* Senate approves short-term fix to lift US debt ceiling

* China’s energy crunch is reverberating throughout the global economy

* China orders ramp-up in coal production to ease energy crunch

* Natural gas industry scrambles to meet demand amid supply shortage

* Global minimum tax deal could be announced as early as today

* US consumer credit growth slowed to seven-month low in August

* China services sector activity rebounded in September

* US jobless claims fell more than expected last week–close to pandemic low:

High Beta Stocks Still Leading US Equity Factor Returns This Year

Shares with the highest beta-risk continue to top the US factor race in 2021 by a wide margin, based on a set of exchange traded funds.

Macro Briefing: 7 October 2021

* Democrats expected to accept GOP offer to push debt deadline to December

* CDC director says US at risk of severe flu season this year

* Biden and Xi agree on holding a US-China virtual summit

* Fed Chair Powell’s renomination at risk amid new political risks

* Natural-gas prices pull back as Russia agrees to boost supplies to Europe

* Analysts warn that Europe becoming hostage to Russia over energy supplies

* World’s first malaria vaccine approved for use in Africa

* GM predicts its transition to all-electric vehicle lineup will boost sales

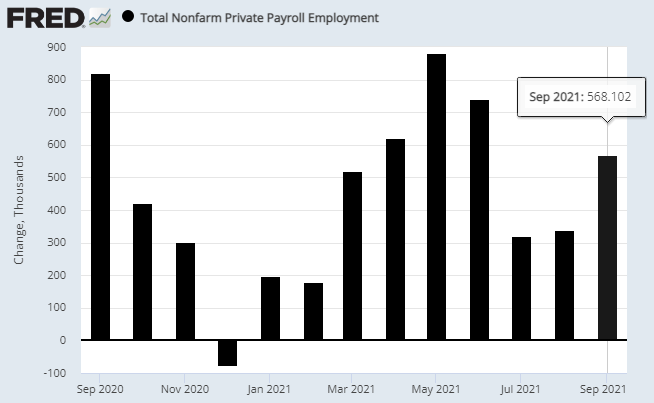

* US companies added workers at fastest pace in three months in September:

The ETF Portfolio Strategist: 6 October 2021

Finding compelling slices of global markets to overweight isn’t getting any easier. After an extended run higher in much of the world’s risk assets, the low-hanging fruit has been picked. But there’s always relatively attractive markets. All the usual caveats apply, of course, but beggars can’t be choosy.

As an example, consider a new column of data — Spread — that’s now part of the periodic return estimates for the major asset classes on these pages (see this introduction for background). The basic idea is the new addition to the numbers is to identify markets with trailing 10-year returns that deviate substantially from the performance forecasts (based on averaging three models, which are defined below). The logic: If asset x has a trailing return substantially below the expected return, there’s a case for overweighting (and vice versa).

US Economic Growth Estimate For Q3 Ticks Lower… Again

The outlook for this month’s third-quarter GDP report continues to edge down, based on a set of nowcasts. The Oct. 28 release from the Bureau of Economic Analysis remains on track to report a solid gain in output, but today’s update reflects a mild but ongoing trend of sliding estimates.

Macro Briefing: 6 October 2021

* US recession looms if Congress doesn’t raise debt ceiling, warns Treasury Sec.

* Biden reluctantly agrees to downsize Democrats’ ambitious budget proposal

* Taiwan-China tensions at ‘worst in 40 years,’ says Taiwan’s defence minister

* Rebounding imports drive US trade deficit to new record in August

* New Zealand raises interest rates — first hike in seven years

* German factory orders plunged in August

* Global economic growth ticked up in September via PMI survey data

* US business growth posted softest growth in 9 months via Sep survey data

* Healthcare was fastest-growing US sector (again) in September via survey data

* ISM Services Index continued to indicate strong growth for sector in September:

Major Asset Classes | September 2021 | Risk Profile

Risk-adjusted performance continued to rise in September for the Global Market Index (GMI), an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash). But the widespread losses in markets last month suggest that GMI’s trailing 10-year Sharpe ratio may have peaked for this cycle.

Macro Briefing: 5 October 2021

* Sen. Majority Leader Schumer schedules debt-ceiling vote for Wednesday

* Sen. Minority Leader McConnell warns he won’t cooperate on raising debt ceiling

* Chinese military aircraft enter Taiwan’s air defence zone for fourth straight day

* White House warns China over its provocations against Taiwan

* New signs of stress emerge in China’s property market

* Oil near 3-year highs after OPEC+ rejects plan for big production increase

* US factory orders rose for a fourth straight month in August:

Risk Premia Forecasts: Major Asset Classes | 4 October 2021

The Global Market Index (GMI) fell in September from the previous month, dipping to 5.9% and reversing an upward trend in recent months. The new estimate reflects a long-run forecast for performance over the “risk-free” rate, according to a risk-based model (details below).

Macro Briefing: 4 October 2021

* Dems will continue to struggle this week over fraying unity on Biden agenda

* Broader signs of inflation pressures starting to emerge

* Japan elects new prime minister: Fumio Kishida

* US auto sales plunged over past 3 months due to chip shortages

* Huge leak of offshore data shows tax dodges of rich and powerful

* China raises pressure on Taiwan with surge of provocative military flights

* Trading halted in shares of Evergrande, the troubled property developer in China

* US 60/40 stocks/bonds benchmark suffered rare loss in September

* Key inflation metric monitored by Fed rose to 30-year high in August

* ISM Mfg Index rose in September, signaling strongest growth since May

* US consumer spending rebounded sharply in August: