The US stock market has turned negative on the year, but you wouldn’t know it by looking at results for the low-volatility equity risk factor. Using a set of ETFs to track this space shows that the low-vol risk premium is outperforming the rest of the field by a wide margin in 2025 through Thursday’s close (Mar. 6).

Macro Briefing: 07 March 2025

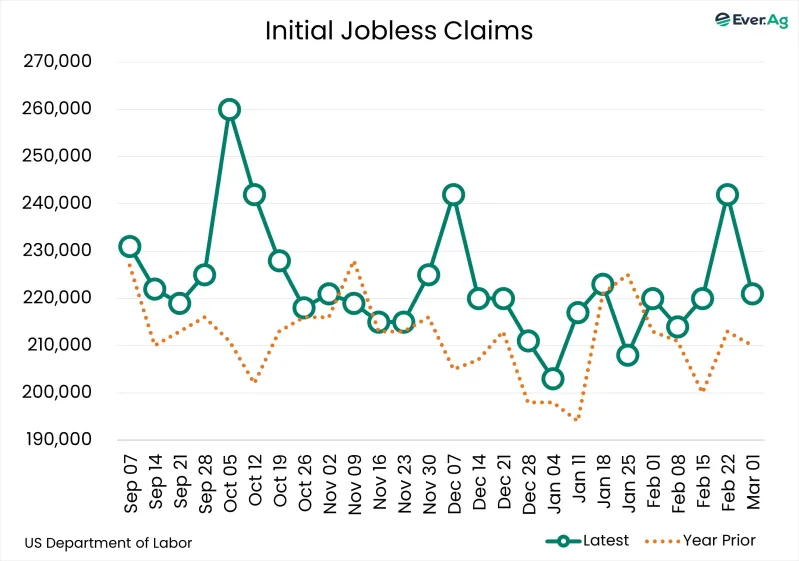

US jobless claims fell last week, returning to a level that suggests an upbeat outlook for the labor market. New filings for unemployment benefits fell to 221,000, holding into the 200,000-250,000 range that’s prevailed in recent history.

Foreign Stocks Lead Global Markets, US Shares Sink Year To Date

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date, based on a set of ETFs through Wednesday’s close (Mar. 5).

Macro Briefing: 06 March 2025

Hiring by US companies slowed sharply in February, according to the ADP Employment Report. Employers added 77,000 workers last month, well below expectations and January’s 186,000 increase. “Policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month,” said ADP’s chief economist, Nela Richardson. “Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead.”

Nowcast For US Q1 GDP Falls Sharply

The rollout of President Trump’s tariffs on Canada, Mexico and China has roiled expectations for US economic activity in the first quarter.

Macro Briefing: 05 March 2025

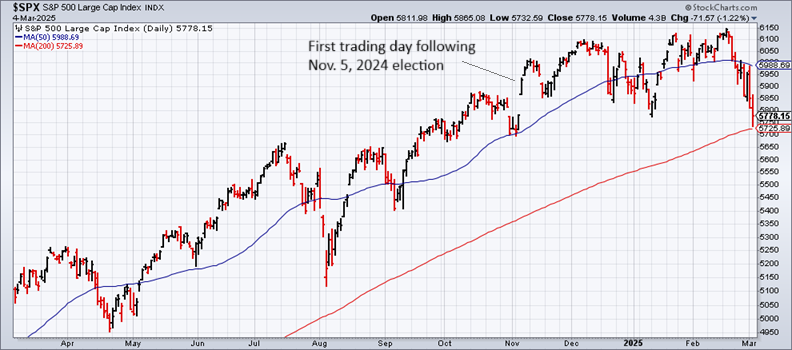

US stock market post-election gain evaporates amid concerns about negative economic effects from President Trump’s trade war. After yesterday’s drop in the S&P 500, equities are 2.5% below the Nov. 6, 2024 close, the first trading day following the election. Addressing Congress Tuesday night, Trump reaffirmed his committment to tariffs, admitting there will be “a little disturbance” and that there “may be a little bit of an adjustment period. You have to bear with me again and this will be even better,” he claimed.

Total Return Forecasts: Major Asset Classes | 04 March 2025

The long-run expected total return for the Global Market Index (GMI) fell in February, sliding to an annualized 7.1% vs. the previous month’s 7.4%. The downward revised forecast follows several months of higher estimates. The analysis is based on three models (defined below) for GMI, a global benchmark built with the major asset classes (excluding cash).

Macro Briefing: 04 March 2025

Major Asset Classes | February 2025 | Performance Review

Most of the major asset classes rallied in February, based on a set of ETFs. The downside exceptions: US stocks and a broad measure of commodities. Otherwise, global markets posted were broadly higher last month.

Macro Briefing: 03 March 2025

Inflation slowed in January, according to Personal Consumption Expenditures, the Federal Reserve’s preferred measure of inflation. Prices rose 2.5% for the year through January, down slightly from 2.6% in December, marking the first decrease in four months. Prices “rose at a mild pace in January, which offers some relief after a string of economic reports suggesting that inflation is heating up again,” writes Key Wealth managing director of fixed income investments Rajeev Sharma.