Turkey edges closer to a full-blown financial meltdown: Bloomberg

Senate considers more sanctions on Russia: CNBC

Russia denounces latest round of US sanctions: Reuters

Bloomberg’s US consumer sentiment index rose to 17-year high: Bloomberg

Pence calls for US to develop space force: NY Times

Chicago Fed President: Inflation to hold at around 2%, the Fed’s target: MNI

US jobless claims continue to trend lower, down to low 213,000: MarketWatch

Wholesale trade inventories in US revised up to 0.6% gain for May: CNBC

Don’t confuse a highly valued stock market with an overvalued one: ETF.com

New research challenges loss aversion in behavioral economics: Bloomberg

US producer prices unchanged in July, pointing to tame inflation: CNBC

5-Year Treasury Market’s Inflation Forecast Dips To 3-Month Low

Economists are expecting that US consumer inflation will hold steady in tomorrow’s July update while Fed funds futures are pricing in another rate hike at next month Federal Reserve meeting. Yet the implied inflation outlook via 5-year Treasuries bears watching in the days ahead as it suggests that a new round of disinflation could be brewing. If so, the case may be weakening for another dose of monetary tightening.

Continue reading

Macro Briefing: 9 August 2018

Israel and Gaza launch missile attacks on each other: BBC

Ohio race inspires Dems to see path to House takeover in fall: The Hill

China responds in kind with latest round of US trade tariffs: MW

Trade war with US causing rifts within China’s leadership: Reuters

Turkey’s currency at new low against dollar as tensions with US rise: Bloomberg

US will impose new sanctions on Russia for nerve agent attack in UK: Reuters

World’s key central banks raising rates despite macro risks: Bloomberg

NYC puts restrictions on Uber and other ride-sharing services: CBS

Policy sensitive 2 year Treasury yield, at 2.68%, holds near 10-year high:

Small Cap Returns Are Leading For US Equity Factors So Far In 2018

After a volatile start to the year, the US stock market has recovered its bullish edge and is currently dispensing strong results. Carving equities up into so-called factor buckets reveals that small-cap firms are leading the field year to date, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 8 August 2018

Republican narrowly leads in Ohio special election in GOP stronghold: Politico

China’s exports accelerate despite trade war with US: Reuters

Iran’s foreign minister says US will not stop Iran oil exports: Reuters

Trump says US GDP growth could soon top 5%: The Hill

US set to impose 25% duties on extra $16 billion in Chinese imports: Bloomberg

Tight labor market is headwind for hiring at small businesses: Fox

US job openings edged up in June, close to record high: MarketWatch

Value Investing For US Equities Continues To Rebound

Several months ago I reviewed the case for thinking that the long-suffering value factor for US equity investing was in the process of reviving. At the time, the evidence was sketchy but the outlook was encouraging. Fast forward to early August and the bullish trend looks a bit stronger for this corner of equities.

Continue reading

Macro Briefing: 7 August 2018

Ex-Trump aide testifies he committed crimes with Manafort: The Hill

US hits Iran with new economic sanctions: The Guardian

EU vows to counter US sanctions on Iran: Politco

As Brexit deadline approaches, UK looks to the Trump factor: Bloomberg

Beijing says China will not surrender to US ‘trade blackmail’: CNBC

India-US trade dispute is simmering: CNBC

California wildfire, largest in state history, continues to rage: Reuters

Corporate boards have ok’d 80% rise in stock buybacks vs. year ago: NY Times

Analysts lowered S&P 500 Q3:2018 earnings estimates by 0.6%: Factset

US REITs Surged Last Week While Foreign Real Estate Tumbled

Securitized real estate shares dominated last week’s performance rankings at the extremes for the major asset classes, based on a set of exchange-traded products. US real estate investment trusts (REITs) posted the highest return for the week through August 3 while foreign REITs/real estate suffered the biggest loss.

Continue reading

Macro Briefing: 6 August 2018

Trump says his son met Russian for political dirt on Clinton: BBC

Tax cuts drive surge in profits at big US firms: WSJ

JPMorgan Chase’s Dimon: “be prepared” for 5% yield on 10yr Treasury: Bloomberg

Turkish lira at record low after US says it’s reviewing trade with Turkey: Reuters

PMI: Global economic growth dips to 4-month low in July: IHS Markit

US trade deficit widened in June for first time in 4 months: Bloomberg

US Services PMI reflects strong growth in July: IHS Markit

ISM Non-Mfg Index fell to 11-month low in July: MarketWatch

Nonfarm payrolls up by less-than-expected 157,000 in July: CNBC

US economy added jobs for 94th month as wage growth remains muted: WaPo

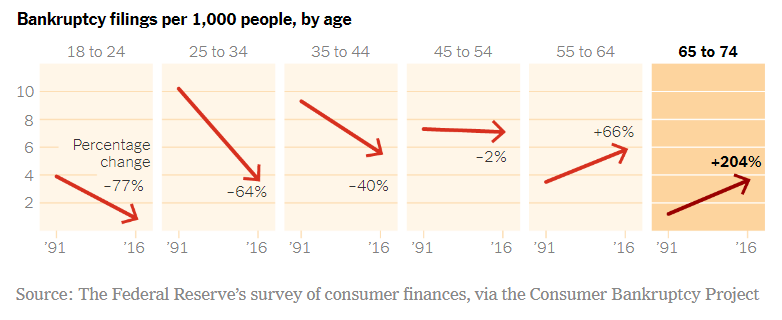

Bankruptcy rate among older Americans up sharply since 1991: NY Times

Book Bits | 4 August 2018

● Crashed: How a Decade of Financial Crises Changed the World

By Adam Tooze

Review via The Economist

Four big themes emerge from Mr Tooze’s account of the post-2008 era. The first was the immediate post-crisis response, in which the banks were rescued and both the monetary and fiscal taps were loosened. The second was the euro-zone crisis, which hit Greece and Ireland hardest, but also affected Portugal, Italy and Spain. The third was the shift in the developed world after 2010 to a more austere fiscal policy. The fourth was the rise of populist politics in Europe and America.

Continue reading