● Economics in the Age of COVID-19

Joshua Gans

Summary via publisher (MIT Press)

The COVID-19 pandemic has unleashed a firehose of information (much of it wrong) and an avalanche of opinions (many of them ill-founded). Most of us are so distracted by the everyday awfulness that we don’t see the broader issues in play. In this book, economist Joshua Gans steps back from the short-term chaos to take a clear and systematic look at how economic choices are being made in response to COVID-19. He shows that containing the virus and pausing the economy—without letting businesses fail and people lose their jobs—are the necessary first steps. Gans outlines the phases of the pandemic economy, from containment to reset to recovery and enhancement. Warning against thinking in terms of a “tradeoff” between public health and economic health, Gans explains that containment gives us the opportunity to develop effective testing that will make it safe for people to interact. Once the virus is contained, we will need to pivot toward innovating, and, finally, we will come together to plan how to protect ourselves from future pandemics. He looks at policy tools that might aid an economic recovery, distinguishing between economic losses during a pandemic and a recession.

Continue reading

Major Asset Classes | April 2020 | Performance Review

April was bounce-back month, with a glaring exception: broadly defined commodities (excluding gold, which rallied sharply). Otherwise, risk assets posted solid gains across the board last month.

Continue reading

Macro Briefing | 1 May 2020

Covid-19 pandemic expected to last 2 years, report predicts: Bloomberg

Half of US states move ahead with economic reopening: Reuters

European Commission calls for investigation into origin of coronavirus: CNBC

Russia’s prime minister says he’s infected with coronavirus: NPR

Federal Reserve’s lending program expands to cover larger firms: WSJ

Coronavirus is reversing global slide in poverty rate: NY Times

Despite surge in jobless, official unemployment probably undercounts: EPI

US consumer spending posted steepest drop on record in March: WSJ

US jobless claims continue surging–up 3.8 million last week: MW

Is Deflation Risk Rising?

Judging by the stock market, the odds are rising for a reflationary run. Economic data, however, offer a conflicting view.

Macro Briefing | 30 April 2020

Gilead reports encouraging results for its antiviral Covid-19 tests: Reuters

Today’s US jobless claims report expected to post a 3.5 million rise: MW

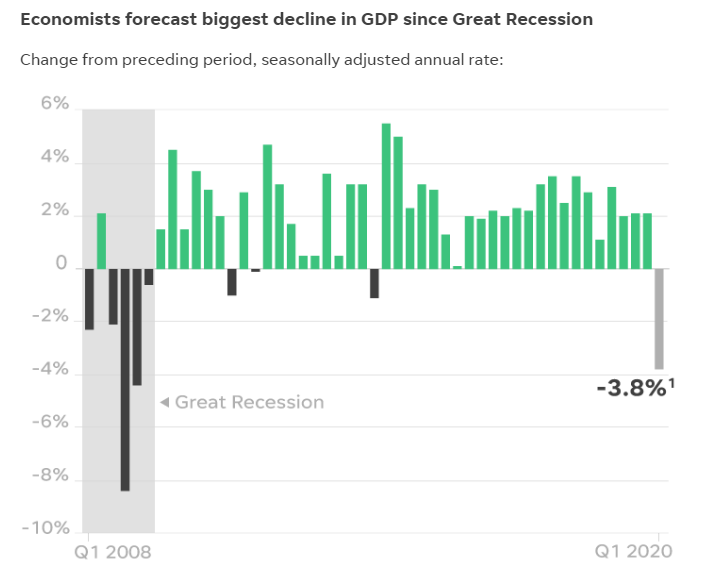

Eurozone economy contracted 3.8% in Q1: MW

Fed chairman: More spending needed from Congress to support economy: WSJ

China Mfg PMI posts mild contraction in Apr after dramatic swings: IHS Markit

Big oil via Royal Dutch Shell cuts dividend–first time since WWI: FT

Global carbon emissions set to drop 8% this year: IEA

US pending home sales fall the most since 2010 due to coronavirus: BBG

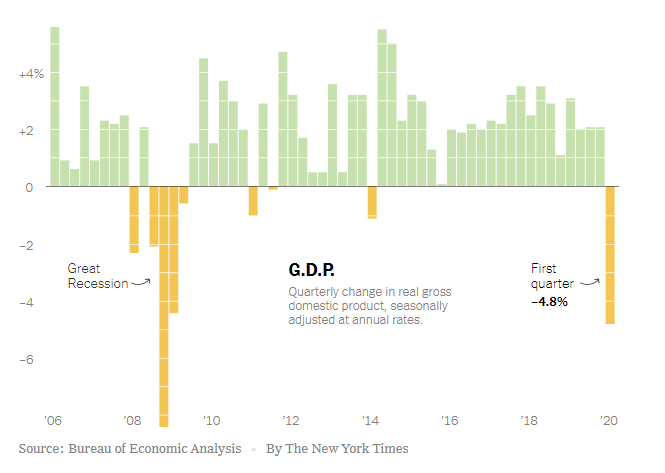

US growth fell sharply in Q1–deepest decline in over a decade: NY Times

China Continues To Lead World’s Major Equity Regions In 2020

Losses still dominate year-to-date results for all the main regional slices of global stock markets, but China is holding on to it leadership position by posting a modest decline, based on a set of exchange traded funds through Apr. 28.

Macro Briefing | 29 April 2020

Second round of coronavirus is ‘inevitable,’ Fauci warns: CNN

Race for developing coronavirus vaccine expands with Pfizer tests: WSJ

What’s on the Fed’s agenda for today’s policy meeting and press conference? BBG

Investors expect big tech will dominate after crisis: NY Times

Eurozone economic sentiment in April posts biggest decline on record: Reuters

Richmond Fed Mfg Index declines sharply in April: RF

US Consumer Confidence Index plunges to 6-year low in April: CNBC

US home prices were rising steadily before coronavirus crisis in Feb: CNBC

Today’s US Q1 GDP report is expected to show a 3.8% fall in output: USAToday

When Will The US Stock Market Regain Its Previous High?

If you didn’t know anything about the coronavirus and remained clueless about the economic devastation, you might look at a chart of the S&P 500 and think that a severe market correction was rebounding and equities would soon reclaim the previous high-water mark. Reality, however, isn’t quite that simple.

Macro Briefing | 28 April 2020

Oxford Group’s coronavirus vaccine may be available as early as Sep: NY Times:

China has near-total control over anti-biotic supply. Is America at risk? STAT

US oil prices continue to slide as lack of storage weighs on market: MW

What’s left in the Fed’s playbook after massive stimulus? CNBC

The Federal Reserve is reinventing itself during coronavirus crisis: WSJ

Surge in internet use due to coronavirus is good news for chipmakers: WSJ

Will US stock market look through dismal earnings season… or two: BBG

VIX Index (US stock market’s ‘fear gauge’) falls to 8-week low:

TIPS And Foreign Corporates Rose Last Week As Stocks Fell

Despite a late-week rally in equity markets, risk-off sentiment dominated last week, leaving most of the major asset classes lower by the close of trading on Friday, Apr. 24. Bucking the trend: inflation-indexed Treasuries, which posted the best gain for the trading week, based on a set of exchange-traded funds.

Continue reading