After three straight weekly declines, the Global Market Index (GMI) rebounded for the trading week through Friday, Aug. 25. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

Macro Briefing: 28 August 2023

* Inflation “remains too high,” says Fed Chairman Powell

* World’s central bankers unsure if rates high enough to tame inflation

* Fallout from China slowdown is probably limited for US economy

* Shares in Evergrande (crisis-hit Chinese developer) crash as trading resumes

* US government shutdown risk for autumn appears to rising

* US home prices have bottomed and will rebound in 2024, predicts Zillow

* Inflation and jobs are in focus for this week’s US economic updates

* Rally in US large-cap growth stocks looks overbought, says RBC analyst:

Book Bits: 26 August 2023

● The Rise and Fall of the EAST: How Exams, Autocracy, Stability, and Technology Brought China Success, and Why They Might Lead to Its Decline

Yasheng Huang

Review via The Wall Street Journal

In the past few years, Yasheng Huang has found himself becoming disenchanted as a scholar, tired of the shackles placed on him by academic journals. Their excessive specialization has led, he complains, to a “suboptimal supply of big ideas.” So he set out to liberate himself from refereed publications and write a sweeping and “self-consciously ambitious” book about his native China. The riveting result is “The Rise and Fall of the EAST,” whose last word isn’t a reference to the Orient but is, instead, an acronym—for Exams, Autocracy, Stability and Technology—the interplay of which has shaped China for nearly 1,500 years.

US Economic Data Still Point To Moderate Growth For Q3

US economic growth in the first half of the year appears on track to continue in the third quarter, based on the median estimate via several sources that are aggregated by CapitalSpectator.com.

Macro Briefing: 25 August 2023

* Will Fed Chair Powell’s speech today mark a shift for monetary policy?

* Fed officials offer mixed views on case for more rate hikes

* US headline durable goods orders fall in July as business equipment orders rise

* German business sentiment drops for fourth straight month in August

* US jobless claims edge lower, continue to reflect solid labor market

* Atlanta Fed’s GDPNow model lifts US Q3 growth to red-hot +5.9% nowcast

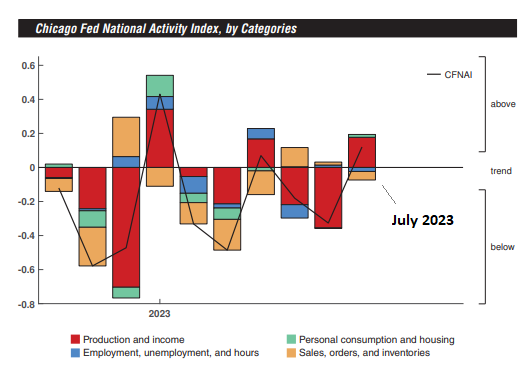

* US economic growth recovers in July via Chicago Fed Nat’l Activity Index:

Large Cap, Growth Are Main Risk Factors For Market Gains In 2023

Betting against large-cap stocks and its growth component remains a tough sell so far this year, based on a set of ETF equity risk factor proxies through Wednesday’s close (Aug. 23). Although most slices of the US equity market’s risk factors are posting gains, the biggest companies that are considered growth stocks are doing the heavy lifting.

Macro Briefing: 24 August 2023

* Fed’s Powell set to give key speech on Friday at Jackson Hole summit

* Faltering consumer confidence at core of China’s economic slowdown

* BRICS group invites six nations to join, including Saudi Arabia and Iran

* New US home sales rise to 17-month high in July

* Nvidia earnings soar as AI-fueled demand for its chips drives sales higher

* US business activity slows to a crawl in August via PMI survey data:

So Many Equity Risk Premium Models, So Little Time

How many equity risk premiums are out there? Too many to address in a single blog post. The variety is at once a challenge and a tool. A challenge because depending on your modeling preference, forecasting how the stock market will fare relative to some proxy of the “risk-free” rate can be all over the map. That’s a problem, except when you consider that combining forecasts and using the median as a relatively robust guesstimate is a tool to make lemonade out of lemons.

Macro Briefing: 23 August 2023

* Stronger US growth requires higher rates, says former St. Louis Fed president

* ‘Higher-for-longer’ rate debate expected to dominate Fed’s Jackson Hole meeting

* Eurozone contraction deepens in August via Composite PMI survey data

* De-dollarization is in focus at BRICS summit, but it’s a ‘fantasy’ says analyst

* Richmond Fed Mfg Index indicates ‘sluggish’ activity continues in August

* US existing home sales fell again in July as prices rise from year-ago level:

Analysts Assess Investing, Macro Implications Of Rising Real Yields

The last time you could lock in a real (inflation-adjusted) yield with inflation-adjusted Treasuries (TIPS) at current levels the world was still cleaning up the mess from the financial crisis. A lot has changed since then, but current yields for 5- and 10-year TIPS securities have come full circle. The jump in real yields has various implications for the economy, financial markets and investors. Here’s a quick look at where we stand and how some analysts are analyzing the recent increase in inflation-adjusted rates.