Below-investment-grade fixed-income securities continue to post a sizable year-to-date performance lead over the rest of the major slices of the US bond market, based on a set of exchange-traded funds. The strong gain for junk bonds is all the more striking when measured against the mixed results for the rest of the field.

SPDR Bloomberg Barclays High Yield Bond (JNK) is the top performer for US bond ETFs year to date through yesterday’s close (Jan. 23) via a 4.0% gain. The second-strongest return for US bond funds so far in 2019 is also a junk-bond portfolio – a fund with a short-term focus on maturities. The iShares 0-5 Year High Yield Corp Bond (SHYG) is ahead by roughly 3.0%.

The year-to-date losses at the moment are found in Treasuries funds with various maturities. The deepest shade of red: iShares 20+ Year Treasury Bond (TLT), which is down by about 1.0% in 2019 through yesterday’s close.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Note that there’s a slightly positive trend for the US bond market generally so far this year, based on a broad measure of the US investment-grade fixed income securities: Vanguard Total Bond Market (BND) is up 0.2% year to date.

The strong 2019 rebound in junk bonds to date follows a sharp correction for this market late last year. The revival isn’t surprising, explains an analyst:

“History indicates that high yield typically bounces back from negative return years, so we can understand why many strategists are increasing their 2019 forecasts,” advises Michael Anderson, head of US credit strategies at Citigroup, in a research note. He adds that “December’s swoon is indicative of an increasingly fragile market. For most of 2018, investors wondered what could derail high yield. Now we see how quickly things can turn.”

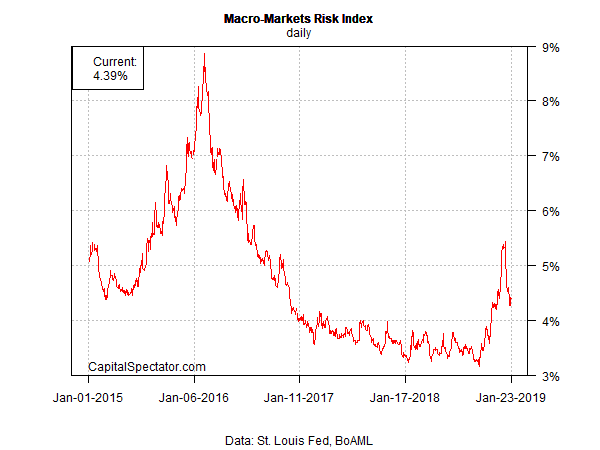

One theory for why junk bonds have popped this year: the sharp slide in prices in late-2018 lifted the market’s yield by a substantial degree (bond yields and prices move in opposite directions). Notably, the spread for junk over Treasury rates (via ICE BofAML US High Yield Master II Option-Adjusted Spread) shot up to 5.44 percentage points on Jan. 3 – a dramatic surge from the previous tough of 3.16 a few months earlier on Oct. 3.

The upward revision in junk’s yield premium was apparently too good to pass over, prompting the crowd to dive in. But the 5.44 spread at the start of the new year has since slumped to 4.39 as of yesterday’s close, courtesy of the rally in price. Perhaps, then, it’s no surprise that this year’s bullish spike in SPDR Bloomberg Barclays High Yield Bond (JNK) has run out of gas in recent days.

The burning question for junk bond investors now: What catalyst might keep the party going? Delaying Fed rate hikes due to the blowback from the partial government shutdown is a possibility, but that factor comes with baggage for the macro trend and, by extension, high-yield bonds.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Junk Bonds Lead Over the Rest of the US Bond Market - TradingGods.net