Inflation anxiety is rising, and not without reason. Several inflation indexes that are widely followed accelerated sharply in April, along with various price sentiment measures and key commodities. In an effort to extract more signal and less noise, CapitalSpectator.com introduces a seven-factor measure of inflation – the Inflation Trend Index (ITI).

Macro Briefing: 28 May 2021

* Biden proposes $6 trillion budget for next year with $1.8 trillion federal deficit

* Russia suspected in new hack on government email accounts

* Senate to pass $195 billion legislation to boost US competitiveness With China

* Eurozone economic sentiment rises to 3-year high in May

* US will not rejoin key arms control deal with Russia

* US core durable goods orders rose sharply in April

* US pending home sales fell in April–third monthly decline in past four

* Revised US Q1 GDP growth holds at strong +6.1 increase

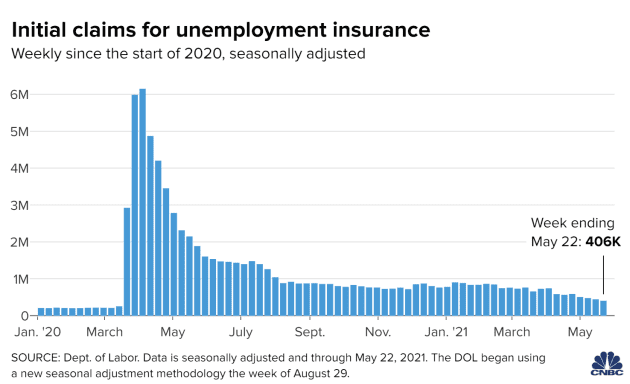

* US jobless claims continue to improve, falling to another pandemic low:

European Stocks Lead World’s Major Equity Regions Year To Date

Shares in Europe have taken the lead for 2021 returns among the world’s main equity regions, based returns for a set of exchange-listed funds through May 26.

Macro Briefing: 27 May 2021

* Biden orders inquiry into origins of coronavirus

* More investors betting on further gains for Eurozone stocks

* Will Biden reappoint or replace Fed Chairman Powell (his term expires in Feb)?

* Supply Shortages loom for world as China’s factories are squeezed

* Top Biden official in Asia: era of US engagement with China has ended

* Hedge fund assets reach a record $4.1 trillion in assets

* Chinese currency at strongest level since 2016 vs. basket of trading partners

* Activist investor ousts Exxon directors in historic win pro-climate campaign

* Royal Dutch Shell ordered by Dutch court to deepen carbon emissions cuts

* Amazon announces deal to acquire MGM and its large film, TV-show library

* Treasury market inflation forecasts remain below recent peaks:

The ETF Portfolio Strategist: 26 May 2021

Emerging markets are on the radar for global asset allocation strategies these days on the assumption that these countries will be the main beneficiaries of the vaccine-led global economic recovery. It’s an intriguing narrative and not without merit, but so far the results are mixed, based on looking at a broad-brush proxy for EM stocks.

Treasury Market’s Reflation Pricing Is On Hold, For Now

After rebounding sharply from pandemic lows, the 10-year Treasury yield is nearly back to levels that prevailed before Covid-19 began to roil the global economy in early 2020. But the 10-year rate has been in a holding pattern for the past two months, raising questions about what happens next.

Macro Briefing: 26 May 2021

* GOP senators set to propose $1 trillion infrastructure counteroffer to Biden

* Exxon faces challenge on climate from an activist investor

* Is money supply the key factor driving the price of gold?

* US Consumer Confidence Index fell for first time in six months in May

* New US home sales fell more than expected in April

* Year-over-year change for US house prices reached 15-year high in March:

Estimating Fair Value For The 10-Year Treasury Yield, Part II

Earlier this month, I reviewed a model that estimates a theoretical level for the world’s most-important interest rate: the 10-year Treasury yield. In today’s follow-up, let’s consider a second model for additional context.

Macro Briefing: 25 May 2021

* EU and US impose new sanctions on Belarus after forced landing of jet

* CNN’s Back-To-Normal Index shows US economy close to full recovery

* Vaccinated Americans remain muted force for powering economic rebound

* Amazon reportedly close to acquiring Hollywood studio MGM

* China’s currency rises to 3-year high against US dollar

* Is market’s inflation focus obscuring risk of flare-up in US-China tension?

* German economy fell more than expected in the first quarter

* Germany businesses are more optimistic in May about economic outlook

* US growth cooled in April after March surge via Chicago Fed Nat’l Activity Index:

Real Estate Rebounds In Mixed Week For Major Asset Classes

Foreign and US property shares rallied last week, posting the strongest gains for the major asset classes, based on a set of exchange traded funds through Friday, May 21.

Continue reading