Stimulus talks in Congress remain in limbo over $1 trillion aid to states: BBG

Israel and UAE sign historic deal that could reorder Mideast geopolitics: AC

US seizes Iranian fuel cargo to enforce sanctions: WSJ

Trump blocks coronavirus aid to derail funding for mail-in voting: Reuters

Greek and Turkish warships involved in ‘mini-collision’ in Mediterranean: Reuters

China’s industrial rebound continues but retail sales still sliding in July: SCMP

Is the stock market too optimistic in pricing in economic recovery? MW

US import prices rise for third straight month in July: MW

US jobless claims fell below 1-million mark last week–lowest since March: CNBC

Tech, Consumer Discretionary Continue To Lead US Equity Sectors

Positive momentum has continued to shine as a forward indicator for technology and consumer discretionary stocks in recent months. Both sectors remain the sector leaders in the US, based on a set of exchange traded funds through yesterday’s close (Aug. 12). Meanwhile, the lagging sectors show few signs that a turnaround is imminent.

Macro Briefing | 13 August 2020

Pompeo hints at broader US restrictions for Chinese tech: CNBC

US: Iran briefly seized oil tanker near the strategic Strait of Hormuz: AP

Next big Covid-19 hurdle: producing hundreds of millions of vaccines: Politico

US favors new tariffs on certain goods made in France and Germany: BBG

China fears deepening financial war as tensions rise with US: Reuters

US economic recovery headwind: state budget cuts due to coronavirus: WSJ

Buffett Indicator — stock-market-cap-to-GDP ratio — is flashing warning: MW

Are new US reporting rules for Covid-19 creating risks for accuracy? NYT

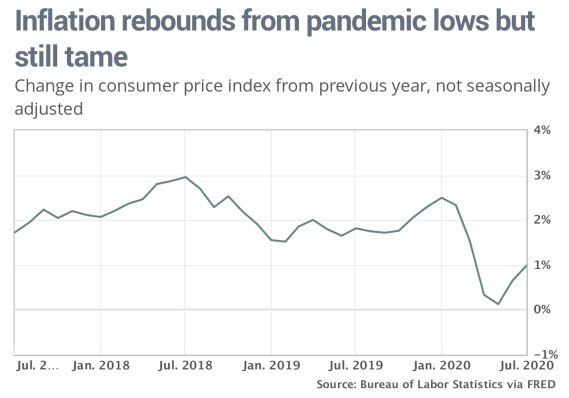

US consumer inflation continues to rebound but 1-year trend remains mild: MW

Will The US Economic Rebound Falter In 2020’s Second Half?

A number of encouraging economic indicators suggest that the US is recovering from the coronavirus recession that crushed output in the second quarter. But deciding if a bounce off a very deep bottom is laying the foundation for a robust, sustained recovery remains unclear. There are still too many unknowns lurking to develop a high-confidence forecast for the second half of 2020.

Macro Briefing | 12 August 2020

Kamala Harris beats rivals to become Biden’s running mate: Politico

Is Russia’s rush to roll out a coronavirus vaccine at risk of backfiring? CNBC

China accelerates effort to be more reliant on domestic economy: WSJ

UK economic activity crashed in Q2 with a record 20.4% decline in GDP: CNBC

Eurozone industrial output rose for a second month in June: MW

Small Business Optimism Index edged down in July after strong gain in June: NFIB

US wholsale inflation rose sharply in July but 1yr trend still negative: MW

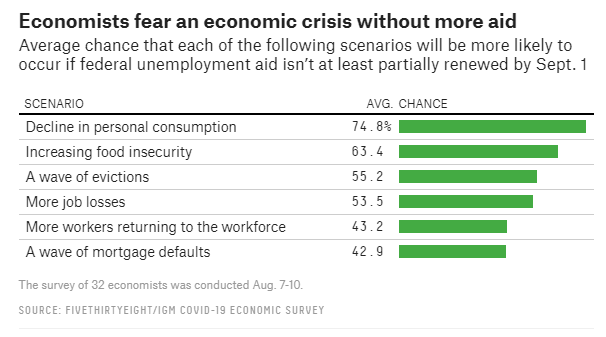

Economists warn that economic-crisis risk will rise without more jobless relief: FTE

China Continues To Lead World Equity Markets In 2020

Reviewing the global equity market as a single portfolio reveals a sleepy affair for year-to-date results through yesterday’s close (Aug. 10). But slicing and dicing shares into the major equity regions reveals a more dramatic story, including a strong lead for China’s stock market, based on a set of exchange traded funds.

Continue reading

Macro Briefing | 11 August 2020

Putin says Russia is the first country to approve a Covid-19 vaccine: Reuters

Trump may block some US citizens returning to America due to Covid-19: Reuters

Trump says he’s considering a capital gains tax cut: BBG

Employers are skeptical of Trump’s plan for deferring payroll taxes: WSJ

New US sanctions on Hong Kong complicate banking industry links to China: CNBC

Big Tech meets the Biden campaign: NYT

German investor sentiment rebounded more than expected in August: Reuters

UK employment fell the most in over a decade in Q2: BBC

US job openings rose more than expected in June: BBG

Stocks In Foreign Developed Markets Led Gainers Last Week

Shares in foreign developed-market nations topped returns last week for the major asset classes. After retreating for two weeks, this corner of global equity markets rebounded and led a wide-ranging rally in risk assets for the trading week through Aug. 7, based on a set of exchange-traded funds.

Continue reading

Macro Briefing | 10 August 2020

Trump signs executive order extending some pandemic relief: CNBC

US virus relief package at standstill after failed negotiations in Congress: BBG

US’ top health official praises Taiwan’s democracy, raising US-China tension: NYT

China briefly sends fighter jets into Taiwan airspace: Reuters

Financial crisis spawned by pandemic is especially bad for millennials: WSJ

Global extreme poverty expected to rise by 100 million, World Bank predicts: AP

US payrolls rose 1.763 million in July, beating Wall Street expectations: CNBC

Consumer borrowing picked up in June, first monthly gain during pandemic: MW

30%-to-40% of US renters may be at risk of eviction: NLIHC.org

Three Risk-Managed Portfolio Strategies

Here’s a quick review of three proprietary strategies that will feature regularly in The ETF Portfolio Strategist:

https://etfps.substack.com/p/three-proprietary-strategies