House speaker and Senate majority leader resume talks on stimulus deal: CNBC

Moderna: vaccine has ‘potential’ to offer longer-term immunity: MW

Biden and three former presidents pledge to publicly take a vaccine: USAT

Should US policymakers stop worrying and learn to love debt? NYT

Softest gain in 6 months expected for today’s November payrolls report: RTRS

Demand for inflation-protected securities surges: FT

German factory orders rose in Oct, level above pre-crisis level: BBG

Global growth ticked lower in November but remained “solid”: IHSM

US jobless claims fell last week, perhaps due to Thanksgiving holiday: WSJ

US Services PMI: sector growth accelerated to five-year high in November: IHSM

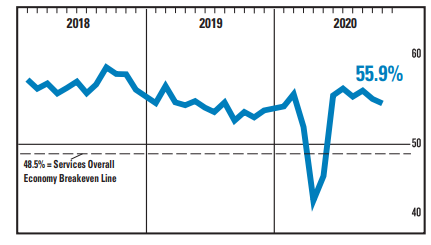

Conflicting with PMI, ISM Non-Mfg Index reflects softer growth in November: ISM

Does The Return Of The Reflation Trade Have Legs?

The Treasury market’s inflation forecast broke above its pre-pandemic high this week, fueling speculation that a new era of firmer pricing pressure is dawning. Maybe, but there are still good reasons to remain cautious before declaring that inflation is at a critical turning point. There’s a case for reviving the pre-pandemic outlook for roughly 2% inflation, but expecting a substantially hotter run still relies heavily on guesswork and dismissing the secular trends — an aging demographic, disinflationary pressure via technology, and other factors — that have prevailed over the past 20 years.

Continue reading

Macro Briefing: 3 December 2020

Negotiations in Congress continue for coronavirus-stimulus bill: WSJ

US posts record number of Covid-19 hospitalizations: BBC

Americans face ‘rough’ winter due to surging coronavirus, CDC chief warns: RTRS

House passes bill that may delist Chinese firms from US stock exchanges: CNBC

China services sector growth accelerated in November: RTRS

Eurozone economic activity contracted in Nov, PMI survey data shows: IHSM

UK economic activity contracted in Nov via PMI survey data: BBG

Survey: economic fear rises sharply among Republicans after election: NYT

Fed Beige Book: US economic rebound gathered momentum recently: WSJ

US companies hired fewer workers than expected in November: BBG

Risk Premia Forecasts: Major Asset Classes | 2 December 2020

The expected risk premium estimate rose for The Global Market Index (GMI), increasing to an annualized 5.3% in today’s revision. That’s a relatively sizable jump relative to last month’s forecast. The estimate represents a long-run projection for the index’s performance over the “risk-free” rate via a risk-based model (details below).

Macro Briefing: 2 December 2020

UK approves Pfizer-BioNTech coronavirus vaccine: CNBC

Trump may veto defense bill over social media protections: AP

Biden says he won’t immediately remove Trump’s tariffs on China: CNBC

Biden’s economic team recommends quick action on stimulus: NYT

Global manufacturing increased in Nov at fastest pace since Jan 2018: IHSM

10-year Treasury yield rises sharply, near 1%: BBG

German retail spending rose more than expected in October: RTRS

US construction spending rebounded in October: MW

US Mfg PMI signaled continued acceleration in growth: IHSM

US ISM Mfg Index: sector growth slowed in November: RTRS

Major Asset Classes | November 2020 | Performance Review

November was unusually kind to risk assets, delivering another clean sweep of gains. For a third month this year, all the major asset classes rallied. From the smallest of fractional increases in cash (a gain of one basis point) up to the dramatic 15%-plus rally in stocks in foreign developed markets, a bullish wave lifted all boats last month — again, following across-the-board increases in May and July.

Continue reading

Macro Briefing: 1 December 2020

Moderna requests approval for its Covid-19 vaccine: WSJ

Biden chooses liberal-minded economic team: AP

Fed Chairman Powell: economic outlook ‘extraordinarily uncertain’: CNBC

China’s Nov mfg activity rose to highest level in a decade: IHSM

Eurozone Mfg PMI held on to moderate gain in Nov: IHSM

UK mfg survey data show sector activity strengthened in Nov: IHSM

Exxon Mobil will sharply cut exploration and production spending: NYT

Chicago PMI: business conditions slowed in Nov: MW

Dallas Fed Mfg Index: sector growth slowed sharply in Nov: MSTAR

US pending home sales fell for a second month in Oct: BBG

US Stocks Led Broad-Based Global Rally Last Week

American equities posted the highest return for the major asset classes for the trading week, based on a set of exchange traded funds through Friday’s close (Nov. 27). The broad-based rally lifted nearly every corner of global markets. The only exception: US investment-grade bonds.

Macro Briefing: 30 November 2020

Trump reportedly will add China’s SMIC and CNOOC to defense blacklist: RTRS

Fauci warns of ‘surge upon a surge’ for Covid-19: NPR

Biden expected to announce economic team this week: NYT

Biden fractures foot while playing with his dog: AP

Congress faces deadlines on gov’t spending and stimulus: BBG

China Mfg PMI shows growth for 9th straight month in Nov: CNBC

Will Senate Republicans block Biden’s judicial nominations? PLTC

OPEC+ considers extending cuts to oil production: RTRS

German 10-year bond yield slips to 3-week low, near -0.6%: RTRS

Financial data consolidation: S&P Global near deal to acquire IHS Markit: WSJ

This week’s US payrolls report for November on track for another gain: BBG

US Treasury yield curve continues to reflect a steepening bias:

Book Bits: 28 November 2020

● The Money Plot: A History of Currency’s Power to Enchant, Control, and Manipulate

Frederick Kaufman

Summary via publisher (Other Press)

Half fable, half manifesto, this brilliant new take on the ancient concept of cash lays bare its unparalleled capacity to empower and enthrall us.

Frederick Kaufman tackles the complex history of money, beginning with the earliest myths and wrapping up with Wall Street’s byzantine present-day doings. Along the way, he exposes a set of allegorical plots, stock characters, and stereotypical metaphors that have long been linked with money and commercial culture, from Melanesian trading rituals to the dogma of Medieval churchmen faced with global commerce, the rationales of Mercantilism and colonial expansion, and the U.S. dollar’s 1971 unpinning from gold.