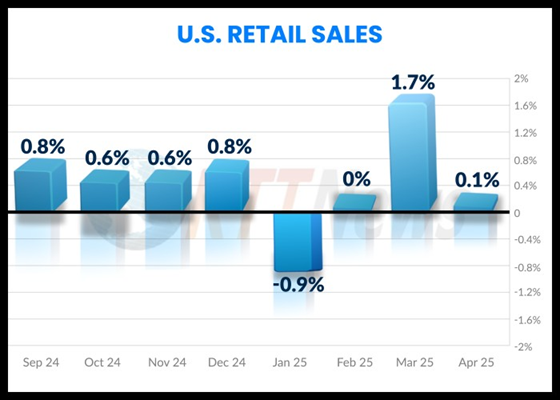

US retail sales slowed to a fractional gain April, rising 0.1% after surging in March, reportedly fueled by front-running purchases to avoid tariffs. Core sales, which excludes several volatile categories and factors into the gross domestic product (GDP) reading for the quarter, fell 0.2%. “We are now witnessing the first-order effects of tariffs on the economy through reduced spending,” said Tuan Nguyen, a US economist at RSM US. “While a recession is no longer our base case over the next 12 months due to the recent reduction in tariffs, the likelihood has increased that the US economy will experience several quarters of sluggish growth.”

US industrial production was unchanged in April, with the manufacturing component falling 0.4%, led by a 1.9% drop in the production of motor vehicles and parts. “[The] outlook for industrial production and the manufacturing sector has become less negative, at least temporarily, since the partial rollback of the tariffs on China,” said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics.

Business activity continued to decline modestly in New York State in May, according to the survey-based NY Fed Manufacturing Index. The negative print marks the third monthly decline.

Manufacturing activity in the region remained weak in May, the Philly Fed reported for its district. “The current general activity index rose but remained negative. The new orders index turned positive, while the shipments index remained negative and declined further.”

Homebuilder sentiment fell sharply in May, according to the Housing Market Index. The indicator dropped to its lowest level in 18 month amid a cloudy outlook for the industry and the economy.

US jobless claims were steady last week, holding at a relatively low level. “A gradual climb higher still seems likely in the coming months, as an uncertainty-driven pullback in hiring makes it harder for recently laid-off workers to find new roles,” Oliver Allen, senior US economist at Pantheon Macroeconomics, said in a note to clients.