The Treasury market’s implied inflation forecast continues to rise, but the source of this reflationary trend is born of a growing divergence between nominal and real (inflation-adjusted) Treasury yields. Explaining the divergence and pondering the implications can take several paths. But no matter your preference, all roads begin with monitoring the data that highlights this expanding gap.

Macro Briefing: 9 February 2021

* Dems propose additional $1400 payment for $1.9 trillion relief package

* Senate leadership announces plan for today’s Trump impeachment trial

* US carrier groups conduct joint exercises South China Sea

* Hacker attempts to poison water supply in Florida city

* US average junk bond yield falls below 4% for the first time

* Italian government bond yields fall to record low

* Bitcoin rises to record high after Tesla discloses $1.5 billion purchase

* US crude oil benchmark rises for 6th day to nearly $58–a 1yr high:

Emerging Markets Stocks Lead Returns For Major Asset Classes

Shares in emerging markets moved to first place for one-week and one-year returns for the major asset classes, based on a set of exchange-traded funds through Friday’s close (Feb. 5). In addition to topping returns last week, emerging markets equities have widened a first-place performance lead over US stocks, which are in second place for one-year results.

Macro Briefing: 8 February 2021

* Biden: herd immunity in US unlikely before end of summer

* Treasury Sec. Yellen: US could reach full employment by 2022 with Biden plan

* South Africa stops use of AstraZeneca’s Covid-19 vaccine, citing new variants

* Protesters in Mynamar defy military, demand that civilian leader be reinstalled

* Senate prepares for speedy Trump impeachment trial

* German industrial output flat in December amid second coronavirus wave

* Oil prices recover to pre-pandemic level

* US payrolls posted weak rebound in January after sharp decline

* US 10-year rose to 1.19% last week, a one-year high:

Book Bits: 6 February 2021

● Think Again: The Power of Knowing What You Don’t Know

● Think Again: The Power of Knowing What You Don’t Know

Adam Grant

Review via Forbes

Several years into my career, a senior faculty member and I had a conversation that led me to one of those ‘a-ha’ moments. “Just because something is written in a textbook, it is not necessarily true. It is only the author’s version of the truth,” she told me. I was stunned. That one statement contradicted everything I learned throughout my educational and professional career. I let that statement marinate in my head for a while. Before long, I realized that my colleague was correct. I began rethinking everything I learned and reexamined the basis for that truth. In his latest book, Think Again, organizational psychologist and Wharton professor Dr. Adam Grant looks into this very issue. He suggests that success rests in the power of knowing what we don’t know and being released from our tunnel vision.

The ETF Portfolio Strategist: 5 Feb 2021

In this issue:

- Global markets rebound

- Strong week for portfolio-strategy benchmarks

- Risk-on pays off for one of our managed-risk strategies

Return to form in February: The late-January correction turned out to be another head fake for risk assets, which rebounded sharply this week. Equities across the board were higher, led by a strong gain in Africa stocks, which topped our set of fund proxies that collectively represent the world’s major asset classes. (For details on all the risk metrics in the table below, along with profiles of the strategies and benchmarks discussed, see this summary.)

Inflation Expectations Are Rising. Will Actual Inflation Follow?

The Treasury market continues to price in higher odds of reflation and the Federal Reserve remains inclined to let the economy expand for longer with little if any monetary pushback due to nascent signs of pricing pressure. That lays the foundation for higher inflation. But so far, the hard data offers minimal support. Will 2021 be the year of an inflationary regime shift?

Macro Briefing: 5 February 2021

* Biden ends support for Saudi Arabia’s military operations in Yemen

* J&J seeks approval from US regulators for its Covid-19 vaccine

* House removes Marjorie Taylor Greene from committee assignments

* Senate rejects minimum wage bill in Biden’s relief package

* EU diplomat tells Russia ties are low over case of Kremlin critic Navalny

* US warship sails near Chinese-controlled Paracel Islands

* Bank of England says negative interest rates may be near

* US job cuts rose to highest January total since 2009

* US factory orders rose in December–eighth straight monthly gain

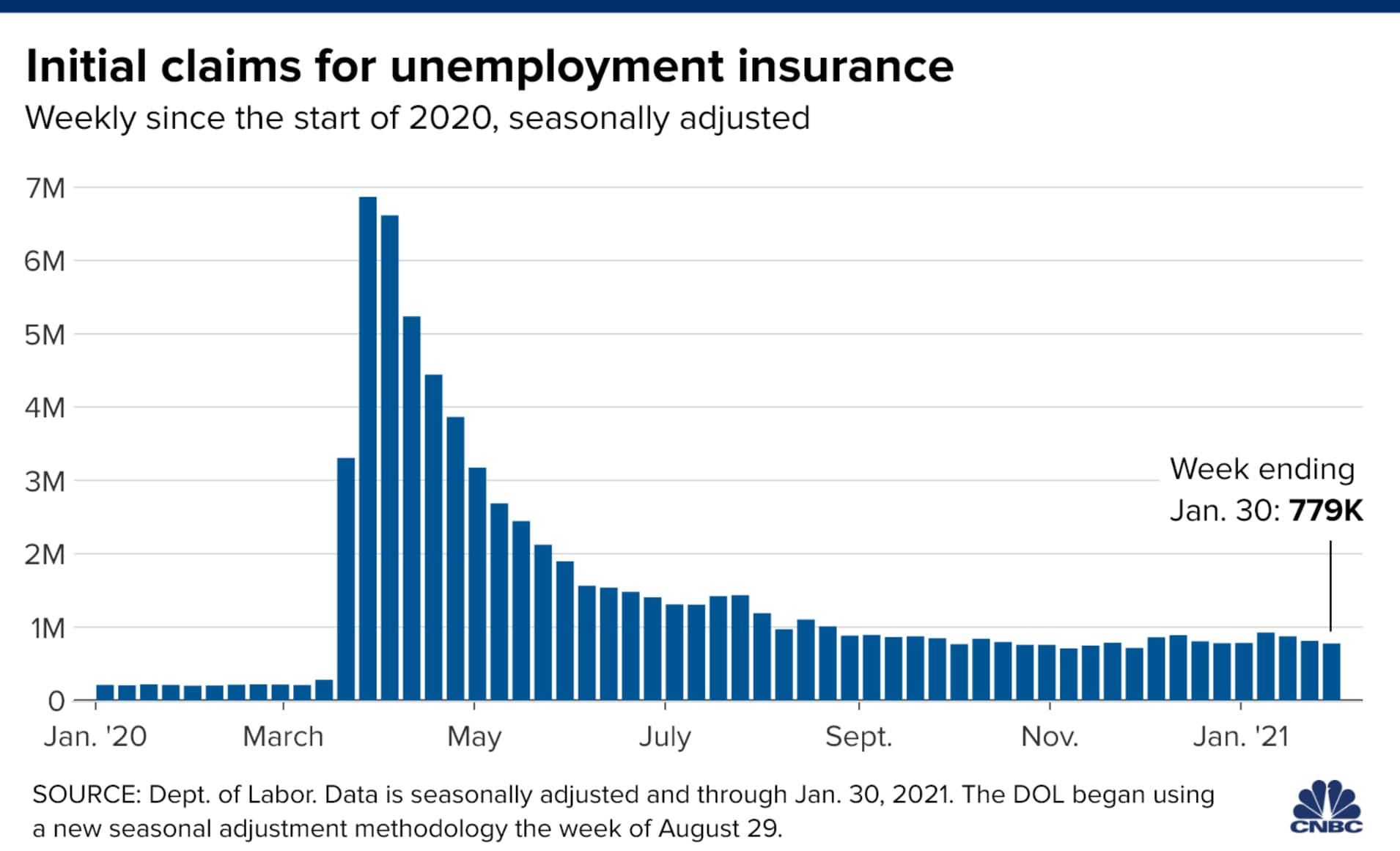

* US jobless claims fell to two-month low last week:

Year-To-Date Equity Leaders: Asia ex-Japan, Small Caps And Energy

The year is still young, but not too young to see trends that could define 2021 for leaders and laggards in US and world equity markets. Reviewing a set of exchange traded funds as proxies highlights three key trends that deserve monitoring: leadership in energy shares, small-cap stocks and markets in Asia ex-Japan.

Macro Briefing: 4 February 2021

* Researchers explore mixed vaccine shots as COVID-19 variants surge

* House GOP keeps Liz Cheney in leadership, rebuking Trump loyalists

* Treasury yield curve at steepest level since 2017

* Biden pushes ahead on his proposed $1,400 stimulus checks

* Survey: nearly 70% of Americans support Biden’s $1.9 trillion relief plan

* Global economic rebound slowed for a third month in January

* Is tighter liquidity in China a new global headwind?

* Sen. Klobuchar (D-Minn.) unveils sweeping antitrust reform bill

* Lazy investing strategy has been a winning strategy

* US Services PMI indicates “sharp upturn in business activity” in January

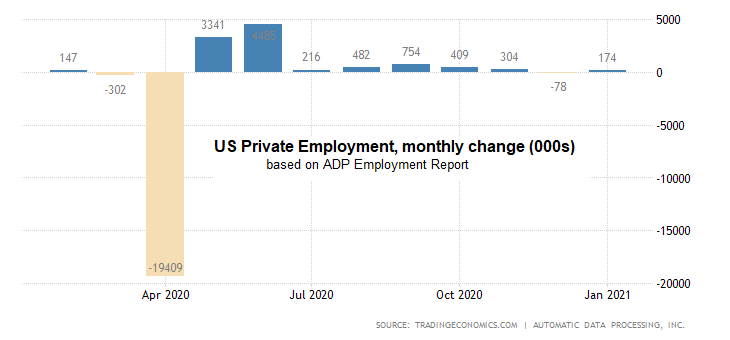

* US private payrolls rebounded modestly in January after December decline: