Breaking a three-week losing streak, broadly defined commodities topped last week’s returns for the major asset classes, based on a set of exchange traded funds. Other than US bonds and real estate investment trusts (REITs), all the primary slices of global markets posted gains for the trading week through Friday, Dec. 6.

Macro Briefing | 9 December 2019

Will new US tariffs on Chinese goods kick in next week? WSJ

US payrolls surged in November: CNBC

True alpha is elusive in active bond strategies, AQR research finds: InstInv

Jobs of the future found mostly in small number of US cities: Reuters

US Consumer Sentiment Index rises to 7-month high in December: Bloomberg

Consumer credit rose at second-strongest monthly rate this year in Oct: MW

The World Trade Organization’s days may be numbered: NY Times

German exports rose in Oct, defying global trade tensions: BT

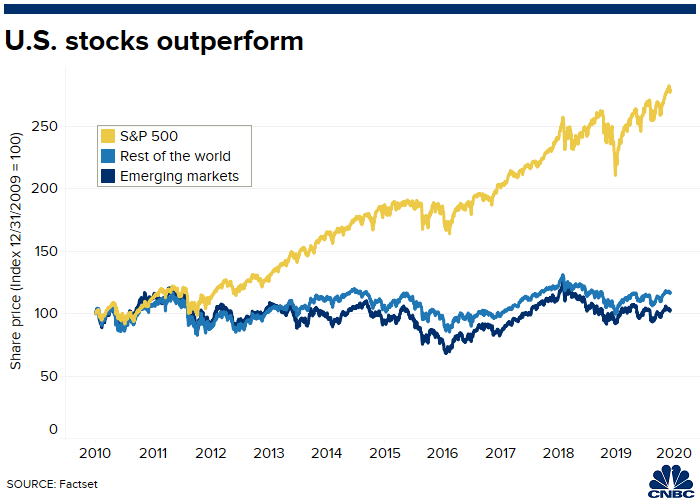

Are foreign stocks poised to outperform US? CNBC

Book Bits | 7 December 2019

● Fewer, Richer, Greener: Prospects for Humanity in an Age of Abundance

By Laurence B. Siegel

Summary via publisher (Wiley)

Why do so many people fear the future? Is their concern justified, or can we look forward to greater wealth and continued improvement in the way we live? Our world seems to be experiencing stagnant economic growth, climatic deterioration, dwindling natural resources, and an unsustainable level of population growth. The world is doomed, they argue, and there are just too many problems to overcome. But is this really the case? In Fewer, Richer, Greener, author Laurence B. Siegel reveals that the world has improved—and will continue to improve—in almost every dimension imaginable. This practical yet lighthearted book makes a convincing case for having gratitude for today’s world and optimism about the bountiful world of tomorrow.

Continue reading

Is The November Payrolls Report As Good As It Looks?

US companies hired substantially more workers than economists expected in November, providing an upside jolt to economic sentiment. From a monthly perspective, the 254,000 increase in private payrolls marks the best gain since January. No matter how you slice it, it’s a strong increase. But a closer look suggests that the slow-growth trend is still with us, even though a myopic focus on the latest employment number inspires thinking otherwise.

Does Recession Risk Rise As The Expansion Ages?

With each passing month, the current US economic expansion sets a new record for duration (125 months and counting through November). That’s a good thing, of course, but for some analysts it’s a warning sign. Expansions, like milk and airline tickets, have a limited shelf life, or so this line of thinking goes. But the hard evidence to support this view is thin, particularly for the post-World War Two era. That doesn’t mean that recession risk is zero these days, or that storm clouds aren’t gathering. But expecting a downturn to start because the expansion’s clock has been ticking longer than before is mostly myth rather than fact.

Macro Briefing | 6 December 2019

House to draw up articles of impeachment against Trump: Reuters

N. Korea reacts to Trump’s Nato comments with fiery rhetoric: USA Today

Opec and Russia plan on deeper oil-production cuts: CNBC

Germany’s industrial recession deepened in October: FT

Looking ahead to today’s November employment report: NY Times

Atlanta Fed’s GDPNow model: Q4 GDP growth estimate ticks up to +1.5%: AF

US trade gap narrowed to 16-month low in Oct as Chinese imports decline: MW

Factory orders in the US rebounded in Oct after 2 monthly losses: Reuters

Job cuts in US fell 13% over the 12 months through November: CG&C

US jobless claims fell to a 7-month low last week: CNBC

Is US Employment Data Flirting With An Economic Warning Sign?

Depending on the employment indicator, the US economic outlook is upbeat or worrisome. Focusing on yesterday’s ADP Employment Report for November leans toward the latter.

Macro Briefing | 5 December 2019

China wants US tariffs cut before agreeing to a trade deal: Reuters

US considering new deployment of troops to Middle East to counter Iran: WSJ

Iran has secretly moved missiles into Iraq: NY Times

Eurozone retail spending fell more than forecast in October: MW

Japan is planning a $120 billion economic stimulus program: Reuters

Global economic growth remains slow but pace strengthened in Nov: IHS Markit

ISM Non-Mfg Index: US services sector slowed more than forecast: CNBC

Services PMI for US reflects modest growth in November: IHS Markit

US private employment growth slowed sharply in November: MW

Quality Is The Lone Equity Factor Beating The Market This Year

Volatility has returned to the stock market this week after a couple months of relative calm. Not surprisingly, the sharp wave of selling on Monday and Tuesday has reordered the horse race for primary equity factors. As a result, the so-called quality factor is the last man standing for outperforming the broad market year to date, based on a set of exchange-traded funds.

Macro Briefing | 4 December 2019

House impeachment report: Trump abused power: The Hill

Trump suggests US-China trade war could continue beyond 2020 election: WSJ

Despite recent tension, US and China reportedly closer to trade deal: BBG

Will a new round of US tariffs on Chinese goods roll out on Dec 15? CNBC

China Composite PMI for Nov shows solid rebound for economy: IHS Markit

Eurozone economy continued to post near-stagnant growth in Nov: IHS Markit

10-year Treasury yield falls sharply to 1.72% — lowest since Oct 31: