* Markets weigh possibility of three-facet Fed policy-tightening moves

* US 10yr Treasury yield briefly topped 1.75% on Thursday, a pandemic high

* Russia boosts influence in Kazakhstan amid political unrest

* Eurozone inflation ticked up to 5% in December, a new record high

* US jobless claims rose last week but remain near historic low

* US factory orders grew for a seventh-straight month in November

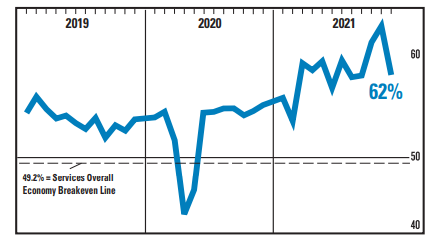

* US services sector growth slowed sharply in December via ISM survey data:

Predicting Risk: Not Easy, But Easier Relative To Return, Part I

Forecasting is a necessary evil in investing. The very act of investing is an exercise in making assumption about future events. If you didn’t expect to book a profit, presumably you wouldn’t make the trade. The trouble starts when you move beyond this basic axiom and start making decisions about how to forecast, what to forecast, and over what time frame. But none of this changes the basic truism that risk is easier to forecast than return. There are caveats, of course, but even small relative advantages can be useful at times.

Macro Briefing: 6 January 2022

* Fed minutes suggest possible rate hike set for March

* Rising bond yields take a bite out of tech stocks

* Russia sends paratroopers into Kazakhstan on Thursday to suppress uprising

* North Korea says it successfully expands at strongest rate since July

* US economy slowed in December but ended 2021 with strong upside bias

* US company payrolls rose much faster than expected in Dec, ADP reports:

Major Asset Classes | December 2021 | Risk Profile

The Global Market Index’s risk-adjusted performance continued to roar higher through the end of 2021, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. GMI started looking a bit subdued in November, thanks to widespread selling. But the strong rebound for risk assets in December fired up risk-adjusted results for GMI, an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash).

Macro Briefing: 5 January 2022

* North Korea reportedly fires ballistic missile into the sea

* Protests in Kazakhstan intensify: government declares state of emergency

* Stock market ignores rising bond yields, for now

* Global manufacturing expansion continued at end of 2021

* Can US regain some of mfg output lost to foreigners? Companies aim to try

* Toyota tops GM for US car sales–first time foreign firm leads

* US home prices set to continue surging in 2022, Zillow predicts

* Job openings in US fell in Nov, but remained near record high

* Small-company wages up 4%-plus in December, a record high estimates Paychex

* US mfg activity slowed in Dec to 11-month low via ISM Mfg Index:

Risk Premia Forecasts: Major Asset Classes | 4 January 2022

The expected risk premium for the Global Market Index (GMI) continued to hold at the 6.0%-plus level in December. Today’s 6.1% estimate (fractionally above the previous month’s forecast) marks the third straight month at 6.0% or higher.

Macro Briefing: 4 January 2022

* US sets new daily record of 1 million-plus Covid-19 cases

* Severe cases and hospitalizations due to Covid-19 have yet to soar

* Passive ETFs pay a high price for predictable rebalancing techniques

* China’s factory activity grew at fastest pace in 6 months in December

* Supply shortages kept US manufacturing constrained in December

* UK manufacturing expansion continued at 2021’s close

* US construction spending rose for ninth straighth month in November:

Major Asset Classes | December 2021 | Performance Review

US real estate shares were the big winner for the major asset classes in December and for 2021 overall, based on a set of ETFs. Although several corners of risk assets rallied last month and for the year, real estate investment trusts (REITs) left the competition in the dust.

Macro Briefing: 3 January 2022

* Biden reaffirms ‘decisive’ support to Ukraine if Russia invades

* Hospitalization rate is the main stress test for Omicron, says Fauci

* Economists expect US employment to strengthen despite Covid-19 surge

* ‘Inflation’ is most frequently cited term in Wall Street firms’ 2022 outlooks

* Trading suspended in Hong Kong for troubled property developer Evergrande

* At least 20 US states set to raise minimum wage rate

* China manufacturing sector continued expanding in December via survey data

* BlackRock and Vanguard are cautious on US Treasury market outlook for 2022

* US 10yr Treasury yield starts 2022 at middling rate relative to 2021’s range: