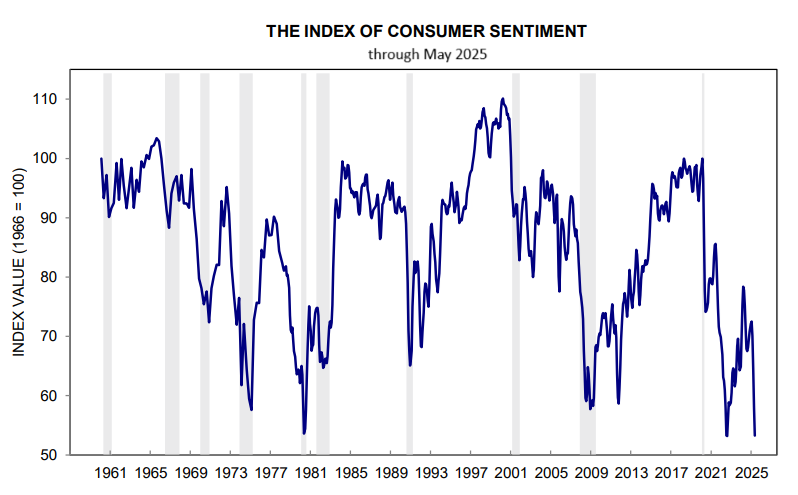

US Consumer Sentiment Index dropped to second-lowest level on record in May, based on polling by the University of Michigan. The caveat is that most of the survey was conducted before the US and China agreed to a 90-day pause on most tariffs. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” Joanne Hsu, director of the Surveys of Consumers, advised.

Moody’s downgraded US credit rating to to Aa1 from Aaa, citing concern over the government’s ability to pay back its debt. The announcement was no surprise: Moody’s warned in 2023 that its US triple-A rating was at risk. The other two major credit rating outfits — Fitch Ratings and S&P Global Ratings — previously downgraded the US rating. Nonetheless, the latest news is a milestone: Moody’s held a perfect credit rating for the US since 1917. “Higher for longer yields will add to the government’s net interest cost and deficits,” wrote Societe Generale strategist Subadra Rajappa in a note to clients.

US Treasury Secretary Bessent on Sunday noted that Walmart, the largest US retailer, may pass along some of the costs of tariffs to shoppers by raising prices. “Walmart will be absorbing some of the tariffs, some may get passed on to consumers,” he said in an interview with CNN.

China’s economy was a “mixed bag” in April, due partly to an ongoing property slump and sliding property prices. “The immediate impact of the escalated trade war may have more of a direct impact on sentiment and confidence,” ING reports. “The April data showing slowdowns in FAI and retail sales, as well as a bigger downturn in property prices, illustrates that China’s private sector and households may be erring on the side of caution amid the recent volatility.”

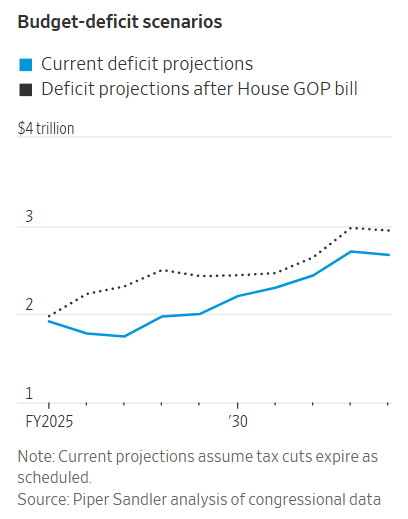

The GOP spending bill that advanced in the House late on Sunday doesn’t reduce the federal deficit. The current proposal would increase projected budget deficits by nearly $3 trillion through 2034, according to The Wall Street Journal. “On the horizon that investors care about, which is the first four years, it makes [the deficit] worse,” said analyst Don Schneider of Piper Sandler.

The GOP spending bill that advanced in the House late on Sunday doesn’t reduce the federal deficit. The current proposal would increase projected budget deficits by nearly $3 trillion through 2034, according to The Wall Street Journal. “On the horizon that investors care about, which is the first four years, it makes [the deficit] worse,” said analyst Don Schneider of Piper Sandler.