Promising results from Moderna’s first Covid-19 vaccine trial: NBC

Widespread mask use would control Covid-19 spread, says CDC director: STAT

China says it will retaliate after Trump ends Hong Kong’s special status: Reuters

Prime Minister Boris Johnson bans China’s Huawei from UK’s 5G network: CNN

Banks bulk up on cash to prepare for a surge in loan losses: NY Times

Sharp drop in global fertility rate will have “jaw-dropping” impact on societies: BBC

Fed’s Brainard: coronavirus still poses hefty economic risks for US: WSJ

Fed’s Kaplan expects pickup in US growth in 2021: CNBC

Apple scores a major victory on taxes in European Union: WSJ

US headline consumer price inflation up 0.6% in June–first gain in 4 months: MW

US small business optimism rebounded sharply in June: NFIB

Category Archives: Uncategorized

Parsing The Treasury Market’s Mixed Messages

Once upon a time the bond market could be counted on for sober analysis and clear thinking in the critical work of providing reliable economic indicators based on the so-called wisdom of the crowd. But those days appear to be long gone, or so one could surmise after reviewing the conflicting signals emanating from the US Treasury market of late.

Macro Briefing | 14 July 2020

US states roll out new restrictions as coronavirus cases spread: WSJ

California rolls back economic opening as Covid-19 cases soar: CNBC

Immunity to Covid-19 may only last a few months, UK study finds: CNBC

US and Canada expected to extend non-essential travel ban: Reuters

US: parts of China’s South Sea claims ‘unlawful’: BBC

China’s imports rose in June–first gain since coronavirus crisis started: Reuters

UK economy rebounded at slower pace than expected in May: BBC

Eurozone industrial output posts a record rebound in May: MW

US monthly budget deficit expands to record $864 billion: NY Times

Emerging Market Stocks Surged Last Week

Equity prices in emerging markets posted the strongest gain for the major asset classes for the trading week through Friday, July 10, based on a set of US-listed exchange traded funds.

Macro Briefing | 13 July 2020

White House undercuts Fauci re: US coronavirus response: NBC

Summer doesn’t appear to be slowing Covid-19’s transmission rate: WSJ

US warns citizens of “heightened risk of arbitrary detention” in China: CNBC

China announces sanctions on US officials in retaliation to Uighur policy: Reuters

Poland’s conservative President Duda narrowly wins re-election: BBC

US bankruptcies persist due to ongoing Covid-19 blowback: Bloomberg

Producer price index for US unexpectedly fell in June: CNBC

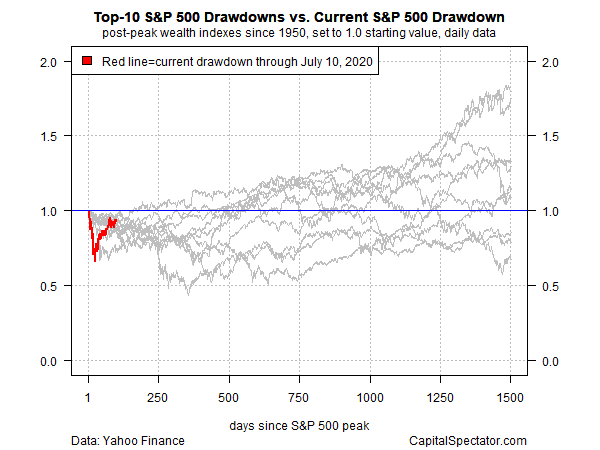

US stock market (S&P 500) begins trading week with drawdown near -6%:

Book Bits | 11 July 2020

● The Rules of Contagion: Why Things Spread–And Why They Stop

Adam Kucharski

Review via Wired

Kucharski, an epidemiologist at the London School of Hygiene and Tropical Medicine, is a mathematician by training. He uses data and models to predict how disease outbreaks will progress. His new book, The Rules of Contagion: Why Things Spread—and Why They Stop, lays out those tools and how they can be applied to other parts of life. Think methods to predict how panic might course through the global financial system, or how bad information is transmitted on Facebook. But most important, Kucharski says, is what he calls “epidemiological thinking.” That’s a mindset for dealing with incomplete information, as infectious-disease researchers must when they encounter a novel, fast-moving pathogen. Sometimes you might make bad assumptions, and your models might make predictions that never come to pass. But in a crisis, coming up with a hypothesis, even if it’s a rough one, is often the only way to get people to act.

Large Cap Growth And Momentum Dominate 2020 Factor Returns

If your US equity strategy is posting a gain this year there’s a good chance that the key driver is a hefty allocation to either the large-cap growth or momentum factors. These are the only two factor strategies posting gains so far in 2020, based on a set of exchange-traded funds. Otherwise, red ink rules, based on numbers through July 9.

Macro Briefing | 10 July 2020

US economic recovery dependent on managing coronavirus, say economists: WSJ

Coronavirus killing record number of Americans in Sunbelt: Bloomberg

A second round of stimulus checks may be coming for US workers: CNBC

Vaccine arms race has health and economic risks, consultancy warns: CNBC

Wealthy investors are increasingly focused on sustainability trends: CNBC

Second South American leader tests positive for coronavirus: NY Times

Supreme Court: roughly half of Oklahoma is Native American land: BBC

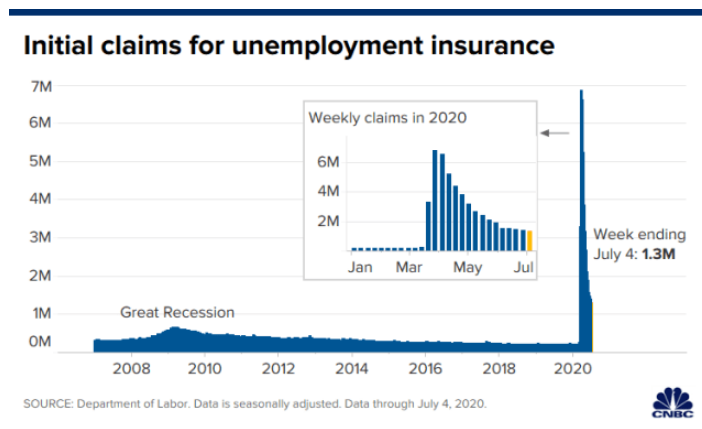

US jobless claims rise by 1-million-plus for 15th straight week: CNBC

Has The Fed Launched A Yield-Curve-Control Policy For Treasuries?

The Federal Reserve has publicly disclosed it’s considering it and many commentators have analyzed the implications. Officially, the central bank is conducting “further analysis” on so-called yield curve control (YCC). But looking at the flat trend in the 10-year Treasury yield in recent months raises the obvious question: Has YCC already started?

Macro Briefing | 9 July 2020

Top Chinese diplomats offer conciliatory comments as tension rise with US: CNBC

Rising US Covid-19 cases trigger tougher face-mask rules: Reuters

Supreme Court expands worker exemptions for health care regulations: WSJ

Supreme Court set to rule on access to Trump’s taxes: Politico

Australia announces suspension of extradition agreement with Hong Kong: NYT

United Airlines will furlough up to 36,000 workers: BBC

China’s factory deflation eased in June amid rebound in commodity prices: MW

Decline in US consumer credit slowed in May as economy began to rebound: MW

Gold continues to rise, nearing record high price: Bloomberg