* Eurozone business activity rebounds to 10mo high in March: PMI survey data

* Will banks’ $1.7 trillion in unrealized losses become a problem?

* Expected fall in lending due to bank turmoil will help Fed tame inflation

* China could be a ‘relative safe haven’ this year, advise Citi economists

* Bond market volatility has surged, hinting at greater uncertainty and risk

* Tech consulting firm Accenture to cut 19,000 jobs

* US jobless claims edge down, continue to show tight labor market

* US economic activity eases in February: Chicago Fed Nat’l Activity Index

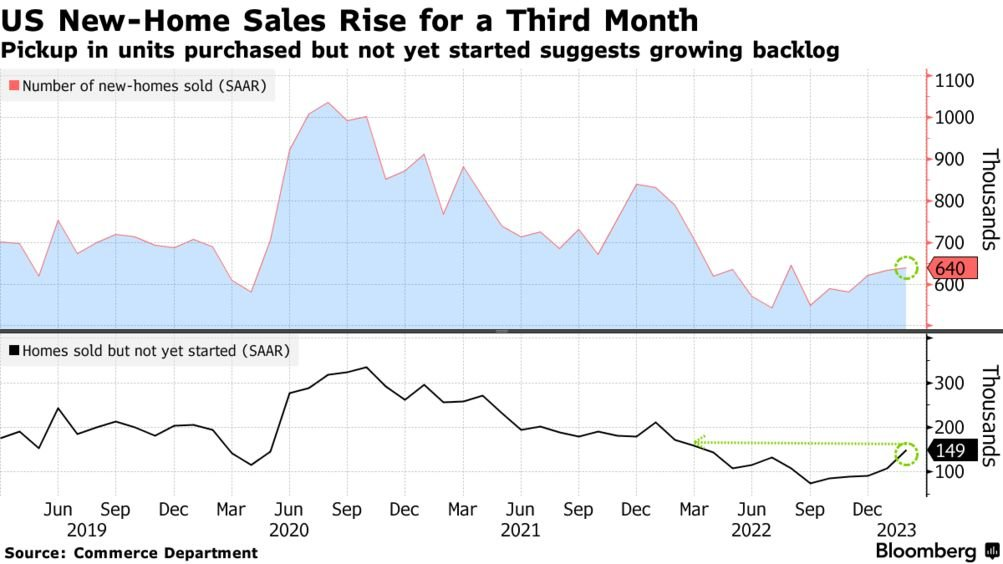

* New US home sales rebound for third month in February:

Category Archives: Uncategorized

Another Fed Rate Hike Keeps Policy Modestly Tight

Yesterday’s ¼-point rate hike by the Federal Reserve was expected, although there’s debate about whether another round of policy tightening is wise in the wake of recent bank turmoil following the collapse of Silicon Valley Bank (SVB).

Macro Briefing: 23 March 2023

* Treasury Sec. Yellen: blanket guarantee to all bank deposits not being discussed

* Fed’s Powell says SVB collapse was “outlier” and banking system is “sound”

* Bank stocks fall after comments from Federal Reserve and US Treasury

* Bank turmoil complicates debt-ceiling talks in Washington

* Fed oversight bill backed by Sens. Rick Scott (R) and Elizabeth Warren (D)

* Macro hedge funds hit hard by recent bank turmoil

* Investment firms buying land in US West for water rights

* SEC set to bring lawsuit against Coinbase, a leading crypto firm

* Federal Reserve raises interest rates despite bank turmoil:

Risk Of Wider Bank Crisis Appears To Be Easing

These are still early days for evaluating the risk outlook linked to the banking turmoil triggered earlier this month by the collapse of Silicon Valley Bank (SVB), but there are nascent signs that the worst has passed. Reverberations for the economy remain a threat, but for the moment the odds of contagion risk that spreads across the financial system seem to be receding. Blowback for the economy in the months ahead is less clear, but the immediate goal is avoiding a spike in financial-system risk writ large and on that front there’s a case for cautious optimism.

Macro Briefing: 22 March 2023

* China’s Xi tells Putin he wants to ‘strengthen coordination’ with Russia

* Federal Reserve faces tough choice on today’s decision on interest rates

* Fed will come under intense scrutiny in Congress over SVB failure

* UK inflation posts unexpected increase in February

* Bank crisis is expected to pinch commercial real estate lending

* Bank turmoil takes a bite out of oil prices

* Gold pulls back after briefly trading above $2000 an ounce

* US home prices fall vs. year-ago level–first decline in 11 years

* US existing home sales rebound sharply in February:

Tech And Communications Services Lead Equity Sectors In 2023

Technology is killing it–again. The sector is posting the strongest year-to-date performance for US equity sectors stocks, based on a set of ETF proxies. A close second: communication services. Meanwhile, financials and energy are suffering this year.

Macro Briefing: 21 March 2023

* Chinese leader Xi praises Putin in Moscow as Ukraine war grinds on

* Japan prime minister makes surprise visit to Ukraine

* Japan prime minister announces new Indo-Pacific plan during India visit

* French government survives no-confidence votes re: pension reform

* JPMorgan CEO Jamie Dimon leads efforts for First Republic Bank rescue

* Amazon will cut an additional 9,000 jobs

* Fed should continue rate hikes, says chief economist for S&P global ratings

* Fed to hike interest rates by 1/4 point tomorrow via futures market forecast:

Bonds Extend Rally Amid Fears Of Bank Crisis

Bond prices continued to rebound last week as investors worried that the turmoil in the banking sector could spread.

Macro Briefing: 20 March 2023

* Chinese leader Xi meeting with Russia’s Putin today in Moscow

* Central banks say they will boost liquidity to tamp down bank-crisis risk

* UBS is buying Credit Suisse in effort to tame risk of banking crisis

* S&P downgrades First Republic’s credit rating deeper into junk status

* US lawmakers will review merits of higher FDIC bank deposit insurance cap

* Lending to small firms and individuals expected to fall in wake of bank turmoil

* Gold rallies to 11-month high:

Book Bits: 18 March 2023

● Meganets: How Digital Forces Beyond Our Control Commandeer Our Daily Lives and Inner Realities

David B. Auerbach

Excerpt via Gizmodo

The Googles, Facebooks, cryptocurrencies, and government systems of our world accumulate influence at a mystifying rate. The constant critiques and attempted regulation directed at these systems never seem to yield real reform. Such efforts run into a brick wall for one ultimate reason: no one is really in control. Even the companies and executives who run them are trapped by the persistent, evolving, and opaque systems they have created. What is it that has so destabilized our elites so that they have lost control of the very systems they built and run? With every passing day we intuitively sense a loss of control over our daily lives, society, culture, and politics, even as it becomes more difficult to extricate ourselves from our hypernetworked fabric. No explanation ever seems sufficient.