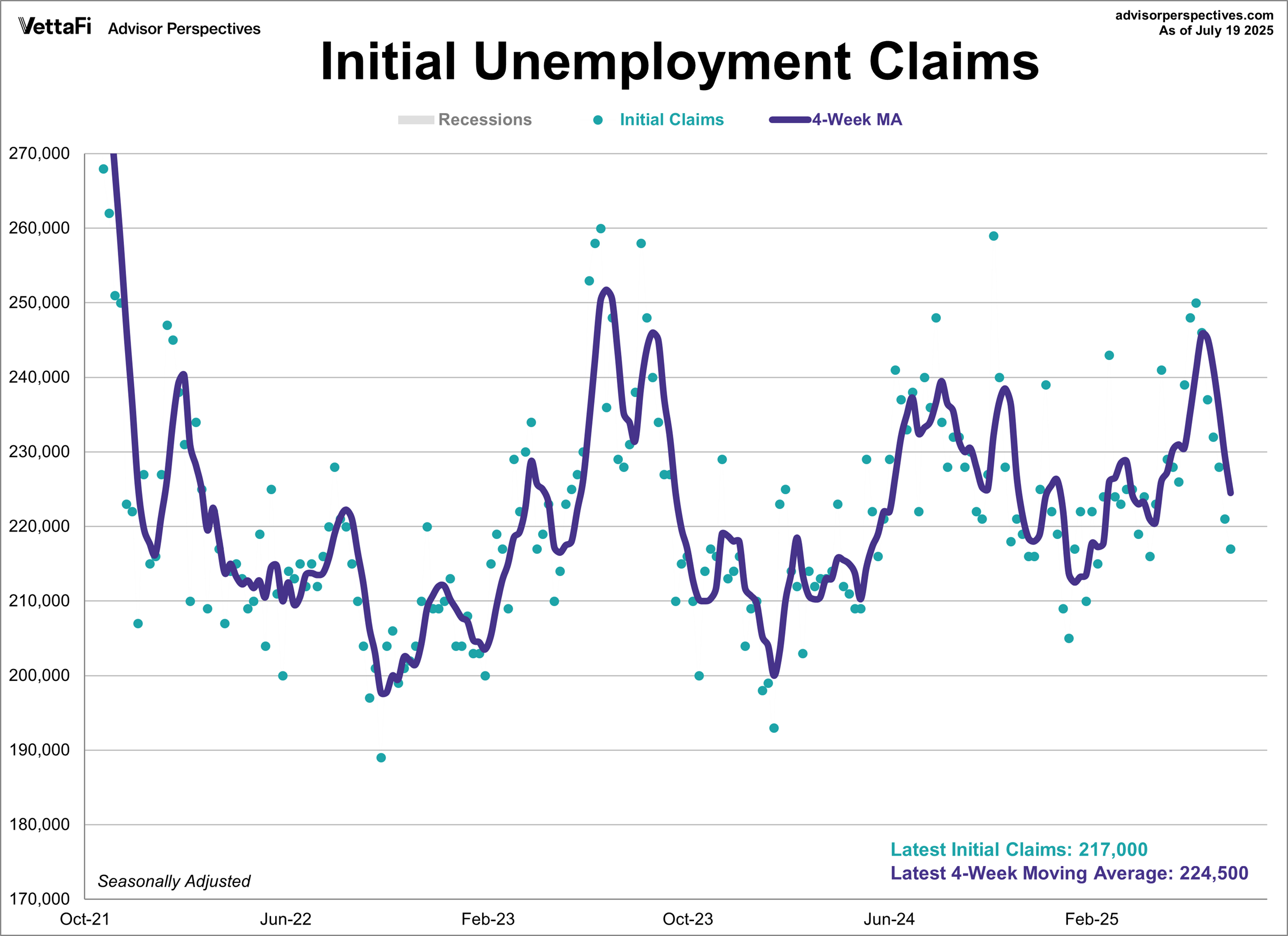

US jobless claims fell for a sixth straight week, dropping to a 3-month low and signaling labor market strength. “The weekly jobless claims give Fed officials no cover whatsoever if they are seriously thinking of cutting interest rates at next week’s meeting,” said Christopher Rupkey, chief economist at FWDBONDS.

Japan Trade Deal Boosts Return Premium For Foreign Stocks

Global equities ex-US were already leading US stocks in 2025 by a wide margin ahead of the trade deal announced this week between the US and Japan. Following the news, shares in Japan surged, providing lift to foreign stocks generally. The US market also rallied on the news, lifting the S&P 500 Index to a new record high. But in relative terms, the international return premium this year has continued to widen, based on a set of ETFs through Wednesday’s close (July 23).

Macro Briefing: 24 July 2025

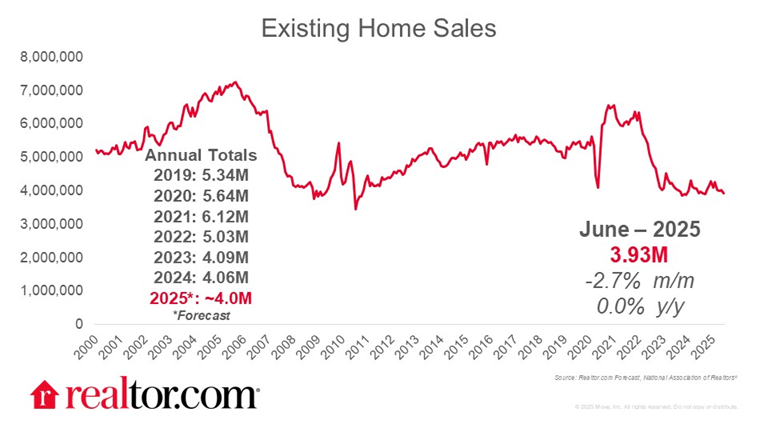

US existing home sales fell 2.7% in June, more than economists expected. The decline left the number of homes sold at the slowest since Sep. 2024. The year-over-year change was flat while the median home price rose 2% two percent from a year ago to $435,300, a record high for the month of June. “Multiple years of undersupply are driving the record-high home price,” said NAR chief economist Lawrence Yun in a statement.

Medium-Term Corporates Lead US Bond Market In 2025

As reported yesterday at CapitalSpectator.com, the bond market is showing a degree of resiliency despite tariff-related inflation risk. Leading the resiliency this year: medium-term corporate bonds, based on a set of ETFs tracking various types of US fixed income securities through Tuesday’s close (July 22).

Macro Briefing: 23 July 2025

Trump announces trade deal with Japan, with tariffs at 15%. Trump said that Japan will “open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things.” Stocks in Japan rose sharply on the news.

Have The Bond Vigilantes Dismissed Tariff-Inflation Risk?

There is no shortage of items to worry about for the bond market. From threats to strongarm the Federal Reserve to push interest rates lower to projections of a deepening federal budget deficit to the potential for higher inflation from tariffs, risk factors abound. Treasury yields, however, continue to trade in a range.

Macro Briefing: 22 July 2025

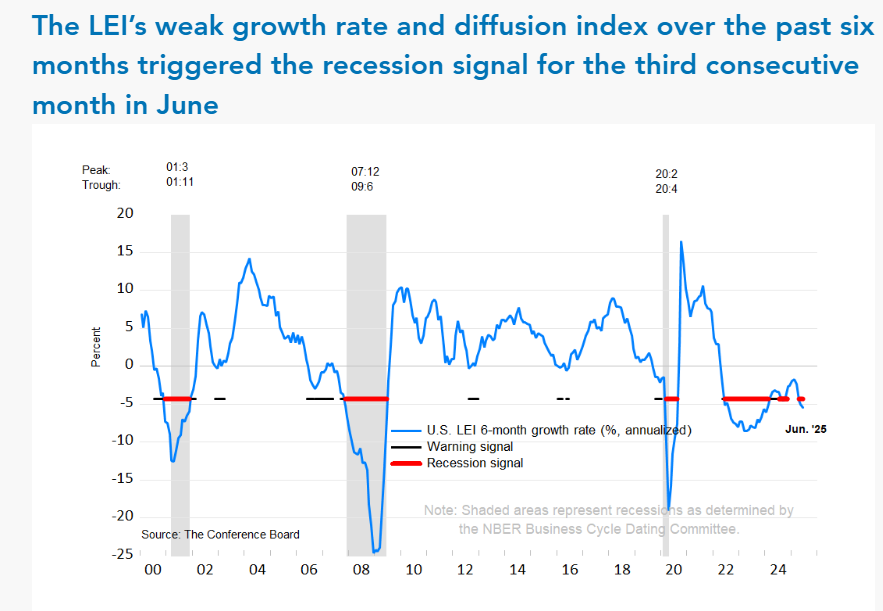

The Conference Board’s Leading Economic Index signaled elevated US recession risk for a third straight month. A spokesperson for the consultancy said: “At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow substantially in 2025 compared to 2024.”

Risk-On Sentiment Remains Resilient For Global Strategies

The August 1 tariffs deadline that will raise prices for US imports is approaching, but market sentiment remains unaffected, based on set of proxy ETFs through Friday’s close (July 18). Following the April tariff tantrum, when markets tanked, prices have rebounded and the risk-on posture looks no worse for wear with less than two weeks to go for implementing new US tariffs.

Macro Briefing: 21 July 2025

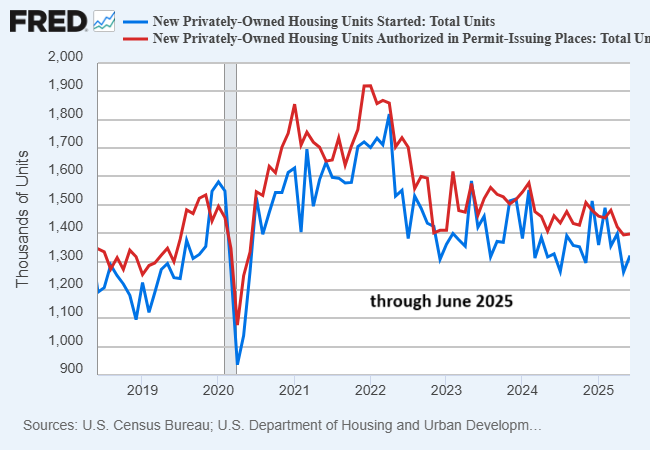

US housing starts rebound in June after dropping to 5-year low, but the downside bias in recent years remains intact. “Everywhere builders look there are reasons to delay or scrap projects,” said Christopher Rupkey, chief economist at FWDBONDS. “The nation’s housing market outlook has never looked this troublesome. This could actually end quite badly for the economy.”

Book Bits: 19 July 2025

● A Field Guide to Responsible Investing: Asset Management in the Age of Polycrises

● A Field Guide to Responsible Investing: Asset Management in the Age of Polycrises

Amy O’Brien

Summary via publisher (Palgrave Macmillan)

For years, responsible investing has been a bewildering precinct in asset management. To many, the idea of aligning your values with your investment portfolio seemed naive. Slowly and steadily, responsible investing morphed from a movement into an industry on course to command $50 trillion in assets by 2025— a third of the capital at work in the markets. And yet responsible investing has remained as difficult to traverse as ever. It’s drawn fire from critics who’ve branded the approach “woke capitalism” whilst more “responsible” generations of investors are poised to marshal trillions of assets of their own into the business – we are at an inflection point.