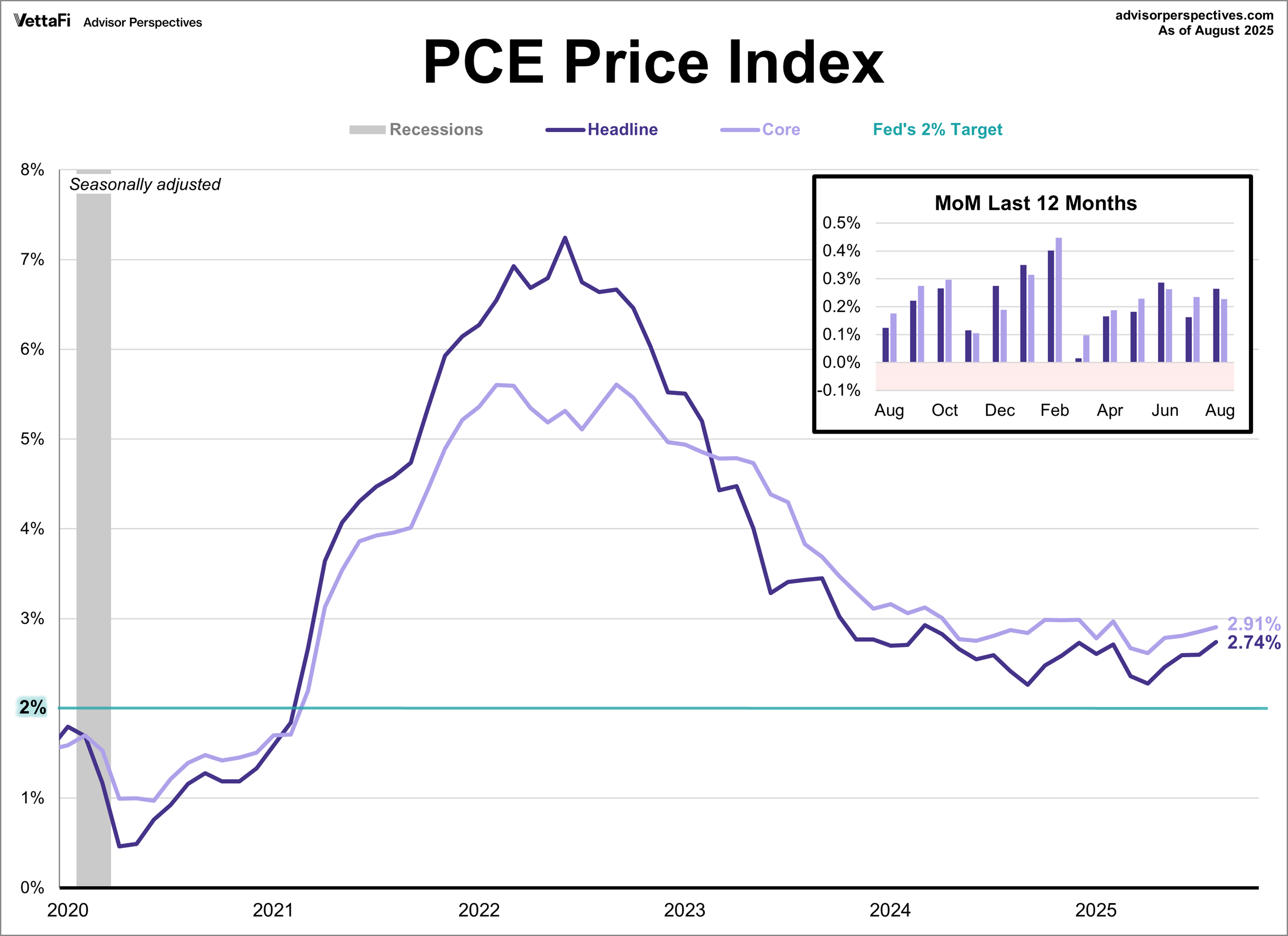

US inflation continued to edge higher in August based on a price index for personal consumption expenditures (PCE). The headline index was up 2.7% year-over-year, the highest level since April 2024. Core PCE prices, which exclude volatile prices for food and energy, rose 2.9% over the year, matching July’s trend.

US government shutdown looms starting Oct. 1 as President Trump plans to meet with Congressional leaders today. Democratic leaders and their Republican counterparts are expected to attend.

Consumer spending continued rixing at a robust pace in August, underscoring the resilience of the economy. Outlays rose 0.4% last month, matching July’s increase and marking the third straight monthly advance.

US Consumer Sentiment Index eased about 5% from last month but remains above weak readings in April and May. “Although September’s decline was relatively modest, it was still seen across a broad swath of the population, across groups by age, income, and education, and all five index components,” wrote the surveys of consumers director at the University of Michigan.

US soybean farmers are becoming collateral damage — again — in Trump’s trade war with China. Politico reports: “China has not purchased any US soybeans since May, according to the American Soybean Association. Beijing has pivoted to suppliers in Brazil and Argentina — logging huge orders for Latin American beans and leaving US farmers in the cold and panicking.”

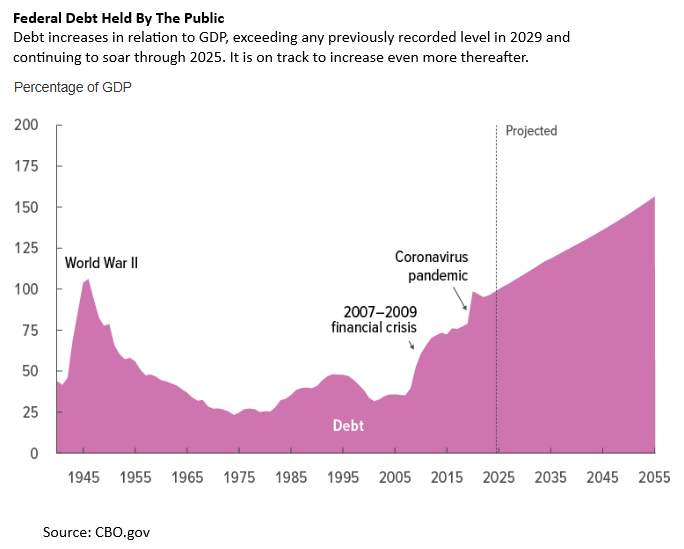

The Federal government has several options to resolve the growing US debt burden. Monetization of debt, fiscal austerity, and economic growth are three likely paths for solving the budget deficit, advises TMC Research, a unit of The Milwaukee Company, a wealth manager.