US consumer spending rose for a third month in April, matching expectations with a 0.2% monthly increase. Profiling consumption expenditures on a real (inflation-adjusted) year-over-year basis suggest the trend still looks resilient via a 3.2% increase (see chart below). Notably, the year-over-year change for real disposable income (DPI) continued to rebound, rising to a 2.9% pace. The pickup in DPI in recent months suggests that the consumer sector will continue to grow in the near term and provide timely support for the economy that’s facing tariff-related headwinds.

US-China trade tensions look set to worsen this week after Beijing on Monday refuted Washington’s claims that it had broken the recent trade agreement negotiated last months. China is “comfortable taking an extremely firm stance in these negotiations” and “sees no reason to roll over,” said Stephen Olson, visiting senior fellow at Yusof Ishak Institute in Singapore.

“It is well understood in Beijing that any deal reached with the U.S. will only buy some short-term peace, not the end of the story,” Olson added.

Consumer sentiment in May held steady vs. May, reflecting four months of sharply lower readings. “Overall, consumers see the outlook for the economy as no worse than last month, but they remained quite worried about the future,” wrote Surveys of Consumers Director Joanne Hsu.

Fed funds futures continue to price in a high probability (99%) for no change in interest rates at the upcoming June 18 policy meeting. The possibility of a cut in the Fed’s target rate looks better for the July FOMC meeting, but only moderately so. September, by contrast, is projected to be the first meeting when the central bank cuts, based on an estimated 71% probability for easing.

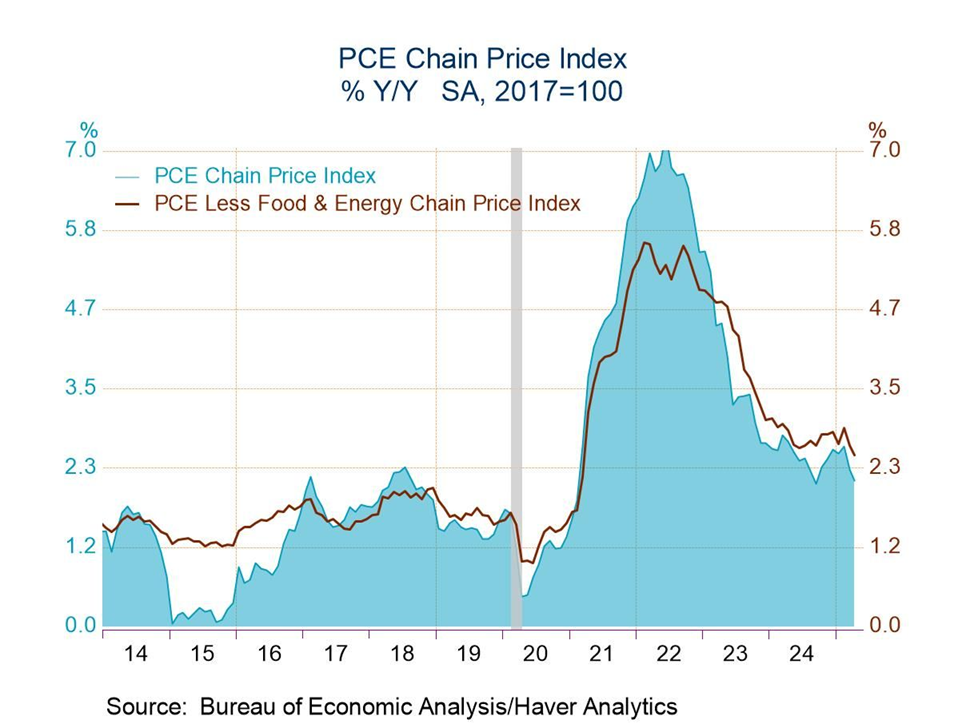

US consumer inflation remained modest in April, according to PCE price inflation data. The year-over-year pace edged down to 2.1% from 2.3% in March, its softest increase since September. The core PCE price index (excluding food & energy) also eased in year-over-year terms, dropping to 2.5% last month from 2.7% in March, the slowest since March 2021.