* Israel-Gaza conflict continues with no sign of ceasefire

* China accuses US of threatening peace as warship transits Strait of Taiwan

* World currently facing multiple crises, UN Secretary warns

* Ex-Treasury secretary Summers says Fed will be forced into sudden rate rise

* President, Treasury secretary promote $2.3 trillion infrastructure package

* Is 4% inflation the tipping point for triggering lower stock prices?

* Chinese regulators tighten rules on using cryptocurrencies for payments

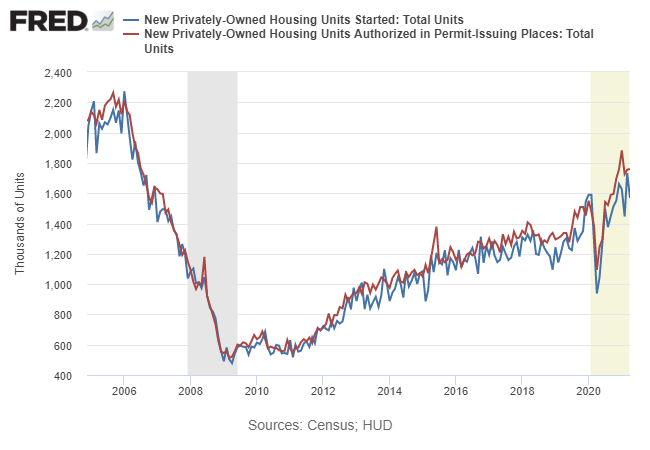

* US housing starts fell sharply in April but building permits rose moderately:

High Beta Stocks Top US Equity Factor Returns In 2021

So-called high beta shares have rallied sharply in recent weeks and are now the top performer for US equity factor returns year to date, based on a set of ETF proxies through yesterday’s close (May 17).

Macro Briefing: 18 May 2021

* Israel-Palestinian conflict continues to rage on Tuesday

* Japan’s economy contracted more than expected in first quarter

* Supreme Court will hear case that challenges Roe v. Wade abortion case

* Amazon pursuing deal to acquire MGM in bid to expand entertainment footprint

* Investors rushing into bank stocks for an economic recovery play

* Brent crude oil rebounds to $70 a barrel

* NY Fed Mfg Index ticks lower in May, but still signals strong growth

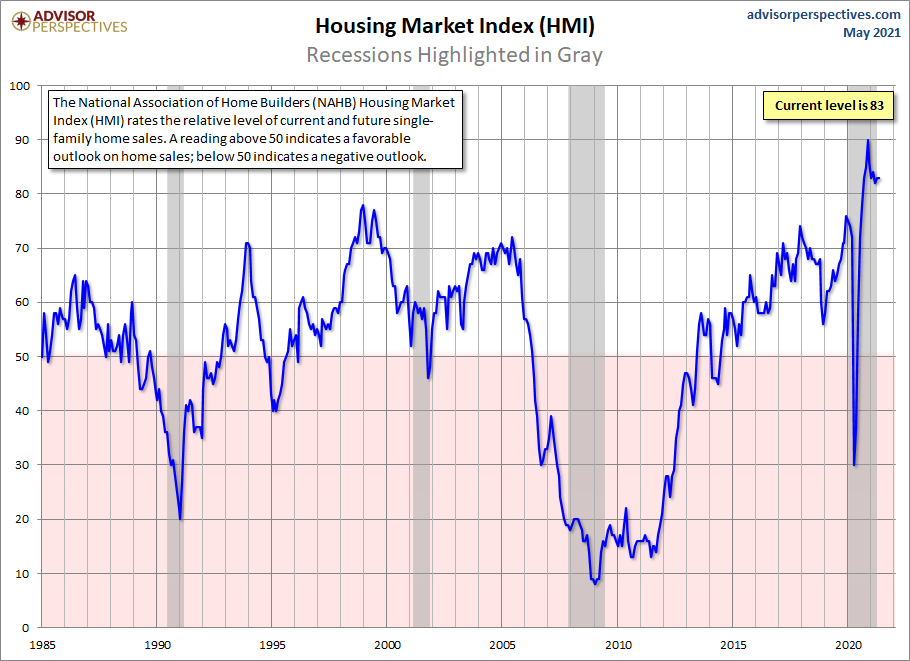

* US homebuilder sentiment is unchanged in May, holding at high level:

Major Asset Classes Had A Rough Time Last Week: Everything Fell

Red ink splattered near and far in last week’s trading for the major asset classes, based on a set of exchange traded funds at the close on Friday, May 14.

Macro Briefing: 17 May 2021

* Israeli airstrikes on Gaza continue with no end in sight

* China’s economy grew at slower pace in April

* Global supply chains stretched to the limit as corporate demand surges

* Nations take action to counter global computer chip shortage

* Expected merger of WarnerMedia with Discovery would be media giant

* White House is warily monitoring inflation risk as potential threat to economy

* Corporate America expect Biden’s tax-the-rich plan will fail

* US stock market’s ‘fear gauge’, a.k.a. VIX Index, pulled back sharply on Friday:

The ETF Portfolio Strategist: 16 May 2021

Our trio of proprietary strategies outperformed their common benchmark last week. Alas, the outperformance was in the form of lesser declines, but that still beats underperformance.

Book Bits: 15 May 2021

Daniel Kahneman, et al.

Summary via publisher (Little, Brown Spark)

In Noise, Daniel Kahneman, Olivier Sibony, and Cass R. Sunstein show the detrimental effects of noise in many fields, including medicine, law, economic forecasting, forensic science, bail, child protection, strategy, performance reviews, and personnel selection. Wherever there is judgment, there is noise. Yet, most of the time, individuals and organizations alike are unaware of it. They neglect noise. With a few simple remedies, people can reduce both noise and bias, and so make far better decisions. Packed with original ideas, and offering the same kinds of research-based insights that made Thinking, Fast and Slow and Nudge groundbreaking New York Times bestsellers, Noise explains how and why humans are so susceptible to noise in judgment—and what we can do about it.

The ETF Portfolio Strategist: 14 May 2021

In this issue:

- Across-the-board losses this week for global markets

- Portfolio strategy benchmarks take a hit

Research Review | 14 May 2021 | Stock Returns

Long-Horizon Stock Returns Are Positively Skewed

Adam Farago and Erik Hjalmarsson (University of Gothenburg)

April 28, 2021

At long horizons, multiplicative compounding induces strong-to-extreme positive skewness into stock returns; the magnitude of the effect is primarily determined by single-period volatility. Consequently, at horizons greater than five years, returns –individual or portfolio– will be positively skewed under reasonable parametrizations. From an investor perspective, the strong positive skewness implies that the mean compound return will serve as a poor guide for typical long-horizon outcomes. Moreover, the large effects of compounding on higher-order moments are shown to affect the validity of Taylor expansions used to approximate preferences for skewness, when applied to returns of annual or longer horizons.

Macro Briefing: 14 May 2021

* CDC says vaccinated Americans can go maskless in most settings

* Fighting in Gaza intensifies as Israeli ground forces launch attacks

* Fed governor Christopher Waller predicts inflation surge will be temporary

* Colonial pipeline paid roughly $5 million to ransomware attackers

* US Producer Price Index rose sharply in April

* US jobless claims continued to slide last week, dropping to new pandemic low: