* German Chancellor Scholz says Russia will pay high price if Ukraine invaded

* Biden to meet with German Chancellor Scholz today in White House

* Germany urged to ‘wake up’ to Ukraine-Russia threat

* French president Macron to meet Putin in effort to avert Ukraine war

* US labor shortages expected to continue through second half of 2022

* Gold has been relatively steady amid recently volatility in US dollar and bonds

* US set to unveil new Asia-Pacific economic strategy to counter China

* Germany’s industrial production declined unexpectedly in December

* Two January estimates of US private payrolls show sharply divergent results:

Book Bits: 5 February 2022

Rupert Russell

Review via Publishers Weekly

Documentary filmmaker and sociologist Russell debuts with a harrowing look at the disastrous consequences of financial speculation. Contending that recent political and social turmoil in Iraq, Ukraine, Venezuela, and other countries has been triggered by irrational price shocks that don’t correspond to actual issues of supply and demand, Russell details how small market movements are amplified and manipulated by hedge fund managers and commodities traders seeking to deliver consistent profits regardless of real-world conditions. Among a plethora of disturbing case studies, Russell describes how oil wealth generated by market speculation fueled corruption and then caused ruinous hyperinflation in Venezuela; explains how artificially low coffee prices, climate change, and agricultural debt led to a surge in migration from Guatemala toward the U.S.; notes that the terrorist organization al-Shabaab drove down cattle prices in Somalia during a 2010–2011 drought in order to compel desperate farmers to join their ranks; and contends that Western governments suspending “the rules of the game” to prop up their economies during the Covid-19 pandemic only underscores how much arbitrary control markets and prices have over the global economy.

Desperately Seeking Yield: 4 February 2022

The inverse relationship between prices and yields, if not quite a blessing, is at least useful. And so it’s been since our last update on trailing yields for the major asset classes via ETF proxies. As prices have fallen, some of the pain is offset by rising trailing yields.

Macro Briefing: 4 February 2022

* Leaders of Russia and China meet at Olympics in Beijing, denounce US pressure

* Global growth in January slowed “notably” in January via PMI survey data

* Bank of England lifted interest rates, again, to fight inflation

* ECB president Lagarde hints at faster policy tightening amid high inflation

* Meta (Facebook) loses $250 billion in market value amid weak earnings results

* Amazon shares soar on strong revenue gain in Q4

* Eurozone retail sales fell more than expected in December

* US jobless claims fell for a second week, hinting at softer Omicron blowback

* Factory orders in US fell 0.4% in December, in line with expectations

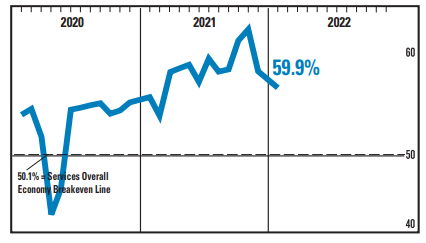

* US ISM Services Index continued to fall in January, reflecting slower growth:

Major Asset Classes | January 2022 | Risk Profile

After a stellar run higher, the Global Market Index’s risk-adjusted performance reversed in January, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The downturn was dramatic, but no less expected after the hefty increase in previous months. As noted in last month’s risk profile, “History suggests that upward spikes in GMI’s Sharpe ratio are quickly reversed, which implies that choppy market activity lies ahead.”

Macro Briefing: 3 February 2022

* NATO: Russia stepped up deployments to Ukraine’s northern neighbour Belarus

* Russia condemns US decision to send extra troops to Europe

* Russia’s economy is prepared for more sanctions

* US special forces launch large-scale counterterrorism raid in northwestern Syria

* Eurozone economic growth continued to slow in January via PMI survey data

* High Eurozone inflation will persist, says CEO of Nordea, Denmark-based bank

* Oil giant Shell reports sharp increase in full-year profit

* Tech stocks may face new selling pressure after Facebook profit disappoints

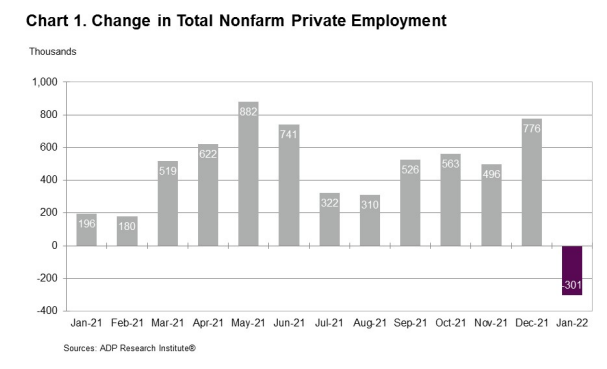

* US companies unexpected reduced employment in January, ADP estimates:

Risk Premia Forecasts: Major Asset Classes | 2 February 2022

The expected risk premium for the Global Market Index (GMI) edged down in January from the previous month’s estimate. Today’s revised 5.9% annualized forecast marks the first dip below the 6.0%-plus mark since October.

Macro Briefing: 2 February 2022

* Putin says West has ‘ignored’ Russia’s key concerns over Ukraine

* Despite blaming US for Ukraine tensions, Putin still open to diplomacy

* US consumer spending pivoting from goods to services

* US national debt tops $30 trillion for first time

* Eurozone annual inflation rose to 5.1% in January–a record high

* Global manufacturing output and new order growth slowed in January

* Google parent Alphabet reports strong 32% revenue growth in Q4

* Job openings in US remain elevated, near 11 million in December

* US construction spending continued to edged higher in December

* US ISM Mfg Index fell again in January but still indicates growth:

Major Asset Classes | January 2022 | Performance Review

Red ink flowed like wine for most of the major asset classes in January, with some notable exceptions, based on a set of ETFs.

Macro Briefing: 1 February 2022

* Kremlin says US stoking ‘hysteria’ over Ukraine at UN Security Council meeting

* Richmond Fed President Barkin says businesses would welcome higher rates

* Eurozone jobless rate fell to lowest level on record in December

* Eurozone manufacturing activity in January rose to a 5-month high

* German retail sales fell much more than expected in December

* New York Times buys Wordle, popular word game that’s become a hit

* Growth in Texas mfg activity moderated in Jan, but outlooks remain upbeat

* Chicago area economic activity picked up in January via PMI sentiment data

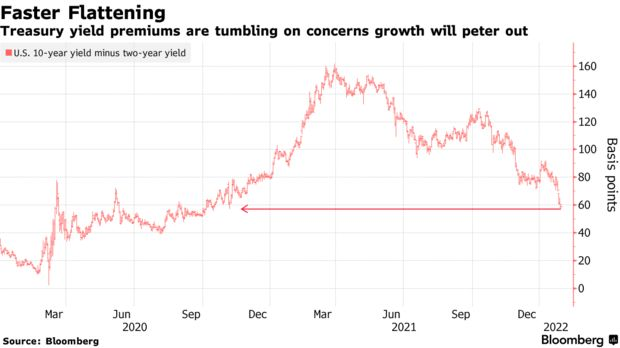

* US 10yr-2yr yield continues to edge lower, falling to lowest since Oct 2020: