* Leaders of Russia and China meet at Olympics in Beijing, denounce US pressure

* Global growth in January slowed “notably” in January via PMI survey data

* Bank of England lifted interest rates, again, to fight inflation

* ECB president Lagarde hints at faster policy tightening amid high inflation

* Meta (Facebook) loses $250 billion in market value amid weak earnings results

* Amazon shares soar on strong revenue gain in Q4

* Eurozone retail sales fell more than expected in December

* US jobless claims fell for a second week, hinting at softer Omicron blowback

* Factory orders in US fell 0.4% in December, in line with expectations

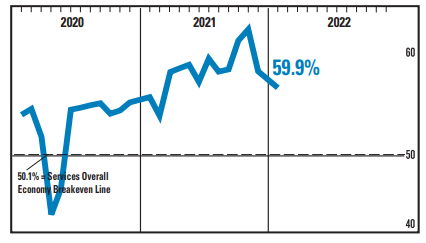

* US ISM Services Index continued to fall in January, reflecting slower growth:

Major Asset Classes | January 2022 | Risk Profile

After a stellar run higher, the Global Market Index’s risk-adjusted performance reversed in January, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The downturn was dramatic, but no less expected after the hefty increase in previous months. As noted in last month’s risk profile, “History suggests that upward spikes in GMI’s Sharpe ratio are quickly reversed, which implies that choppy market activity lies ahead.”

Macro Briefing: 3 February 2022

* NATO: Russia stepped up deployments to Ukraine’s northern neighbour Belarus

* Russia condemns US decision to send extra troops to Europe

* Russia’s economy is prepared for more sanctions

* US special forces launch large-scale counterterrorism raid in northwestern Syria

* Eurozone economic growth continued to slow in January via PMI survey data

* High Eurozone inflation will persist, says CEO of Nordea, Denmark-based bank

* Oil giant Shell reports sharp increase in full-year profit

* Tech stocks may face new selling pressure after Facebook profit disappoints

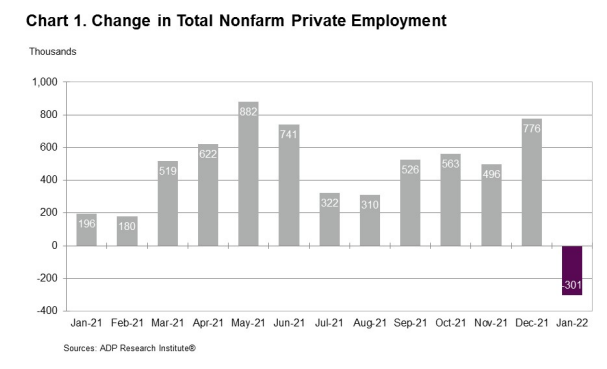

* US companies unexpected reduced employment in January, ADP estimates:

Risk Premia Forecasts: Major Asset Classes | 2 February 2022

The expected risk premium for the Global Market Index (GMI) edged down in January from the previous month’s estimate. Today’s revised 5.9% annualized forecast marks the first dip below the 6.0%-plus mark since October.

Macro Briefing: 2 February 2022

* Putin says West has ‘ignored’ Russia’s key concerns over Ukraine

* Despite blaming US for Ukraine tensions, Putin still open to diplomacy

* US consumer spending pivoting from goods to services

* US national debt tops $30 trillion for first time

* Eurozone annual inflation rose to 5.1% in January–a record high

* Global manufacturing output and new order growth slowed in January

* Google parent Alphabet reports strong 32% revenue growth in Q4

* Job openings in US remain elevated, near 11 million in December

* US construction spending continued to edged higher in December

* US ISM Mfg Index fell again in January but still indicates growth:

Major Asset Classes | January 2022 | Performance Review

Red ink flowed like wine for most of the major asset classes in January, with some notable exceptions, based on a set of ETFs.

Macro Briefing: 1 February 2022

* Kremlin says US stoking ‘hysteria’ over Ukraine at UN Security Council meeting

* Richmond Fed President Barkin says businesses would welcome higher rates

* Eurozone jobless rate fell to lowest level on record in December

* Eurozone manufacturing activity in January rose to a 5-month high

* German retail sales fell much more than expected in December

* New York Times buys Wordle, popular word game that’s become a hit

* Growth in Texas mfg activity moderated in Jan, but outlooks remain upbeat

* Chicago area economic activity picked up in January via PMI sentiment data

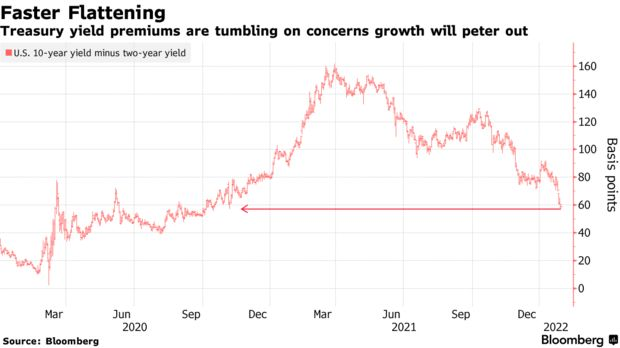

* US 10yr-2yr yield continues to edge lower, falling to lowest since Oct 2020:

US Stocks And Treasury TIPS Edged Up In Last Week’s Global Selloff

Shares in US companies and inflation-protected Treasuries managed to post gains last week as the rest of the major asset classes lost ground, based on a set of ETFs through Friday’s close (Jan. 28).

Macro Briefing: 31 January 2022

* White House says Omicron spike could affect this week’s update on jobs data

* Atlanta Fed’s Bostic says central bank could hike rates by a half-point if needed

* China manufacturing sector contracted in January–weakest reading in 23 months

* Bank of England may be moving closer to first back-to-back rate hikes in 17 years

* Eurozone growth slowed in Q4

* Surging prices for construction materials appear to restrain housing-bubble risk

* US consumer spending fell in December as inflation hit 40-year high

* US 10yr-2yr Treasury yield spread at lowest level since Oct. 2020:

Book Bits: 29 January 2022

Nicholas Mulder

Review via Foreign Affairs

For those who see economic sanctions as a relatively mild way of expressing displeasure at a country’s behavior, this book, charting how they first emerged as a potential coercive instrument during the first decades of the twentieth century, will come as something of a revelation. In an original and persuasive analysis, Mulder shows how isolating aggressors from global commerce and finance was seen as an alternative to war that worked precisely because of the pain it imposed on the target society.