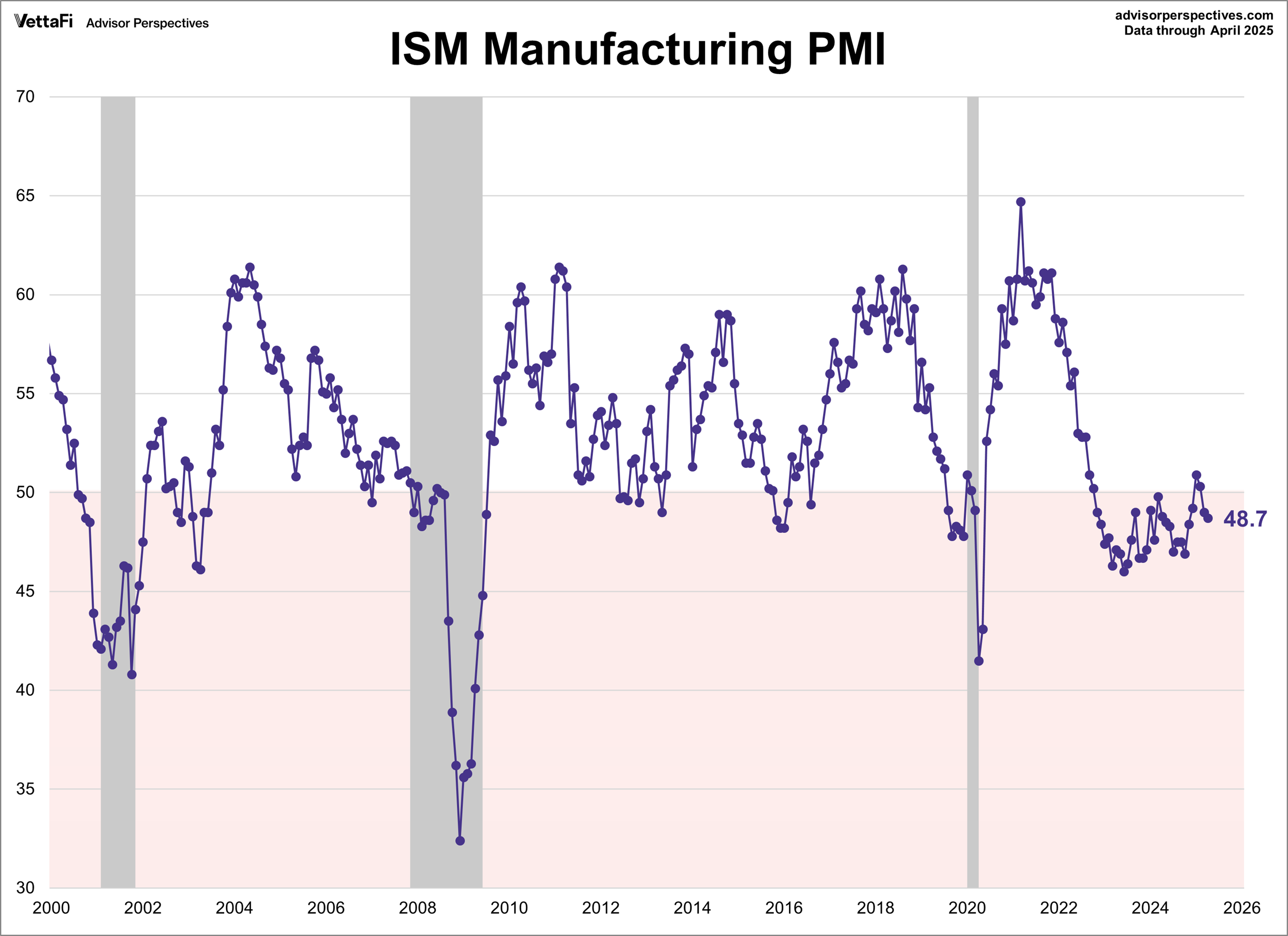

US manufacturing activity contracted for a second month in April, according to the ISM Manufacturing Index, a survey-based profile of the sector. The weak reading indicates that the brief recovery, following a 26-month run of contraction, has faded. “Demand and output weakened while input strengthened further, conditions that are not considered positive for economic growth,” said Institute for Supply Management chair Timothy Fiore said in a press release.

US jobless claims rose to the highest level since Feb. 22. A majority of the increase is related to one state — New York. “Nonetheless, the deterioration in the timeliest hiring and firing indicators over the last couple weeks suggests that jobless claims will trend up over coming weeks,” according to Sam Tombs, chief U.S. economist at Pantheon Macroeconomics.

Construction spending unexpectedly fell in March. The Commerce Department reported a 0.5 percent decline last month after February’s increase. The surprising pullback in construction spending partly reflected a decline in spending on private construction, which slid by 0.6%.

A technical profile of the US stock market continues to indicate a cautious outlook is warranted, based on analysis at The ETF Portfolio Strategist. The review is based on several proprietary indicators developed for the newsletter.

US monetary policy appears to shifting to a passively restrictive stance, based on TMC Research’s Fed funds model. “Our current estimate of the neutral rate is more than one percentage point below the median Fed funds target rate,” reports the research unit of The Milwaukee Company, a wealth manager.