Consumer inflation was softer than expected in January, but the news hasn’t changed the market’s outlook for the Federal Reserve to keep its target interest rate steady until June. But the bond market looks poised to test challenge the timetable by pricing in an earlier rate cut.

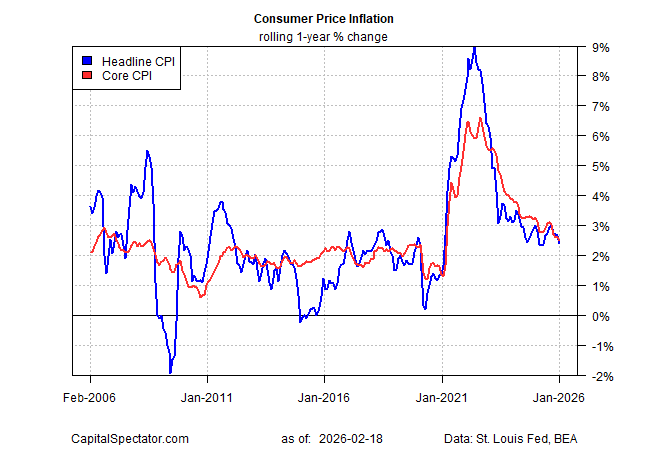

On Friday, the government reported the consumer price index (CPI) rose 2.4% for the year through January, easing from 2.7% in December, dropping to an eight-month low. Core CPI, which strips out energy and food and is seen as a more reliable measure of the trend, also ticked lower, rising 2.5% from the year-earlier level, marking the softest pace since 2021.

The downshift is encouraging, but a closer look at the numbers beyond the top-level disinflation suggests caution is still warranted about inflation’s future path. Ongoing price increases in tariff-sensitive goods is one reason. Another is food inflation, which rose 2.9% year-over-year, which is high relative to the historical record. Energy prices posted an even sharper increase, as did homeowners and renters insurance prices. Another sign that the Fed will remain cautious is that the inflation is still running above its 2% target.

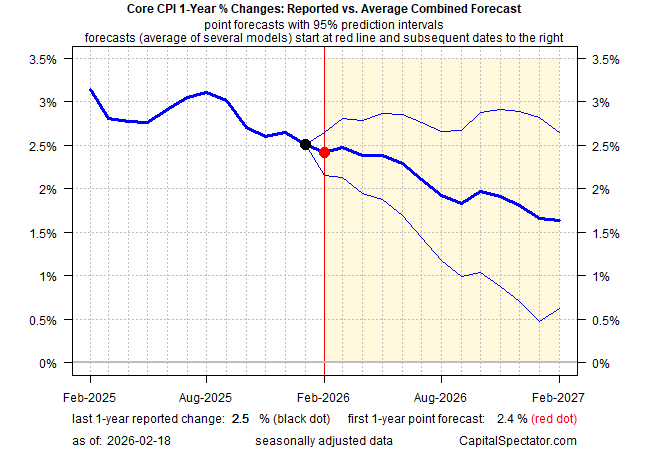

It’s still too early to declare victory, but as the broad price trend continues to ease there’s a case for arguing that the worst has passed. The Capital Spectator’s ensemble forecast for core CPI has been predicting ongoing disinflation for months, an outlook that has been more or less accurate, at least so far. The model continues to see core CPI’s 1-year trending lower, slipping to 2.4% for the upcoming February report.

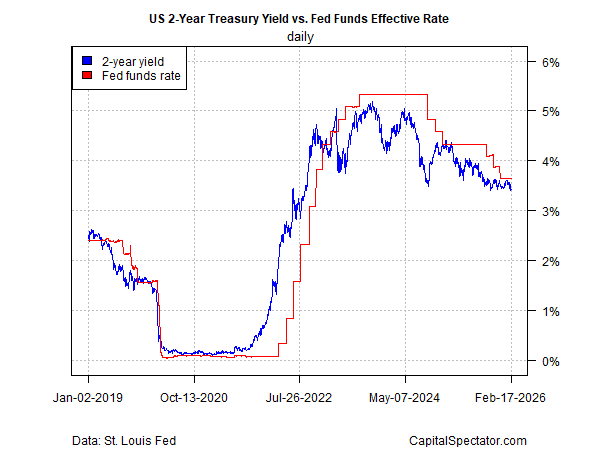

The implied forecast via Fed funds futures is still pricing in no rate cut until the June policy meeting, but the Treasury market is testing the waters for an earlier round of cutting. The policy-sensitive two-year yield is currently 3.45%, close to the lowest level since 2022 and below the Fed’s 3.50%-to-3.75% range for its target rate.

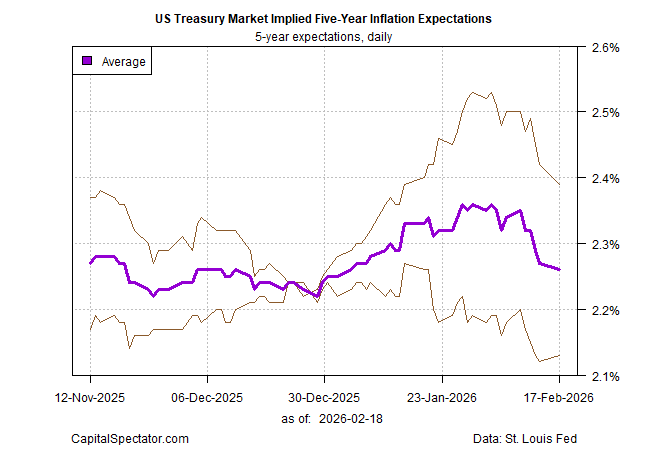

Sentiment in the Treasury market, in short, is leaning into the view that a rate cut is nearer than expected. Other market-based metrics are also pricing in higher odds that disinflation will continue. The average of two Treasury market-based forecasts now estimates 5-year inflation in the low-2% range, the softest in a month and close to the Fed’s 2% target. The jump in expectations in January has now reversed, suggesting that the market has become less concerned with inflation risk in recent weeks.

Markets can be wrong, of course, but it would take a significant surprise in the economic data in favor of reflation to reverse the crowd’s disinflationary outlook. For the moment, markets aren’t inclined to take that bet.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno