Amid ongoing concerns over inflation, commodities continued to rise, posting the strongest gain for an otherwise mixed week for global markets through Oct. 8, based on a set of ETFs.

Macro Briefing: 11 October 2021

* Global rebound at risk from supply bottlenecks, rising energy prices and inflation

* Congress faces a challenging autumn as crucial legislation awaits approval

* China property bonds tumble as default worries lurk over industry

* Inflation threat rises as energy prices increase

* Analysts predict that the recent surge in corporate earnings has peaked

* America’s port crisis, born of supply chain disruption, shows no sign of easing

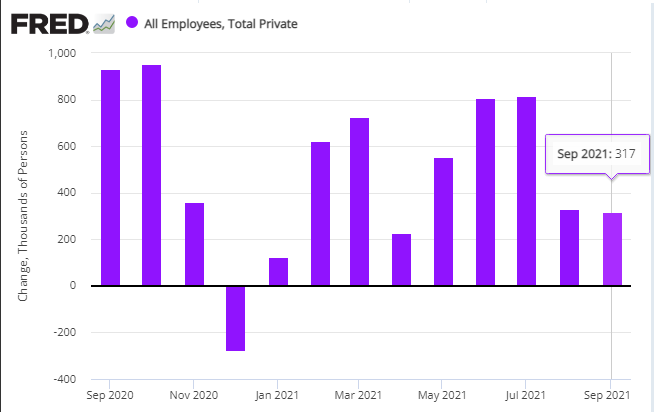

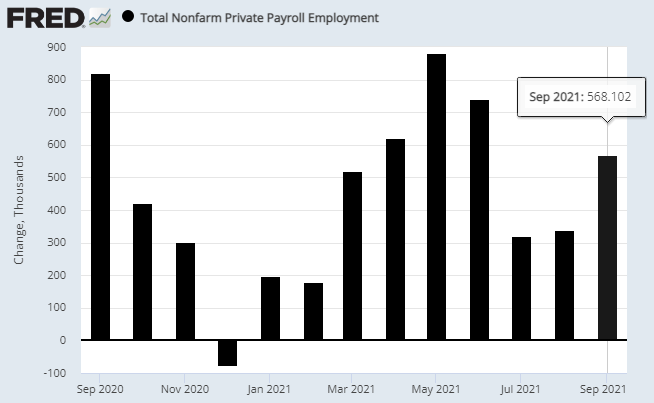

* US payrolls didn’t surge in September as jobless benefits were cut

* US companies added fewer jobs than expected in Sep, close to Aug’s gain:

Book Bits: 9 October 2021

Stanley McChrystal and Anna Butrico

Summary via publisher (Penguin Random House)

Retired four-star general Stan McChrystal has lived a life associated with the deadly risks of combat. From his first day at West Point, to his years in Afghanistan, to his efforts helping business leaders navigate a global pandemic, McChrystal has seen how individuals and organizations fail to mitigate risk. Why? Because they focus on the probability of something happening instead of the interface by which it can be managed. In this new book, General McChrystal offers a battle-tested system for detecting and responding to risk. Instead of defining risk as a force to predict, McChrystal and coauthor Anna Butrico show that there are in fact ten dimensions of control we can adjust at any given time. By closely monitoring these controls, we can maintain a healthy Risk Immune System that allows us to effectively anticipate, identify, analyze, and act upon the ever-present possibility that things will not go as planned.

The ETF Portfolio Strategist: 8 October 2021

- Commodities deliver a winning weekly performance

- All but one of our portfolio benchmarks rose this week

Playing a hot hand in commodities: Broadly defined commodities rose for a third straight week through today’s close (Friday, Oct. 8), posting the strongest weekly within our 16-fund opportunity set that spans the globe and major asset classes. For details on all the strategies and metrics in the tables, see this summary.

Research Review | 8 October 2021 | Dynamic Portfolio Strategies

Time-Varying Factor Allocation

Stefan Vincenz and Tom Oskar Karl Zeissler (Vienna U. of Economics and Business)

September 15, 2021

In this empirical study, we provide evidence on how predictive information can be utilized to profitably allocate a cross-asset factor portfolio, covering various well-known factors over the asset classes equity, commodity, fixed income, and foreign exchange. We investigate the performance of a meaningful set of predictors, which we broadly divide into macro and market indicators. Our analysis shows that tilting a global factor portfolio according to signals derived from business cycle indicators, inflation, and short-term interest rates, among other predictors, significantly outperforms a static factor benchmark. The established results are based on practical considerations, survive conservative transaction cost assumptions, and are validated over an extensive out-of-sample period. In sum, we highlight the potential benefits of an asset-allocation framework conditioned on predictive variables, but caution to time factors on a standalone basis.

Macro Briefing: 8 October 2021

* Senate approves short-term fix to lift US debt ceiling

* China’s energy crunch is reverberating throughout the global economy

* China orders ramp-up in coal production to ease energy crunch

* Natural gas industry scrambles to meet demand amid supply shortage

* Global minimum tax deal could be announced as early as today

* US consumer credit growth slowed to seven-month low in August

* China services sector activity rebounded in September

* US jobless claims fell more than expected last week–close to pandemic low:

High Beta Stocks Still Leading US Equity Factor Returns This Year

Shares with the highest beta-risk continue to top the US factor race in 2021 by a wide margin, based on a set of exchange traded funds.

Macro Briefing: 7 October 2021

* Democrats expected to accept GOP offer to push debt deadline to December

* CDC director says US at risk of severe flu season this year

* Biden and Xi agree on holding a US-China virtual summit

* Fed Chair Powell’s renomination at risk amid new political risks

* Natural-gas prices pull back as Russia agrees to boost supplies to Europe

* Analysts warn that Europe becoming hostage to Russia over energy supplies

* World’s first malaria vaccine approved for use in Africa

* GM predicts its transition to all-electric vehicle lineup will boost sales

* US companies added workers at fastest pace in three months in September:

The ETF Portfolio Strategist: 6 October 2021

Finding compelling slices of global markets to overweight isn’t getting any easier. After an extended run higher in much of the world’s risk assets, the low-hanging fruit has been picked. But there’s always relatively attractive markets. All the usual caveats apply, of course, but beggars can’t be choosy.

As an example, consider a new column of data — Spread — that’s now part of the periodic return estimates for the major asset classes on these pages (see this introduction for background). The basic idea is the new addition to the numbers is to identify markets with trailing 10-year returns that deviate substantially from the performance forecasts (based on averaging three models, which are defined below). The logic: If asset x has a trailing return substantially below the expected return, there’s a case for overweighting (and vice versa).

US Economic Growth Estimate For Q3 Ticks Lower… Again

The outlook for this month’s third-quarter GDP report continues to edge down, based on a set of nowcasts. The Oct. 28 release from the Bureau of Economic Analysis remains on track to report a solid gain in output, but today’s update reflects a mild but ongoing trend of sliding estimates.