Trumps risks stoking racial tensions with trip to Kenosha today: AP

US announces new economic support for Taiwan to counter China: Reuters

China’s mfg sector continued to recover in Aug, PMI survey data shows: CNBC

China’s exports are surging despite Trump’s tariffs: NYT

China’s economic growth in 2020 expected to slow to just 2%: BBG

Eurozone mfg sector held on to a modest recovery in Aug: IHS Markit

India’s economy contracted at a record pace in Q2: CNN

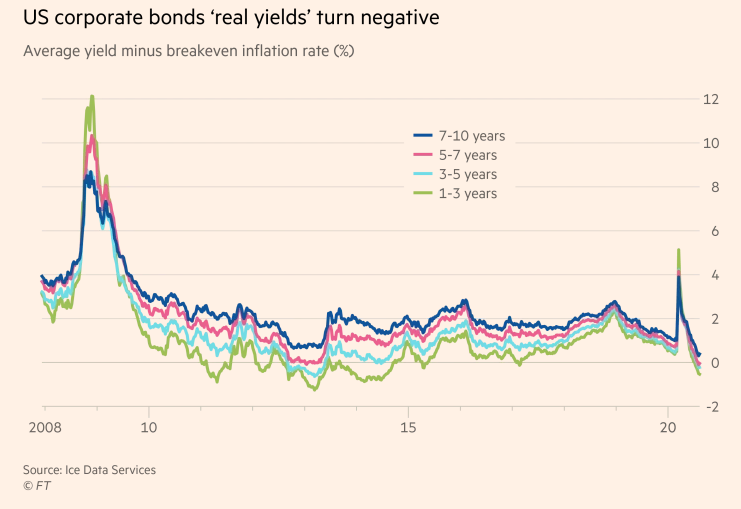

US corporate bond real yields go negative for short maturities: FT

US Stocks Led Broad-Based Gains In Major Asset Classes Last Week

American shares led a global rally for the trading week ended Aug. 28, based on a set of exchange-traded funds. With the exception of investment-grade bonds in the US, risk-on sentiment lifted every corner of the major asset classes.

Macro Briefing | 31 August 2020

FDA to expedite coronavirus vaccine before phase three trials end: CNBC

One dead in clash between Trump supporters and Oregon protesters: AP

Dems consider response after US intel chief ends election security briefings: USAT

Belarus protests continue, calling for president to step down: BBC

Does the Fed have the tools to carry out its new monetary policy? WSJ

Buffett’s Berkshire Hathaway buys stakes in Japanese trading firms: CNBC

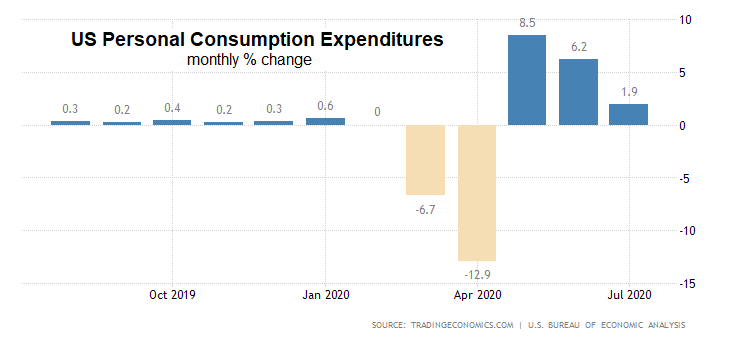

US consumer spending growth slowed in July, rising for 3rd straight month: CNBC

Book Bits | 29 August 2020

● 2030: How Today’s Biggest Trends Will Collide and Reshape the Future of Everything

Mauro F. Guillen

Review via Eurasia Review

“Ideas are like rabbits. You get a couple and learn how to handle them, and pretty soon you have a dozen.” This John Steinbeck quote, featured in the concluding chapter of Mauro F. Guillen’s 2030: How Today’s Biggest Trends Will Collide and Reshape the Future of Everything, is quite apt. 2030 is full of hypotheses and projections about, well, the state of the world in the year 2030. The most obvious place to start would be shifting demographics. The book spends much of its time writing about how the human population will look vastly different by 2030.

The ETF Portfolio Strategist: Risk-On Rolls On

Another week, another risk-on rally. US stocks continued to be a leader this week in global markets. SPDR S&P 500 (SPY) surged 3.3% at the close of the trading week (Aug. 28), marking the fund’s fifth straight weekly advance. Bonds, however, hit a rough patch. Vanguard Total US Bond Market (BND) fell 0.6% this week – the second weekly loss in the past three.

Research Review | 28 August 2020 | Portfolio Strategy

Fire Sale Risk and Expected Stock Returns

George O. Aragon (Arizona State U.) and Min S. Kim (Michigan State U.)

July 29, 2020

We measure a stock’s exposure to fire sale risk through its ownership links to equity mutual funds that experience outflows during periods of systematic outflows from the fund industry. We find that more exposed stocks earn higher average returns: a portfolio that buys (shorts) stocks with the highest (lowest) exposure outperforms by 3-7% per annum. Our findings cannot be explained by several known determinants of average returns and are consistent with the ex-ante pricing of the risk of future fire sales. We conclude that stocks’ exposures to risks inherited from the constraints of shareholders have important implications for stock prices.

Macro Briefing | 28 August 2020

Putin warns protesters in Belarus that Russia may intervene: NYT

Japan’s Prime Minister Abe resigns due to health issues: Reuters

Fed’s new inflation policy is greeted with skepticism by some analysts: BBG

Key moments from Trump’s speech on accepting Republican nomination: CNBC

US consumer spending likely increased in today’s upcoming July report: WSJ

Pending homes sales in US rise for third straight month in July: Reuters

Eurozone’s economic sentiment improves for third month in August: Reuters

German consumer morale slips, raising questions about recovery trend: Reuters

KC Fed Mfg Index up moderately in August, improves over June and July: KCF

US Q2 GDP loss revised up slightly to still-deep annualized 31.7% loss: MW

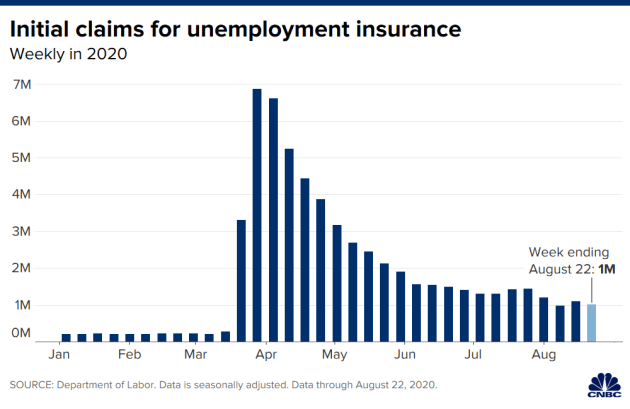

US jobless claims increased 1-million plus for a second week: CNBC

Will The Fed Unveil A New Monetary Policy Today?

If it’s broke, fix it. The Federal Reserve is expected to embrace that rule when Jerome Powell, chairman of the central bank, speaks later today and outlines a new plan on inflation targeting.

Macro Briefing | 27 August 2020

Hurricane Laura pounds coasts of Texas and Louisiana: USAT

US and Russian military vehicles collide in Syria, injuring US troops: BBC

Turkey to hold military drills in contested area of eastern Mediterranean: Reuters

Another currency crisis stalks Turkey’s economy: NYT

Fed expected to change policy to fight low inflation: CNBC

Fed’s inflation hawk isn’t opposed to letting inflation rise above 2% target: BBG

US durable goods orders continued to rebound at a strong rate in July: MW

US Equity Factors Continue To Post Wide-Ranging Results In 2020

There’s nothing subtle about the span of year-to-date returns for a broad set of US equity risk factors. At the extreme, the spread between the strongest and weakest performances is a stunning 40 percentage points, based on a set of exchange traded funds through yesterday’s close (Aug. 25).