* US supports plan to waive intellectual property rules for vaccines

* Treasury Dept. urges Congress to raise US debt level this summer

* World’s biggest pension fund rethinking ESG investing

* Epic rally in lumber prices adds average of $36,000 to cost of new homes

* Global economic growth accelerated to 11-year high in April via survey data

* US Services PMI reflects strongest growth on record (since 2009) in April

* US services growth slowed in April but still strong via ISM data

* Growth in US private payrolls accelerated in April–biggest gain in 7 months:

Category Archives: Uncategorized

The ETF Portfolio Strategist: 5 May 2021

Commodities continue to benefit from ongoing worries about inflation and real-time reports of price hikes for basic materials.

Major Asset Classes | April 2021 | Risk Review

Today’s post rolls out the inaugural Risk Review column for the major asset classes, a monthly update that’s the companion piece to the monthly performance report and risk-premia estimates. Readers can use this trio for a quick summary of historical and expected return and how that compares with several measures of risk.

Macro Briefing: 5 May 2021

* Rates may need to rise to prevent overheating US economy, says Treasury Sec.

* Supply shortages, logistical logjams may force firms to raise prices

* Covid deaths in India may double in weeks ahead, forecasters warn

* Eurozone growth continued to strengthen in April via PMI survey data

* Birthrate in US declined to another record low in 2020

* US factory orders rebounded sharply in March

* US trade deficit surged to record in March

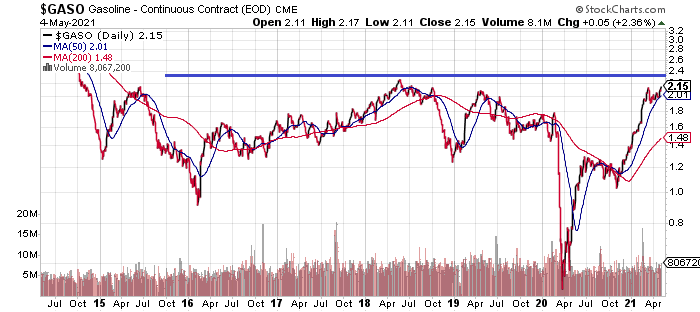

* US gasoline price approaching seven-year high:

Risk Premia Forecasts: Major Asset Classes | 4 May 2021

The expected risk premium for the Global Market Index (GMI) in the long run ticked higher again in April, rising to 5.9% annualized — modestly above the previous month’s estimate. The current expected return estimate — defined as performance above the “risk-free” rate — is still well below the previous realized performance peak for GMI, but today’s revision represents a solid bounce off the lows for recent projections.

Macro Briefing: 4 May 2021

* Biden lifts limit on refugees allowed into US

* Congressional debate set to begin on Biden’s economic plan

* India’s pandemic worsens as total Covid-19 cases reported surpasses 20 million

* Warren Buffett names successor to run Berkshire Hathaway

* Global manufacturing activity rebounded less than forecast in March

* US Mfg PMI continued to rise in April but ISM Mfg Index unexpectedly slipped:

Major Asset Classes | April 2021 | Performance Review

April delivered across-the-board gains in the major asset classes as risk-assets around the world rebounded from widespread losses in March. Thanks to a strong tailwind, you had to really work hard to lose money last month in conventionally managed multi-asset-class portfolios.

Macro Briefing: 3 May 2021

* Households in wealthy nations amassed record savings–will they spend it?

* Nearly two-thirds of Americans are optimistic on direction of US, poll finds

* Warren Buffett says US economy is red hot with rising inflation risk

* Verizon is considering selling AOL and Yahoo remnants

* Eurozone manfacturing activity continued to accelerate sharply in April

* US dollar on track for longest run of weakness in nine months

* Broad-based commodities bull market is gathering momentum

* Is herd immunity still possible for the US? Maybe not

* US consumer spending rebounded in March

* US personal income spending surged in March due to gov’t stimulus:

The ETF Portfolio Strategist: 2 May 2021

Keeping up with beta while maintaining a risk-management overlay remains challenging this year, but two of our three proprietary strategies dispatched some trivial success this week by losing slightly less than their benchmark. Not particularly impressive, but it beats a kick in the head.

Book Bits: 1 May 2021

Cass R. Sunstein

Summary via publisher (NY University Press)

The world is increasingly confronted with new challenges related to climate change, globalization, disease, and technology. Governments are faced with having to decide how much risk is worth taking, how much destruction and death can be tolerated, and how much money should be invested in the hopes of avoiding catastrophe. Lacking full information, should decision-makers focus on avoiding the most catastrophic outcomes? When should extreme measures be taken to prevent as much destruction as possible?