Italy’s political crisis poses risks for the global economy: NY Times

Asian stocks extend losses after sharp drop in US equities: Reuters

Trump announces US moving ahead with trade tariffs on China: New York Mag

China says it will respond to ‘reckless’ US trade threats: Reuters

US home prices rose a solid 6.8% in March from year-earlier level: USA Today

Texas factory activity increased in May, reaching a 12-year high: Bond Buyer

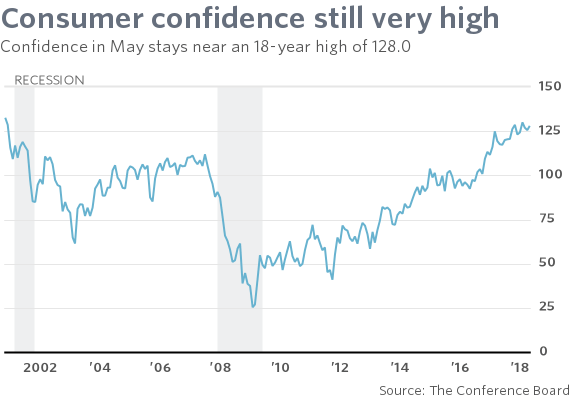

US Consumer Confidence Index up in May, close to 18-year high: MarketWatch

Momentum Continues To Lead For US Equity Factor Returns

The US stock market has been on a roller coaster for much of 2018, but the surge in volatility hasn’t derailed momentum’s leadership for US equity factors, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 29 May 2018

N. Korea sends top aide to US for pre-summit talks: Bloomberg

Trump presses aides to move ahead with US-N. Korea summit: CNN

Russia says reports of US troops in Poland could bring “counteraction”: Newsweek

Italy’s political crisis triggers heavy selling in European markets: Reuters

OECD chief: global growth still needs fiscal-policy support: CNBC

NY Fed’s nowcast for Q2 GDP growth ticks down to still-solid 3.01% rise: NY Fed

Oil prices set for longest run of losses since February: Bloomberg

German 10-year government bond yield falls to new 2018 low:

Remember The Veterans

It’s Memorial Day in the US — a day to honor the men and women in the military who paid the ultimate price to serve and defend their country. It’s also the perfect day for Americans to honor the wounded vets who made it home. Please consider a donation to your favorite charity that supports veterans or:

It’s Memorial Day in the US — a day to honor the men and women in the military who paid the ultimate price to serve and defend their country. It’s also the perfect day for Americans to honor the wounded vets who made it home. Please consider a donation to your favorite charity that supports veterans or:

Disabled American Veterans

Paralyzed Veterans of America

To all the American Vets… thank you for your service!

US Real Estate Shares Rose Sharply Last Week

Real estate investment trusts (REITs) posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 28 May 2018

S. Korea calls for more talks with North; US planning Trump-Kim meeting: Reuters

Political crisis erupts in Italy amid calls for impeaching president: BBC

Italy names former IMF official as interim prime minister: Reuters

China sends ships to confront US Navy near disputed islands in S. China Sea: Time

China-Iran summit planned to avoid disruption amid nuclear deal doubt: Reuters

US durable goods orders fell in Apr, mainly due to drop in aircraft orders: MW

US consumer sentiment holds steady in May at elevated level: WSJ

Oil prices tumble on concerns of rising supply: MW

World trade volume: sharp slowdown in annual growth to 2.1% in March: CPB

Book Bits | 26 May 2018

● Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State

By Paul Tucker

Review via Reuters Breakingviews

How much influence should central bankers wield in a democracy? That’s the question Paul Tucker ponders in “Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State”… Central bankers are being sucked into deeply political decisions over how the government is financed, and how income is distributed. Yet these “overmighty citizens” have no electoral legitimacy. At the same time, frustrated voters in the West have turned to demagogues. As a result, central bank independence is under threat.

Continue reading

Research Review | 25 May 2018 | Business Cycle Risk

Is Fertility a Leading Economic Indicator?

Kasey Buckles (University of Notre Dame), at al.

March 28, 2018

Many papers show that aggregate fertility is pro-cyclical over the business cycle. In this paper we do something else: using data on more than 100 million births and focusing on within-year changes in fertility, we show that for recent recessions in the United States, the growth rate for conceptions begins to fall several quarters prior to economic decline. Our findings suggest that fertility behavior is more forward-looking and sensitive to changes in short-run expectations about the economy than previously thought.

Continue reading

Macro Briefing: 25 May 2018

Trump cancels N. Korea meeting and China stands to benefit: NY Times

Taiwan scrambles jets as Chinese bombers circle island: Reuters

EU official: UK ‘chasing a fantasy’ in Brexit talks: Guardian

Revised UK GDP data for Q1 remains at sluggish +0.1%: Bloomberg

Mexican president is ‘optimistic’ as country makes new NAFTA offer: Reuters

Big tech faces big lawsuits as Europe’s new data protection law kicks in: CNN

ECB minutes: Euro zone growth could slow further: Reuters

US existing home sales fall in Apr; y-o-y change is negative for 2nd month: Builder

US jobless claims increase to 7-week high: MarketWatch

Kansas City Fed Mfg Index rises to new record high in May: KC Fed

2018 Atlantic hurricane season expected to be near- or above-normal: NOAA

Rate Hike Expected As Fed Signals It Will Allow Higher Inflation

The Federal Reserve is prepared to let inflation run above its two-percent target, according to the minutes of its policy meeting held earlier this month. The bond market appears comfortable with the news: the implied inflation forecast (based on the yield spread between nominal and inflation-indexed Treasuries) ticked down yesterday, reaching the lowest level in over a month for the 10-year maturities. Meanwhile, the crowd continues to bet that the central bank will continue to raise interest rates, including a hike at next month’s FOMC meeting. A period of dovish tightening, in other words, prevails.

Continue reading