It’s long been established that stock market returns aren’t normally distributed and that fat tails (extreme returns that are unexpected for a normal distribution) apply. This has implications, of course, for portfolio design and management. The first question: What are the choices for managing tail risk for equity exposures? There are many answers, each with a different set of pros and cons. Perhaps the first choice to consider: focus on longer-term results and look through the shorter-term noise. Is this a viable risk-management strategy? Let’s take a look at the data for insight.

Continue reading

Macro Briefing | 5 June 2020

Is the slow rise in US coronavirus cases since Memorial Day noise? CNBC

US exports and imports down sharply in April due to coronavirus: WSJ

Jobless rate expected to soar to 20% in today’s employment report: Reuters

US warship sailed through Taiwan Strait on Thursday: Reuters

Deflation risk warrants further ECB bond buying, central banker says: BBG

Germany factory orders plunged in April: AP

People with type A blood more likely to suffer severe Covid-19 symptoms: NYT

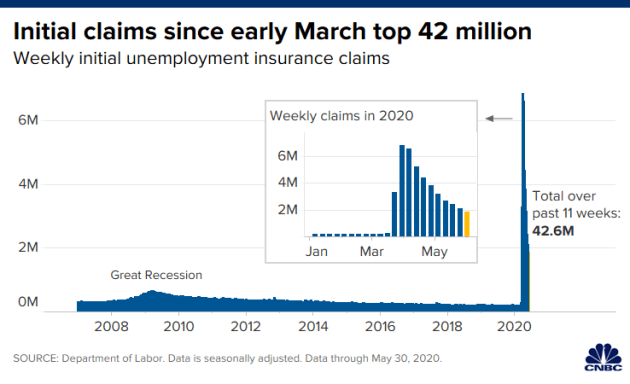

New filings for unemployment continued to surge in the US last week: CNBC

Is The Stock Market’s Optimism For Economic Recovery Valid?

The S&P 500 Index rose again on Wednesday (June 3), closing at a three-month high and paring the market’s drawdown to a relatively mild 7.8% decline — a shadow of the nearly 34% drawdown at the height of the correction on March 23. Fueling the market’s rebound is the view that the worst of the coronavirus recession has passed and the recovery is coming into view. Is this wishful thinking? Or is the crowd’s implied forecast valid? The future, as always, remains unknown, but let’s consider the pros and cons of Mr. Market’s outlook for some perspective.

Macro Briefing | 4 June 2020

US protests continue but subdued after after new charges in Floyd case: AP

Much of US govt’s coronavirus stimulus funds have been spent or committed: WSJ

Today’s US jobless claims set for slower rise but still painfully high: Reuters

European Central Bank set to ramp up stimulus program: CNBC

Will China weaponize its $1 trillion-plus hoard of US Treasuries? MW

Hedge funds prepared for second stock-market downturn: FT

Global economic downturn eases in May after record decline: IHS Markit

US factory orders continued to plunge in April: Reuters

Speed of US downturn in US services sector eased in May: IHS Markit

US private sector lost 2.76 million jobs in May: MW

Back In The Saddle Again: Growth And Momentum Equity Factors

The ongoing rebound in US stocks has been uneven across the main factor strategies, but two corners stand out as revival leaders: large-cap growth and momentum. On both fronts, these risk factors are the first to return to positive year-to-date performances, based on a set of exchange traded funds.

Macro Briefing | 3 June 2020

George Floyd protests continue across US with fewer clashes: CNN

Will Trump militarize response to US protests? Reuters

Dr. Fauci worries about the “durability” of a coronavirus vaccine: CNBC

US firms warily eye Hong Kong but no plays to exit yet: CNN

China Services PMI rebounded sharply in May as economy reopened: IHS Markit

Eurozone Composite PMI up slightly in May but still signals recession: IHS Markit

Does economic recovery for the US require negative interest rates? CNBC

Global mfg activity bounced in May but still deep in recession: IHS Markit

Risk Premia Forecasts: Major Asset Classes | 2 June 2020

The long-term forecast for the Global Market Index’s (GMI) risk premia ticked higher in May, rising for a second month after a run of declines earlier in the year. The revised annualized total return estimate for GMI is currently 4.5%, which reflects the index’s long-run projection over the “risk-free” rate, based on a risk-centered model outlined by Professor Bill Sharpe (details below).

Macro Briefing | 2 June 2020

Trump considers using military to end protests: Bloomberg

CBO projects a slow US economic recovery after deep loss in Q2: CBO

US economic reopening plans challenged by protests in cities: NY Times

G7 members at odds over Trump’s plan to re-admit Russia: BBC

US dollar’s safe-haven status faces new challenges: Reuters

US construction spending dropped less than forecast in April: MW

A slightly softer US mfg recession in May via PMI survey data: IHS Markit

US ISM Manufacturing Index up modestly in May but still deep in recession: ISM

Major Asset Classes | May 2020 | Performance Review

Asset prices continued to rebound in May, building on April’s widespread gains. Commodities joined the party this time by leading the across-the-board celebration in global markets last month.

Macro Briefing | 1 June 2020

George Floyd protests continue across US: Reuters

Will protests trigger second wave of Covid-19 infections? NY Times

Does Russia have an effective treatment for Covid-19? CNBC

Trump postpones G7 summit: CNBC

Eurozone mfg sector continued to contract sharply in May: IHS Markit

UK mfg sector fell sharply in May but not as deep vs. Apr: IHS Markit

Consumer sentiment in US edged up in May after sharp decline in April: CNBC

Chicago-region business activity fell in May–lowest level since 1982: Chicago PMI

US trade deficit widened more than expected in April: MW

US consumer spending collapsed in April, falling nearly 14%: Reuters