* Biden meets Putin today in Geneva

* Israel bombs Gaza — first airstrike since last month’s ceasefire

* No policy changes expected for today’s Fed announcement

* Biden ban on new oil and gas leases blocked by federal judge

* China’s industrial output, retail sales rose less than expected in May

* NY Fed Mfg Index reflects slower growth for second straight month in June

* Producer price inflation continued to accelerate in May

* US industrial production rebounded in May following weak gain in April

* US retail sales fell more than expected in May:

Short Junk And TIPS Continue To Lead US Bond Market In 2021

The recent slide in the bond market has been granted a reprieve over the last two months. Interest rates have retreated in recent weeks, which has lifted bond prices. The challenge is deciding if this is noise or the start of an extended run higher for fixed-income securities.

Macro Briefing: 15 June 2021

* Change in Israel’s leadership creates new diplomatic opportunities with US

* Will Fed signal earlier-than-expected rate hikes at this week’s policy meeting?

* Retail group asks White House to address congestion at ports

* Housing markets around the world flash bubble-warning signs

* Will lingering job losses from pandemic keep inflation contained?

* Senate GOP leader pledges to block any Biden Supreme Court nominee

* Airbus-Boeing trade dispute between US and EU set to end after 17 years

* US stocks close at record high for third trading day in a row:

US REITs Led Major Asset Classes For Second Straight Week

Property shares in the US were last week’s top performer for the major asset classes for a second straight week, based on trading through Friday’s close (June 11).

Macro Briefing: 14 June 2021

* Israel’s Netanyahu voted out of power after 12 years as prime minister

* This week’s Biden-Putin meeting will be contentious

* G-7 nations agree to set up infrastructure plan to counter China

* Reported leak at Chinese nuclear plant attracts US assessment

* No margin for error in markets’ low-flation forecast

* Eurozone industrial output rose substantially more than expected in April

* When will the NBER announce an end date to the pandemic recession?

* US workers quitting jobs at highest rate in over two decades

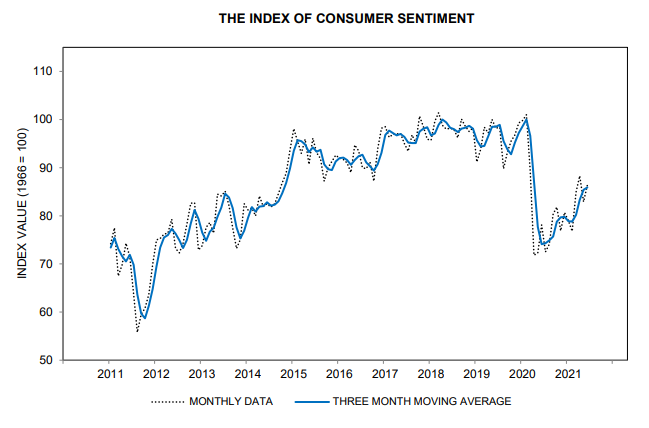

* US consumer sentiment rebounds in early June:

The ETF Portfolio Strategist: 13 June 2021

Unmanaged beta risk remains in the lead this year for generating returns relative to our three risk-managed strategies. The Global Beta 16 Index (G.B16), which represents the 16-fund opportunity set for the proprietary portfolios, still enjoys a respectable lead.

Book Bits: 12 June 2021

Neil Fligstein

Summary via publisher (Harvard U. Press)

More than a decade after the 2008 financial crisis plunged the world economy into recession, we still lack an adequate explanation for why it happened. Existing accounts identify a number of culprits—financial instruments, traders, regulators, capital flows—yet fail to grasp how the various puzzle pieces came together. The key, Neil Fligstein argues, is the convergence of major U.S. banks on an identical business model: extracting money from the securitization of mortgages. But how, and why, did this convergence come about?

The ETF Portfolio Strategist: 11 June 2021

- Real estate stays hot

- The trend remains bullish for our portfolio strategy benchmarks

Is Inflation Still Transitory? New Data Raise More Questions

The inflation-is-transitory narrative took a beating in yesterday’s hotter-than-expected report for US consumer prices in May. Even after accounting for so-called base effects (temporary pandemic-related factors driving inflation higher), pricing pressure has accelerated.

Macro Briefing: 11 June 2021

* Bipartisan group of Senators reach deal on infrastructure package

* Iran warships sailing in Atlantic

* European Central Bank defers on when it might start reducing stimulus program

* Weak US dollar is spurring foreign investment in US government bonds

* Oil demand expected to exceed pre-coronavirus levels by 2022’s close

* UK economic growth picked up in April

* US jobless claims fell for sixth straight week, sliding to new pandemic low

* Some analysts predict higher US inflation is temporary

* US consumer inflation rose at 5% annual rate in May–highest since 2008: