* Cease-fire between Israel and Hamas puts 11-day war on hold

* US proposes minimum 15% global tax on multinational firms

* US Treasury wants crypto transfers over $10k reported to IRS

* Eurozone Composite PMI (a GDP proxy) rises to 39-month high in May

* UK private-sector growth in May jumps to fastest pace in two decades-plus

* Japan slips back into economic contraction in May via PMI survey data

* US Leading Economic Index rose in April, surpassing pre-pandemic high

* Philly Fed Mfg Index: growth cooled in May but remains strong

* US jobless claims continue falling, dropping to new pandemic low:

US Economic Growth Still Expected To Accelerate In Q2

First-quarter growth posted a strong improvement over the previous quarter and a repeat performance is expected for the second-quarter report on gross domestic product (GDP) that’s scheduled for release in late-July.

Macro Briefing: 20 May 2021

* Ceasefire expected soon for Israeli-Palestinian conflict

* Israel unleashes another wave of airstrikes in Gaza on Thursday

* US and Russian diplomats meet ahead of Biden-Putin summit

* Biden waives US sanctions on Russian-German gas pipeline company

* GOP defections help House pass inquiry into Jan. 6 siege on the Capitol

* Most GOP states plan to cut unemployment benefits as jobless claims fall

* Fed officials discussed conditions for easing stimulus in April policy meeting

* German producer prices accelerated sharply to 5.2% annual rate in April

* Gold rises to highest level since January:

The ETF Portfolio Strategist: 19 May 2021

Inflation anxiety is rising, commodities prices have popped and the consumer price index increased at a pace far above expectations in April. What isn’t increasing is the benchmark 10-year Treasury yield. Let’s restate that: it’s no longer rising.

Beware The Surge In Economic Noise

Identifying which way the macro wind is blowing isn’t getting easier. So far this month the government has published five key economic reports and each one has delivered sharply divergent results relative to the consensus forecasts. It’s unclear how long the surprise factor will remain in overdrive, but for the near term the incoming numbers may be unusually misleading.

Macro Briefing: 19 May 2021

* Israel-Gaza conflict continues with no sign of ceasefire

* China accuses US of threatening peace as warship transits Strait of Taiwan

* World currently facing multiple crises, UN Secretary warns

* Ex-Treasury secretary Summers says Fed will be forced into sudden rate rise

* President, Treasury secretary promote $2.3 trillion infrastructure package

* Is 4% inflation the tipping point for triggering lower stock prices?

* Chinese regulators tighten rules on using cryptocurrencies for payments

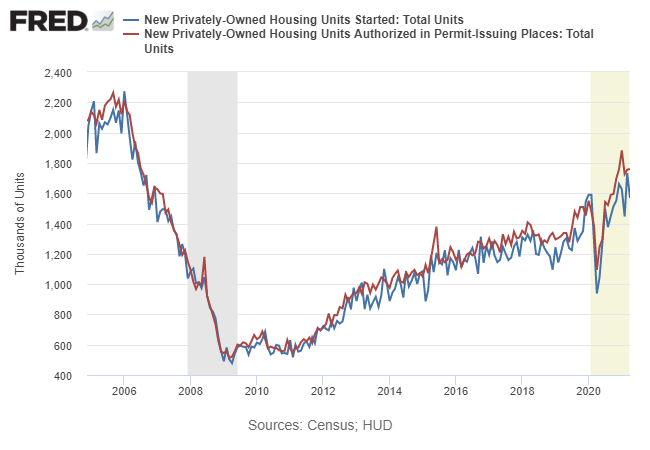

* US housing starts fell sharply in April but building permits rose moderately:

High Beta Stocks Top US Equity Factor Returns In 2021

So-called high beta shares have rallied sharply in recent weeks and are now the top performer for US equity factor returns year to date, based on a set of ETF proxies through yesterday’s close (May 17).

Macro Briefing: 18 May 2021

* Israel-Palestinian conflict continues to rage on Tuesday

* Japan’s economy contracted more than expected in first quarter

* Supreme Court will hear case that challenges Roe v. Wade abortion case

* Amazon pursuing deal to acquire MGM in bid to expand entertainment footprint

* Investors rushing into bank stocks for an economic recovery play

* Brent crude oil rebounds to $70 a barrel

* NY Fed Mfg Index ticks lower in May, but still signals strong growth

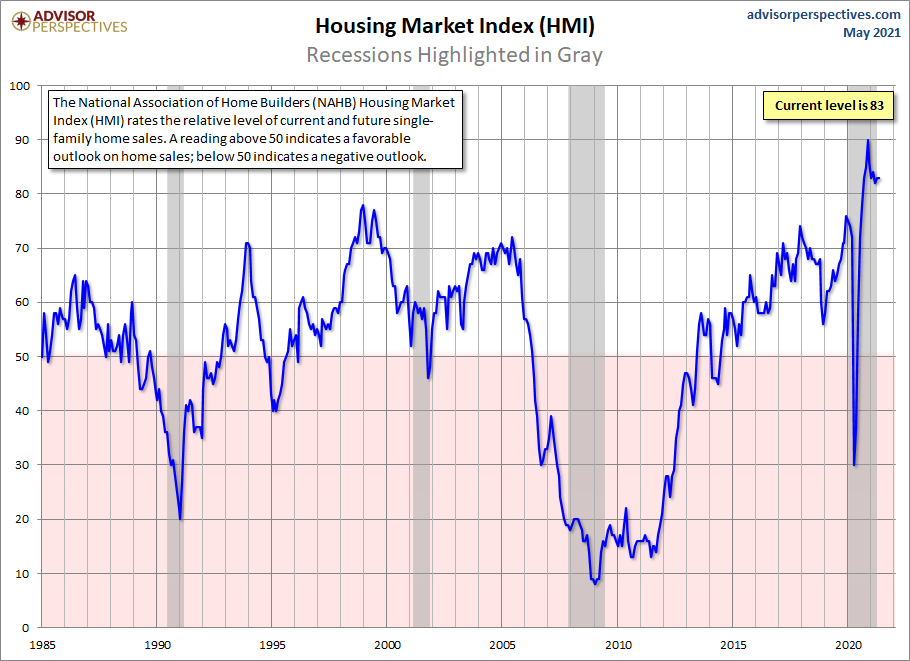

* US homebuilder sentiment is unchanged in May, holding at high level:

Major Asset Classes Had A Rough Time Last Week: Everything Fell

Red ink splattered near and far in last week’s trading for the major asset classes, based on a set of exchange traded funds at the close on Friday, May 14.

Macro Briefing: 17 May 2021

* Israeli airstrikes on Gaza continue with no end in sight

* China’s economy grew at slower pace in April

* Global supply chains stretched to the limit as corporate demand surges

* Nations take action to counter global computer chip shortage

* Expected merger of WarnerMedia with Discovery would be media giant

* White House is warily monitoring inflation risk as potential threat to economy

* Corporate America expect Biden’s tax-the-rich plan will fail

* US stock market’s ‘fear gauge’, a.k.a. VIX Index, pulled back sharply on Friday: