What’s keeping long-dated bonds at the head of this year’s performance ledger for fixed-income markets? Recession worries still top the list, although nervous investors can point to this week’s renewed prospects for impeaching Trump as a factor, too. Whatever the driver, year-to-date returns for bonds continue to show that long maturities are running well ahead of the rest of the field, based on a set of ETFs that span the US fixed-income markets.

Category Archives: Uncategorized

Macro Briefing | 26 September 2019

Summary of Trump’s call to Ukraine president fuels impeachment debate: The Hill

A China trade deal may be near, says Trump: Reuters

Iranian President: talks with US contingent on ending sanctions: WSJ

UK Prime Minister Johnson’s remarks spark furor in Parliament: Bloomberg

Is the US stock market betting on a rally if Trump is impeached? CNBC

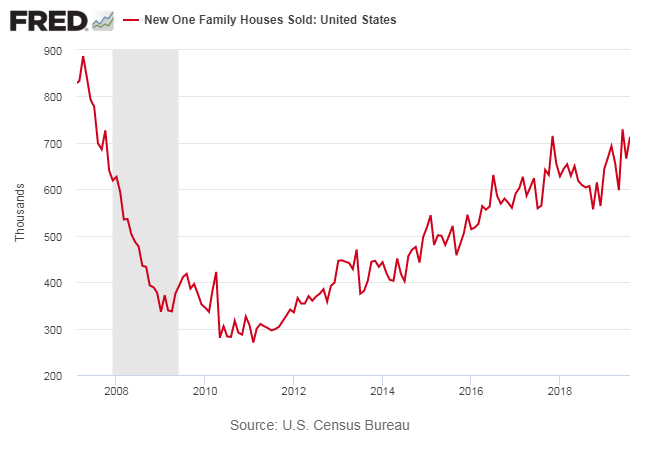

New home sales in the US rebounded in Aug, close to post-recession high: CNBC

Mr. Market Ponders Impeachment Risk

The House of Representatives has formally launched an impeachment inquiry into President Trump, a turn of events with precious little history and so the investment implications are necessarily speculative. The crowd’s initial response: an orderly but determined move into safe havens, starting with Treasuries. Deciding what comes next is unclear, but it’s a reasonable guess that the political factor will remain front and center until further notice.

Macro Briefing | 25 September 2019

Democrats launch formal impeachment inquiry on Trump: Reuters

Did Trump already admit to a crime in Ukraine crisis? Fox

Investors consider political risk anew after formal impeachment inquiry: MW

Gold strengthens as US political tensions rise: Bloomberg

China’s foreign minister: US should “remove all unreasonable restrictions”: CNBC

Mid-Atlantic region manufacturing activity eased in September: Richmond Fed

One-year trend for US home prices eased to 7-year low in July: Bloomberg

US consumer confidence stumbled in Sep, slipping to 3-month low: MW

US Q3 Growth Estimate Ticks Up To A Modest 2.2% Pace

Recession worries have become topical in recent months, but the odds are low that a smoking gun will be found in next month’s initial report on third-quarter GDP, according to a revised set of nowcasts. In fact, the current numbers reflect a slightly stronger outlook compared with estimates from early September.

Macro Briefing | 24 September 2019

Ukraine controversy fuels talk of Trump impeachment: The Hill

Trump considers a new meeting with N. Korea’s Kim Jong Un: CNBC

US Treasury Secretary: trade talks to happen in 2 weeks: SCMP

German business sentiment rebounded in September: Reuters

Hard data on German mfg still heightens recession risk: Bloomberg

US economy continued to strengthen at a modest pace in Aug: Chicago Fed

US growth is slow but steady in September, PMI survey data shows: IHS Markit

Commodities Topped Gains For Global Markets Last Week

Concerns over Saudi Arabia’s supply of crude oil drove commodities prices higher last week, delivering the strongest gain for the major asset classes, based on a set of exchange traded funds.

Macro Briefing | 23 September 2019

Pressure to impeach Trump builds after new Ukraine revelations: NY Times

China cancels planned visit to US — at request of US: Bloomberg

Iran releases British-flagged tanker ahead of UN summit: WSJ

Iran’s president calls on Western powers to leave Persian Gulf: Politico

Arab parties in Israel back Gantz to end Netanyahu’s gov’t: BBC

UK Prime Minister Johnson: don’t expect Brexit deal in NY talks: Reuters

Hong Kong protests enter 16th week: CNN

Today’s Chicago Fed data for Aug is expected to show low recession risk

Eurozone’s economy has “virtually stalled” in September: IHS Markit

Book Bits | 21 September 2019

● Paper Dragons: China and the Next Crash

By Walden Bello

Summary via publisher (ZED Books)

Emerging relatively unscathed from the banking crisis of 2008, China has been viewed as a model of both rampant success and fiscal stability. But beneath the surface lies a network of fissures that look likely to erupt into the next big financial crash. A bloated real-estate sector, roller-coaster stock market, and rapidly growing shadow-banking sector have all coalesced to create a perfect storm: one that is in danger of taking the rest of the world’s economy with it. Walden Bello traces our recent history of financial crises – from the bursting of Japan’s ‘bubble economy’ in 1990 to Wall Street in 2008 – taking in their political and human ramifications such as rising inequality and environmental degradation. He not only predicts that China might be the site of the next crash, but that under neoliberalism this will simply keep happening.

Continue reading

Research Review | 20 September 2019 | Factor Investing

Momentum with Volatility Timing

Yulia Malitskaia (VKY Analytics)

July 9, 2019

The growing adoption of factor investing simultaneously prompted the active topic of factor timing approaches for the dynamic allocation of multi-factor portfolios. The trend represents a natural development of filling the gap between passive and active management. The paper addresses this direction by introducing the volatility-timed winners approach that applies past volatilities as a timing predictor to mitigate momentum factor underperformance for time intervals spanning the market downturn and post-crisis period. The proposed approach was confirmed with Spearman rank correlation and demonstrated in relation to different strategies including momentum volatility scaling, risk-based asset allocation, time series momentum and MSCI momentum indexes. The corresponding analysis generalized existing volatility scaling strategies and brought together the two branches of the smart-beta domain, factor investing and risk-based asset allocation.

Continue reading