China’s revival outlook spurs rise in global stock to four-week high: Reuters

Texas and Florida report ‘exponential’ growth in Covid-19 cases: CNBC

V recovery for world economy appears unlikely in 2020’s second half: BBG

US crude output falling at fastest rate on record: WSJ

Eurozone retail sales rebounded sharply in May: ING

German factor orders rebounded in May after three months of decline: BBG

Warren Buffett’s Berkshire buys Dominion Energy natural gas assets: CNBC

One case of bubonic plague diagnosed in China’s Inner Mongolia: BBC

China’s dominance in medical supplies will likely persist: NY Times

US stock market’s forward price-earnings ratio rises to 10-year high: JPM

Book Bits | 4 July 2020

● The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win

Maria Konnikova

Review via Nature

There has never been a more pressing need for digestible and coherent literature on rational decision-making. Enter The Biggest Bluff, psychologist Maria Konnikova’s depiction of her journey into professional poker. What at first seems a light-hearted story about a curious academic dipping her toe into shark-infested waters delivers a crucial lesson in how to thrive in an increasingly misleading world.

Continue reading

Happy Independence Day!

Research Review | 3 July 2020 | Business Cycle Analysis

Forecasting Macroeconomic Risk in Real Time: Great and Covid-19 Recessions

Roberto A. De Santis (European Central Bank)

July 2020

We show that financial variables contribute to the forecast of GDP growth during the Great Recession, providing additional insights on both first and higher moments of the GDP growth distribution. If a recession is due to an unforeseen shock (such as the Covid-19 recession), financial variables serve policymakers in providing timely warnings about the severity of the crisis and the macroeconomic risk involved, because downside risks increase as financial stress and corporate spreads become tighter. We use quantile regression and the skewed t-distribution and evaluate the forecasting properties of models using out-of-sample metrics with real-time vintages.

Continue reading

Macro Briefing | 3 July 2020

US coronavirus cases top 55,000–a new daily record high: WaPo

COVID-19 vaccine candidates set for late-stage clinical studies in July: Reuters

Texas governor issues statewide order to wear masks: CNBC

US and allies focus on punishing China for new Hong Kong security law: NPR

CBO expects US jobless rate will remain 10%-plus through 2020: WSJ

Caixin China General Services PMI rose to 10-year high in June: MW

Eurozone Composite PMI rebounded for second month in June: IHS Markit

US factory orders rebounded in May: Reuters

Pace of US jobless claims continue to slow but remain unusually high: MW

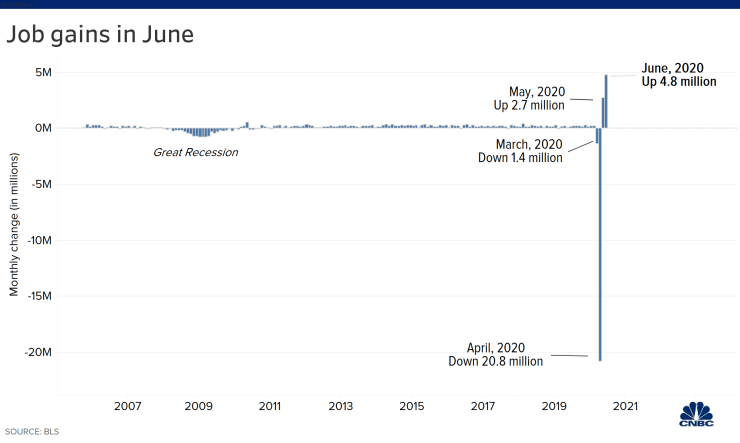

After record loss, US payrolls continued to rebound in June: CNBC

Risk Premia Forecasts: Major Asset Classes | 2 July 2020

The long-term risk premia projection for the Global Market Index (GMI) ticked up again in June, rising to 4.6%. This annualized estimate for GMI reflects the long-run forecast over the “risk-free” rate, based on a risk-centered model outlined by Professor Bill Sharpe (details below).

Continue reading

Macro Briefing | 2 July 2020

Daily increase in US coronavirus cases sets record of 50,000-plus: WSJ

Trump, in a change of message, says: I’m “all for masks”: BBC

China’s new security law for Hong Kong takes a bite out of free speech: Vox

Hundreds arrested in Hong Kong for breaching the new security law: CNBC

Russian voters approve law to let Putin to stay in power through 2036: CNN

Will June’s expected surge in US hiring persist in the months ahead? AP

Two firms report encouraging data for experimental Covid-19 vaccines: STAT

Fed minutes: economy still needs ‘highly accommodative’ policy: CNBC

Global mfg activity recovered most of recent losses in June: IHS Markit

US mfg activity expanded in June, rebounding from sharp decline: ISM

US companies hired nearly 2.4 million workers in June via ADP data: CNBC

Major Asset Classes | June 2020 | Performance Review

Emerging-market equities rose sharply in June, posting the strongest gain for the major asset classes last month. Overall, higher prices prevailed in risk assets. The lone exception: a mild dip for high-yield bonds in the US.

Continue reading

Macro Briefing | 1 July 2020

Fauci warns that new US daily Covid-19 cases could rise to 100,000: BBC

US cases up by 47,000-plus on Tuesday–biggest one-day rise so far: Reuters

Top-2 US economic policy makers pledge additional relief for labor market: WSJ

China OKs experimental Covid-19 vaccine for its military: CNN

First Hong Kong protests emerge since China imposed new security law: CNN

Eurozone mfg moved toward stabilizing in June after deep contraction: IHS Markit

US home prices continued to strengthen in April: CNBC

Chicago PMI rebounded slightly in June after crashing to 38-year low: MW

US Consumer Confidence rose to 3-month high for June: MW

Falling Real Yields Suggest Gold Price Will Continue To Rise

Rising economic and political uncertainty has boosted everyone’s favorite precious metal in 2020. An ounce of gold was priced at just over $1,781 on Thursday (June 29), the highest since 2012, based on the continuous contract reported by Stockscharts.com. Year to date, gold is up 17% vs. a 5.5% loss for US stocks (S&P 500 Index).