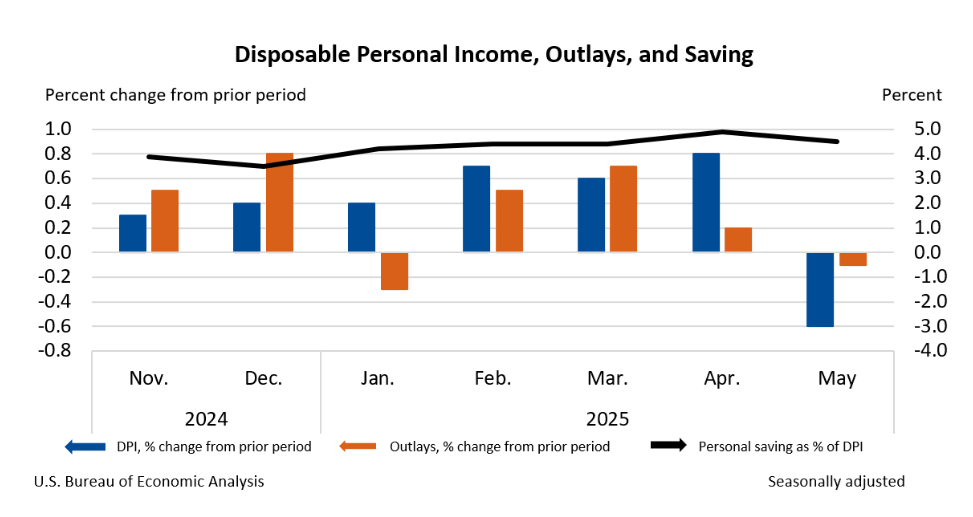

US consumer spending and income fell in May, the Bureau of Economic Analysis reported on Friday. Inflation also ticked up, based on core PCE. This measure of inflation, which is the Fed’s preferred benchmark for monitoring prices, edged up to a 2.7% year-over-year rate. “The report is a wash for the Fed and won’t alter its wait-and-see stance,” said Sal Guatieri, a senior economist at BMO Capital Markets. “The pullback in spending in May partly reflects payback from earlier tariff front-running, while the slightly warmer core price increase doesn’t settle the debate about how much tariffs will impact inflation.”

The Senate is debating Trump’s big spending bill, which is widely projected to add trillions of dollars to the already hefty US federal budget deficit. GOP leaders are trying to meet Trump’s July 4 deadline to pass the bill, but passage by that date is unclear pushback from some Republicans, and Democrats generally, continues.

US inflation could rise from tariffs, warned the Bank for International Settlements (BIS). “In the US, you could face a very difficult scenario for the central bank, which is when you have higher inflationary pressures or deviating inflationary expectations and a slowdown in the economy,” said BIS’s General Manager Agustin Carstens. “That is a circumstance that central banks usually find particularly difficult.”

China manufacturing activity fell for a third straight month in June. The official purchasing managers’ index (PMI) improved slightly to 49.7 in June, remaining just below the neutral 50 mark that separates growth from contraction, according to data from the National Bureau of Statistics.

Canada rescinded its plan to tax US technology firms. As a result, US-Canada trade talks have resumed, said Canadian Prime Minister Mark Carney.

President Donald Trump said last week that he will announce his pick to succeed Federal Reserve Chair Jerome Powell “very soon.” Powell still has 11 months left until the end of his term. “I’d love him [Powell] to resign if he wanted to. He’s done a lousy job,” Trump said on Friday.

US economic activity has strengthened in recent weeks, according to the Dallas Fed’s Weekly Economic Index. The real-time measure rose to 2.37% for the week through June 14, above the 1.99% four-quarter GDP growth through the first quarter of 2025.

Re: US inflation could rise from tariffs, warned the Bank for International Settlements (BIS)

In other words, foreign guy subject to a range of tariffs warns about tariffs. lol

Meanwhile, massive domestic and foreign investments to onshore critical supply chains back into the US may save the country.