The Smart Beta Mirage

Shiyang Huang (University of Hong Kong), et al.

June 2020

We document sharp performance deterioration of smart beta indexes after the corresponding smart beta ETFs are listed for investments. Adjusted by aggregate market return, the average return of smart beta indexes drops from 2.77% per year “on paper” before ETF listing to −0.44% per year after ETF listing. This performance deterioration cannot be explained by strategic timing in ETF listing nor explained by time trend in factor premia. We find evidence of data mining in constructing smart beta indexes as the post-ETF-listing performance decline is much sharper for indexes that are more susceptible to data mining in backtests. Our results caution the risk of data mining in the proliferation of ETF offerings as investors respond strongly to the stellar performance in backtests.

Continue reading

Macro Briefing | 17 July 2020

New US Covid-19 cases for July 16 surged to a record high: 77,000-plus: Reuters

Fauci says new Covid treatment may arrive as early as this autumn: Bloomberg

Western nations say Russia is trying to steal coronavirus research: CNN

Hong Kong demands Taiwan officials sign ‘one China’ document: Reuters

Sliding real yields are key factor in boosting prices of risk assets: WSJ

Weekly US jobless claims continued rising last week by 1-million-plus: CNBC

US home builder sentiment rebounded in July to pre-coronavirus high: CNBC

30-year mortgage rate (US nat’l avg) falls below 3.0% for first time: NY Times

Philly Fed Mfg Index continues to reflect growth in July: Philly Fed

US retail sales rose for a second month in June but at much slower pace: Reuters

Rebalancing: It’s Still Everyone’s Main Risk-Management Strategy

It’s old news that’s forever relevant: rebalancing is the worst choice for managing risk… except when compared with everything else. Granted, it’s not a silver bullet (nothing is) and in the hands of an amateur it can lead to trouble. But when paired with a reasonable asset allocation and a schedule of periodically resetting weights, rebalancing remains the first choice for managing portfolio risk.

Macro Briefing | 16 July 2020

White House orders hospitals to send Covid-19 data to Washington: CNBC

Trump signs law sanctioning Chinese officials: Politico

China will stick with US trade deal despite new pressure from Washington: Reuters

US retail sales expected to rise for second month in today’s report: CNBC

Evidence strengthens that mask-wearing slows Covid-19 spread: VOX

Hacker hijacks high-profile Twitter accounts in cryptocurrency scam: TC

UK labor market continues to shed jobs but at slower rate in June: Reuters

China reports economic rebound from coronavirus: Q2 GDP up 3.2%: CNBC

Former Fed Chairman Bernanke: Congress should ‘save the states’: NY Times

US industrial output surged in June after dramatic decline in May: Bloomberg

Tech Stocks Remain US Equity Sector Leader In 2020

Shares of technology companies continue to hold a wide lead in the US sector race this year, followed by a battle for second place in communication vs. consumer discretionary stocks, based on a set of exchange traded funds as of July 14.

Macro Briefing | 15 July 2020

Promising results from Moderna’s first Covid-19 vaccine trial: NBC

Widespread mask use would control Covid-19 spread, says CDC director: STAT

China says it will retaliate after Trump ends Hong Kong’s special status: Reuters

Prime Minister Boris Johnson bans China’s Huawei from UK’s 5G network: CNN

Banks bulk up on cash to prepare for a surge in loan losses: NY Times

Sharp drop in global fertility rate will have “jaw-dropping” impact on societies: BBC

Fed’s Brainard: coronavirus still poses hefty economic risks for US: WSJ

Fed’s Kaplan expects pickup in US growth in 2021: CNBC

Apple scores a major victory on taxes in European Union: WSJ

US headline consumer price inflation up 0.6% in June–first gain in 4 months: MW

US small business optimism rebounded sharply in June: NFIB

Parsing The Treasury Market’s Mixed Messages

Once upon a time the bond market could be counted on for sober analysis and clear thinking in the critical work of providing reliable economic indicators based on the so-called wisdom of the crowd. But those days appear to be long gone, or so one could surmise after reviewing the conflicting signals emanating from the US Treasury market of late.

Macro Briefing | 14 July 2020

US states roll out new restrictions as coronavirus cases spread: WSJ

California rolls back economic opening as Covid-19 cases soar: CNBC

Immunity to Covid-19 may only last a few months, UK study finds: CNBC

US and Canada expected to extend non-essential travel ban: Reuters

US: parts of China’s South Sea claims ‘unlawful’: BBC

China’s imports rose in June–first gain since coronavirus crisis started: Reuters

UK economy rebounded at slower pace than expected in May: BBC

Eurozone industrial output posts a record rebound in May: MW

US monthly budget deficit expands to record $864 billion: NY Times

Emerging Market Stocks Surged Last Week

Equity prices in emerging markets posted the strongest gain for the major asset classes for the trading week through Friday, July 10, based on a set of US-listed exchange traded funds.

Macro Briefing | 13 July 2020

White House undercuts Fauci re: US coronavirus response: NBC

Summer doesn’t appear to be slowing Covid-19’s transmission rate: WSJ

US warns citizens of “heightened risk of arbitrary detention” in China: CNBC

China announces sanctions on US officials in retaliation to Uighur policy: Reuters

Poland’s conservative President Duda narrowly wins re-election: BBC

US bankruptcies persist due to ongoing Covid-19 blowback: Bloomberg

Producer price index for US unexpectedly fell in June: CNBC

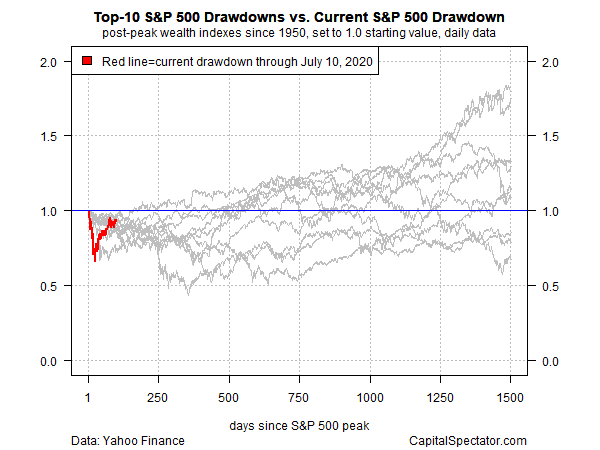

US stock market (S&P 500) begins trading week with drawdown near -6%: