* Political anxiety rising in Washington as debt-ceiling showdown looms

* Biden’s economic legislation at risk of delay as Dems debate

* US, UK and Australia announce new security partnership to counter China

* NY Fed Mfg Index shows sector growth accelerated in September

* US import prices eased for first time in 10 months in August

* Atlanta Fed business inflation expectations steady at elevated pace in Sep

* US poverty rate fell in 2020 via stimulus checks and unemployment benefits

* US industrial output growth slowed in August, partly due to Hurricane Ida:

The ETF Portfolio Strategist: 15 September 2021

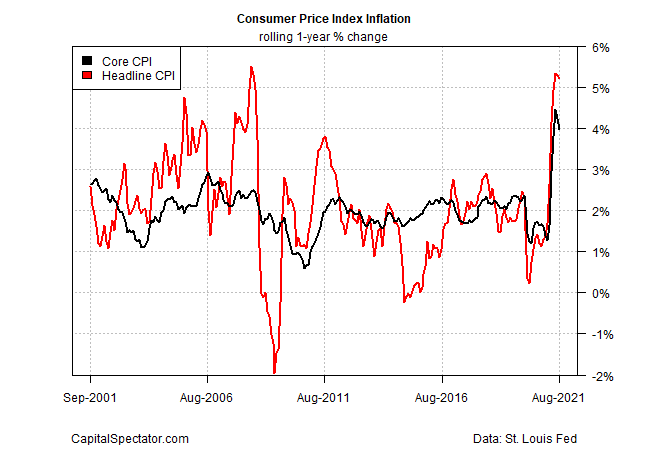

US consumer inflation eased more than expected in August, hinting that the recent surge in pricing pressure may be cooling. But if this was a sign for commodities prices to ease, the market didn’t get the memo.

US Inflation Trend Still Appears To Be Peaking, But Slowly

US consumer inflation’s one-year trend eased in August, marking a second month of lesser pricing pressure, the Bureau of Labor Statistics reports. But the pace of inflation remains elevated and a new run of analytics suggest that the pullback from the recent surge will be unfold slowly.

Macro Briefing: 15 September 2021

* North and South Korea test ballistic missiles as tensions spike on peninsula

* California Gov. Gavin Newsom wins recall election

* Most Americans would see tax cuts in Dems’ tax code plans, estimate shows

* Consumer inflation expectations rose again in August, NY Fed survey reports

* China retail sales rose much slower than expected in July

* Eurozone industrial output increased by more than forecast in August

* US small business sentiment remained middling in August vs. recent history

* SEC chairman says rules for cryptocurrency are in development

* US Consumer Price Index rose less than expected in August:

Profiling Winning And Losing Streaks For The US Stock Market

Is the stock market’s trending behavior changing? Are the winning streaks running longer and the corrections becoming shorter?

Macro Briefing: 14 September 2021

* House Democrats propose new tax hikes to pay for $3.5 trillion spending plan

* Hurricane Nicholas makes landfall on the Texas coast

* Delta variant of coronavirus is weighing on economies around the world

* Covid-19 infections more than double in China’s southeastern province of Fujian

* California’s Gov. Newsom is expected to win today’s recall vote

* UK company payrolls surged in August

* Apple issues emergency security update for iPhones to counter spyware threat

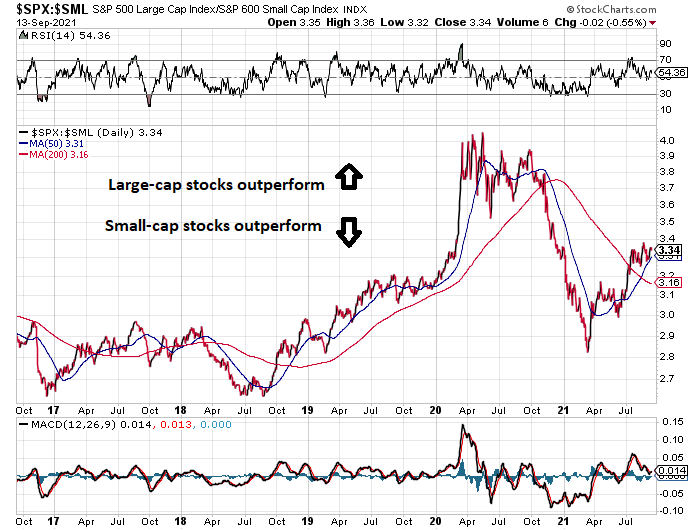

* US small-cap stocks continue to lose ground against large-caps:

Most Markets Retreated Last Week

Nearly every slice of the major asset classes retreated in the trading week through Friday, Sep. 10, based on a set of ETFs. The upside exception: US inflation-indexed Treasuries.

Macro Briefing: 13 September 2021

* House Dems eye taxes on wealthy, corporations to pay for $3.5 trillion budget

* Sen. Manchin, a key swing vote, says he will not vote for $3.5 trillion budget

* Government-shutdown risk is rising threat for Democrats in Washington

* Delta variant drives another Covid-19 outbreak in China

* North Korea reports testing a new long-range missile

* Russia’s military influence in Africa is rising, posing challenge to status quo

* US job growth won’t regain peak until 2030, new gov’t analysis predicts

* US producer inflation accelerated in August, reaching record 8.3% from year ago:

The ETF Portfolio Strategist: 12 September 2021

Our proprietary strategies lost ground in line with the Global Beta 16 (G.B16) benchmark last week. Year to date, the benchmark is still in the lead, but by a narrowing margin — a mere 20 basis points over this year’s top-performing prop strategy — Global Managed Volatility, which is up 9.2% in 2021 vs. 9.4% for G.B16 through Friday’s close (Sep. 10).

Book Bits: 11 Saturday 2021

Rob Reich, et al.

Excerpt via The Atlantic

After decades of innovation by computer and internet companies unfettered by government regulation, Americans are enjoying the benefits provided by Big Tech—but also contending daily with problems that the industry has ushered in. Even consumers who love their smartphones and Instagram accounts may be concerned about how they siphon up personal data and lure users back with every new alert. While tech platforms help keep people in contact with family and friends, they also rely on opaque algorithms that shape the content we see. Seeing these dynamics, many politicians appear uncertain whether to get cozy with the visionary leaders of Google, Apple, and Facebook—or to campaign against the pollution of the American information ecosystem, the amplification of hate speech and harassment, and the striking concentration of market power among a small number of companies.