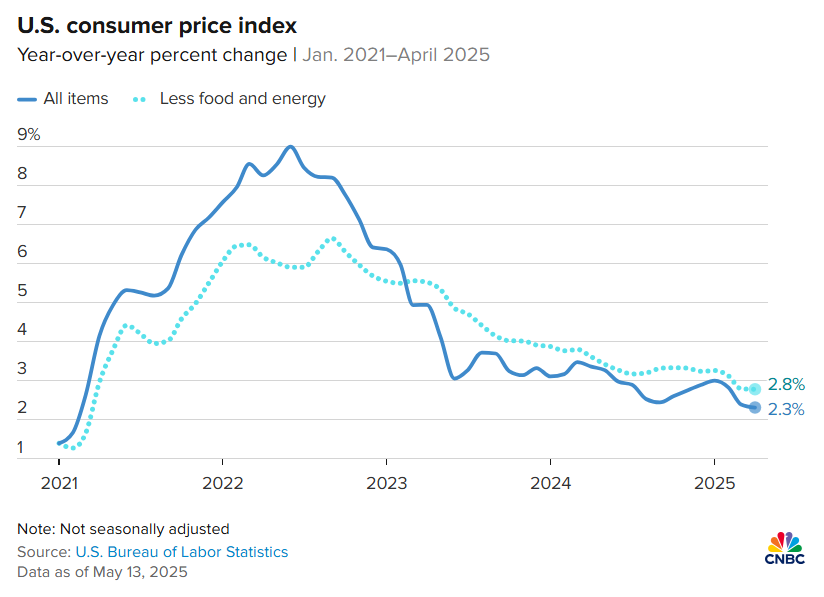

US consumer inflation dipped to an annual 2.3% in April, the lowest in four years. “Good news on inflation, and we need it given inflation shocks from tariffs are on their way,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Non-tariffed goods are still in the pipeline, and perhaps some importers have absorbed their tariff costs for now.”

Economic growth outlook for 2025 is revised down sharply for South Korea, a bellwether for global exporting activity. The state-run think tank halved its growth forecast for the country this year, citing higher US tariffs as a major downside risk to the export-led economy.

Microsoft is laying off about 3% of its workforce. “We continue to implement organizational changes necessary to best position the company for success in a dynamic marketplace,” a Microsoft spokesperson told CNBC.

Japanese carmaker Nissan said it will cut another 11,000 jobs globally and shut seven factories. The latest cutbacks raise the total number of layoffs announced by the company in the past year to roughly 15% of its workforce.

US stocks have recovered 2025’s losses after Tuesday’s rally for the S&P 500 Index. “Relief from policy-inflicted stress may be bullish at the margin, but it does not strengthen the economy or reverse the global slowdown that was already under way,” said Felix-Antoine Vezina-Poirier, strategist at BCA Research.