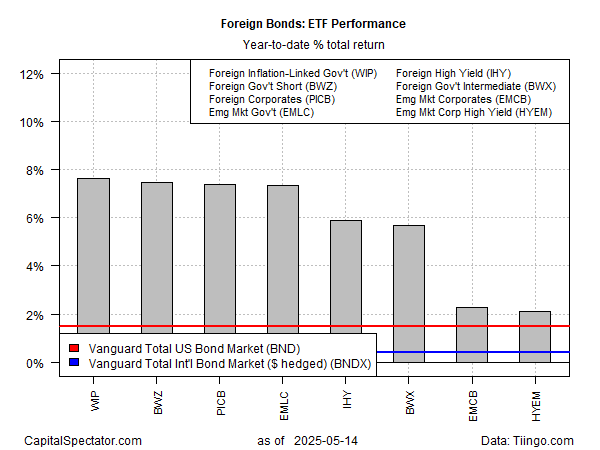

Global diversification for bonds has been a tough sell in recent years, but 2025 is another story. Year to date, fixed-income securities ex-US are outperforming the investment-grade US benchmark for bonds by a hefty degree, based on a set of ETFs through Wednesday’s close (May 14).

Leading the rally: foreign inflation-indexed government bonds. SPDR FTSE International Government Inflation-Protected Bond ETF (WIP) is up 7.6% this year. That’s a sizable premium over the 1.5% gain this year via the US bond benchmark, based on Vanguard Total US Bond Index (BND).

Three other foreign bond markets are posting year-to-date gains just behind the leader. There’s a virtual tie for second place with mid-7% increases in 2025 for short-maturity foreign government bonds in developed markets (BWZ), foreign corporates (PICB), and government bonds issued in emerging markets (EMLC).

The weakest foreign-bond performer in 2025: high-yield bonds in emerging markets (HYEM), with a 2.1% rise, although that still exceeds the 1.5% increase for the US benchmark (BND).

A key factor for the outsized gains in foreign bonds this year is the weak US dollar. In other words, hedging foreign currency risk as been a losing proposition this year. Note that Vanguard’s Total International Bond Market ETF (BNDX), which hedges forex risk, is up only fractionally this year.

The dollar’s slump in 2025 could be a normal run of forex volatility, although some analysts see a regime shift unfolding that will have longer-term implications.

Harvard economics professor Ken Rogoff this week advised that “My thesis is that the U.S. dollar is about to get knocked down a couple pegs. It will still be first in global finance, because nothing is poised to fully replace it. The dollar just won’t be as unique as it once was,” said the author of the newly published Our Dollar, Your Problem: An Insider’s View of Seven Turbulent Decades of Global Finance, and the Road Ahead.

If Rogoff’s analysis is correct, the relative strength for foreign bonds may be just getting started.

Athanasios Vamvakidis, global head of G-10 foreign exchange strategy at Bank of America, recently mused that a major shift in expectations for how the world views the US dollar is underway. “I don’t think we go back to where we were because I think the rest of the world has crossed a red line, and they will try to reduce dependence on the U.S. on trade, on defense and everything,” he told Barron’s last month. In the wake of the US-launched trade war, “There’s no way back.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno