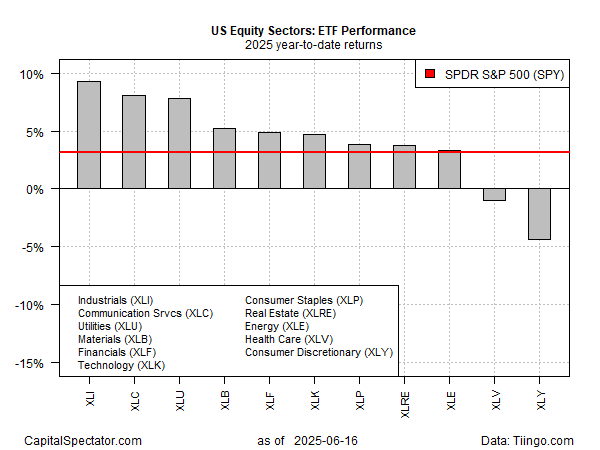

In a year of shocks, turmoil, and tariffs, investor sentiment has been whipped to and fro as the crowd struggles to assess the outlook for risk and reward. But as 2025 approaches its mid-point, stocks in the industrial sector have found their footing and are now the performance leader, based on a set of ETFs through Monday’s close (June 16).

The Industrial Select Sector SPDR Fund (XLI) is up 9.3% year to date, modestly ahead of communications (XLC), the second-best performer. The premium is considerably higher compared with the broad stock market (SPY), which is up 3.1% so far this year.

Most of the equity sectors are posting gains in 2025, with two exceptions: healthcare (XLV) and consumer discretionary (XLY), the latter falling 4.3% year to date.

The current debate is how the market will navigate the ongoing Israel-Iran conflict, which threatens to pull the US into a new phase of Middle East fighting. A key macro concern: oil prices will remain elevated because of the attacks, raising inflation and lowering economic growth.

Torsten Sløk, chief economist at Apollo, advised that the Federal Reserve’s model of the US economy estimates that a $10-a-barrel-increase in oil translates to an increase in inflation by 0.4% and lower GDP by 0.4%.

Crude oil has rallied sharply in recent weeks, and traded above $70 a barrel for a second day on Monday, based on the US benchmark WTI. That compares with the recent low in the mid-$50 range.

Jeff Buchbinder, chief equity strategist at LPL Financial, notes that his analysis of 25 geopolitical shocks since the Pearl Harbor attack in 1941 indicate that stocks have been mostly resilient during those events. Total drawdowns around these events have averaged 4.6% over an average of roughly 19 days, he reports.

The US stock market (S&P 500) was up yesterday, and remains close to its record high, which was set in February. For the moment, the Israel-Iran conflict has had limited, if any, effect on American shares. Analysts predict more of the same if the fighting remains contained between the two countries with minimal US involvement.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report